Table of Contents

- What are Mid-Cap Funds?

- Mid Cap Funds (Investing in Mid Cap Stocks)

- Benefits of Investing in Mid Cap Mutual Funds

- Difference Between Large Cap Funds, Mid Cap Funds and Small Cap Funds

- Who Should Invest in Mid Cap Equity Funds?

- Tax on Mid Cap Funds

- How to Invest in Mid Cap Funds Online?

- Best Mid Cap Mutual Funds in India 2024

- Conclusion

Top 10 Equity - Mid Cap Funds

Midcap Mutual Funds

What are Mid-Cap Funds?

Time and again investors are confused about Investing in mid-cap funds. Well, before investing, it’s important for an investor to have an in-depth knowledge about mid-cap funds.

Mid-cap funds invest in mid-sized companies. Stocks held in mid-cap funds are the companies that are still developing. These are mid-size corporates that lie between large and small cap stocks. They rank between the two extremes on all important parameters like company size, client base, revenues, team size, etc. Let's see mid-cap funds in detail.

Mid Cap Funds (Investing in Mid Cap Stocks)

There are various definitions of mid-caps funds in the Market, one could be companies with a market capitalization (MC= no of shares issued by the company X market price per share) of INR 500 Cr to INR 10,000 Cr. From a standpoint of the investor, the investing period of mid-cap funds should be much higher than large-caps due to the nature of the companies.

When an investor invests in mid caps for a long term, they prefer those companies that they think will be tomorrow's runway successes. Also, the more the investors in mid-cap stocks, the more it tends to grow in size. Since the price of large caps has increased, big investors like Mutual Funds and Foreign Institutional Investors (FIIS) are increasingly investing in mid-caps.

In fact, mid-cap stocks outperformed both large cap and small cap stocks in 2015, due to lower input cost, lower interest rates and improvement in Capital reduction. The BSE mid-cap and BSE small-cap index surged 7.43% & 6.76%, respectively, whereas, BSE Sensex fell 5.03% during the same period of time.

Moreover, companies that are small or mid-sized are flexible and can adapt changes faster. That is why such companies have more potential of higher growth. Some of the most emerging, mid-cap companies in India are- Blue Star Ltd., Bata India Ltd., City Union Bank, IDFC Ltd., PC Jeweller Ltd., etc.

Benefits of Investing in Mid Cap Mutual Funds

Some of the benefits of investing in mid-cap funds are:

- Companies that invest in mid-cap have more potential for growth than large-cap

- Mid-cap firms respond faster to new innovations and changes in the market as they tend to be more focused and specialised in their niche

- Mid-cap stocks are lower in Volatility than small cap stock

- They often tend to outperform large cap and Small cap funds.

Talk to our investment specialist

Difference Between Large Cap Funds, Mid Cap Funds and Small Cap Funds

In order to make a better investment decision in Equity Funds, one should understand the fundamental differences between these types equity funds, i.e.- large-, mid-, and small-cap funds:

Investments

Large cap invests in those companies that have the potential of showing year on year steady growth with high profits. Mid-cap funds invest in mid-sized companies. Investors who invest in mid-cap usually prefer those companies that are future’s runaway success. Whereas, small cap companies are generally younger companies or startups that have a lot of scopes to grow.

Market Capitalization

Large cap companies have a market capitalization of more than INR 1000 crore, while mid caps could be companies with a market cap of