Table of Contents

Mutual Fund Calculator

What is Mutual Fund?

A mutual fund is a professionally managed investment scheme. It is run by an asset management company (AMC) which acts like a mediator for the retail investors. The AMC pools in money from a large number of investors and invests it in equity shares, Bonds, money market instruments and other types of securities. Buying a mutual fund is like buying a small slice of a big pizza. Each investor, in return, is assigned a specific number of units proportionate to his invested amount in the fund. The investor is known as the unit holder. The unit holder shares the gains, losses, Income and expenses of the fund in proportion to his investment in the fund.

What is a Mutual Fund Calculator ?

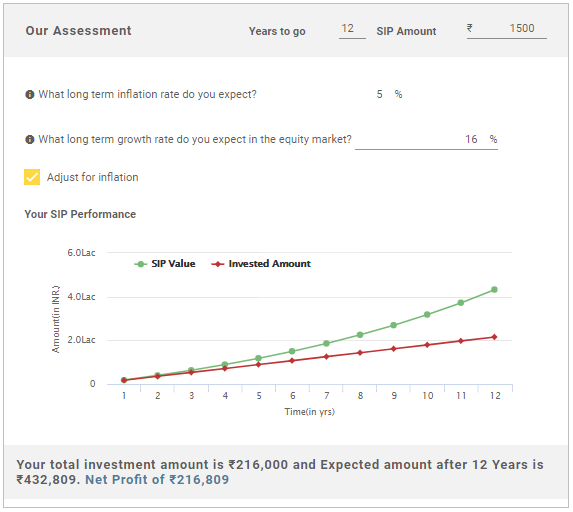

Mutual Fund Calculator helps us in Calculating our interest return for SIP investments or lump sum investment with the help of Fincash Mutual Fund Calculator below.

How does a mutual fund calculator work?

Is your mutual fund scheme generating returns in line with your expectation? Are you wondering what amount of SIP would help you in personal goal accomplishment? Get your answers by using our Mutual Fund Calculator! The Mutual Fund Calculator will give you the investment value at maturity by calculating fund returns according to your investment horizon. You can adjust the variables of the calculator like SIP/lump sum, amount of investment, frequency of SIP, expected rate of return and duration of SIP

Nature of investment ( SIP / Lumpsum )

There are basically two ways of Investing money in your favourite Mutual Funds. You can go via the SIP or the lump sum route

1. Lump sum investment

Under a lump sum, you invest one big chunk of your funds in mutual fund scheme of your choice. It generally happens when you receive huge corpus from say sale of an asset or retirement benefits. But investing a lump sum involves greater risk. That’s why it is always recommended to go via the SIP route

2. Systematic Investment Plan (SIP)

Under a SIP, you instruct the Bank to deduct a? the fixed sum from your Savings Account every month and invest it in the said mutual fund scheme. In this way, you can buy units continuously without worrying about the right time to enter the Market. You get the benefit of rupee cost averaging and enjoy the Power of Compounding

Talk to our investment specialist

Types of Calculators

Lumpsum Calculator

SIP Calculator

Know Your SIP Returns

Top Funds for 2024

*Best funds based on 1 year performance.

The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. SBI PSU Fund is a Equity - Sectoral fund was launched on 7 Jul 10. It is a fund with High risk and has given a Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Invesco India PSU Equity Fund is a Equity - Sectoral fund was launched on 18 Nov 09. It is a fund with High risk and has given a Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. HDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 10 Mar 08. It is a fund with High risk and has given a Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on 1. SBI PSU Fund

CAGR/Annualized return of 8.6% since its launch. Ranked 31 in Sectoral category. Return for 2023 was 54% , 2022 was 29% and 2021 was 32.4% . SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (30 Apr 24) ₹31.4188 ↑ 0.00 (0.01 %) Net Assets (Cr) ₹1,876 on 31 Mar 24 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 2.52 Sharpe Ratio 2.62 Information Ratio -1.01 Alpha Ratio -9.05 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹7,906 30 Apr 21 ₹10,690 30 Apr 22 ₹13,300 30 Apr 23 ₹15,716 30 Apr 24 ₹30,834 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 30 Apr 24 Duration Returns 1 Month 11.3% 3 Month 13.9% 6 Month 63% 1 Year 96.2% 3 Year 42.3% 5 Year 25.3% 10 Year 15 Year Since launch 8.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 54% 2022 29% 2021 32.4% 2020 -10% 2019 6% 2018 -23.8% 2017 21.9% 2016 16.2% 2015 -11.1% 2014 41.5% Fund Manager information for SBI PSU Fund

Name Since Tenure Richard D'souza 1 Aug 14 9.67 Yr. Data below for SBI PSU Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Financial Services 29.75% Utility 20.1% Energy 15.5% Industrials 13.16% Basic Materials 12.55% Asset Allocation

Asset Class Value Cash 8.94% Equity 91.06% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN11% ₹209 Cr 2,777,500

↑ 500,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | 5328989% ₹163 Cr 5,885,554

↑ 1,350,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | 5325558% ₹146 Cr 4,343,244 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 May 20 | 5003125% ₹93 Cr 3,455,000 Hindustan Copper Ltd (Basic Materials)

Equity, Since 30 Apr 21 | 5135995% ₹86 Cr 3,093,315

↑ 700,000 Housing & Urban Development Corp Ltd (Financial Services)

Equity, Since 30 Nov 22 | HUDCO4% ₹81 Cr 4,350,000 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 31 Jul 23 | 5001034% ₹74 Cr 3,000,000 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | 5331064% ₹72 Cr 1,200,000

↑ 1,200,000 Indian Oil Corp Ltd (Energy)

Equity, Since 31 Aug 15 | IOC4% ₹72 Cr 4,281,804 NHPC Ltd (Utilities)

Equity, Since 31 Jan 24 | 5330984% ₹68 Cr 7,600,000 2. Invesco India PSU Equity Fund

CAGR/Annualized return of 13.1% since its launch. Ranked 33 in Sectoral category. Return for 2023 was 54.5% , 2022 was 20.5% and 2021 was 31.1% . Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (30 Apr 24) ₹59.56 ↑ 0.18 (0.30 %) Net Assets (Cr) ₹859 on 31 Mar 24 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.46 Sharpe Ratio 3.07 Information Ratio -1.18 Alpha Ratio -0.44 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹9,782 30 Apr 21 ₹12,732 30 Apr 22 ₹15,408 30 Apr 23 ₹18,289 30 Apr 24 ₹34,191 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 30 Apr 24 Duration Returns 1 Month 8.4% 3 Month 15.7% 6 Month 55.8% 1 Year 86.9% 3 Year 39% 5 Year 27.9% 10 Year 15 Year Since launch 13.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 54.5% 2022 20.5% 2021 31.1% 2020 6.1% 2019 10.1% 2018 -16.9% 2017 24.3% 2016 17.9% 2015 2.5% 2014 54.5% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Dhimant Kothari 19 May 20 3.87 Yr. Data below for Invesco India PSU Equity Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 28.41% Financial Services 25.67% Utility 25.61% Energy 17.26% Asset Allocation

Asset Class Value Cash 3.05% Equity 96.95% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹77 Cr 3,801,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | 5325559% ₹76 Cr 2,254,157 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹75 Cr 990,944

↑ 15,318 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | 5411549% ₹74 Cr 221,859

↑ 64,215 Coal India Ltd (Energy)

Equity, Since 31 Aug 23 | COALINDIA8% ₹70 Cr 1,612,886

↑ 86,457 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 22 | 5328987% ₹63 Cr 2,261,566

↑ 134,899 NHPC Ltd (Utilities)

Equity, Since 31 Oct 22 | 5330986% ₹49 Cr 5,435,618 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | 5005475% ₹42 Cr 699,865

↓ -133,222 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | 5321344% ₹38 Cr 1,431,527 Container Corporation of India Ltd (Industrials)

Equity, Since 31 Mar 17 | 5313444% ₹34 Cr 386,333 3. HDFC Infrastructure Fund

CAGR/Annualized return of since its launch. Ranked 26 in Sectoral category. Return for 2023 was 55.4% , 2022 was 19.3% and 2021 was 43.2% . HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (30 Apr 24) ₹44.35 ↓ -0.05 (-0.11 %) Net Assets (Cr) ₹1,663 on 31 Mar 24 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.56 Sharpe Ratio 4.42 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹6,221 30 Apr 21 ₹9,521 30 Apr 22 ₹12,561 30 Apr 23 ₹14,692 30 Apr 24 ₹26,794 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 30 Apr 24 Duration Returns 1 Month 7.5% 3 Month 11.3% 6 Month 39.2% 1 Year 82.4% 3 Year 41.2% 5 Year 21.8% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2023 55.4% 2022 19.3% 2021 43.2% 2020 -7.5% 2019 -3.4% 2018 -29% 2017 43.3% 2016 -1.9% 2015 -2.5% 2014 73.9% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Srinivasan Ramamurthy 12 Jan 24 0.22 Yr. Dhruv Muchhal 22 Jun 23 0.78 Yr. Data below for HDFC Infrastructure Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 38.15% Financial Services 19.71% Basic Materials 7.49% Energy 6.65% Utility 6.1% Communication Services 3.69% Consumer Cyclical 2.28% Technology 1.64% Real Estate 1.15% Asset Allocation

Asset Class Value Cash 11.74% Equity 86.91% Debt 1.35% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹118 Cr 1,075,000 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | 5329406% ₹95 Cr 1,500,000 Coal India Ltd (Energy)

Equity, Since 31 Oct 18 | COALINDIA5% ₹82 Cr 1,900,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT5% ₹79 Cr 209,762 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK4% ₹72 Cr 500,000

↑ 100,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325554% ₹70 Cr 2,084,125 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | 5222874% ₹70 Cr 650,000

↓ -33,608 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL4% ₹61 Cr 500,000 State Bank of India (Financial Services)

Equity, Since 31 Mar 08 | SBIN3% ₹53 Cr 704,361 G R Infraprojects Ltd (Industrials)

Equity, Since 31 Jul 21 | 5433173% ₹47 Cr 363,007

↑ 64,069

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.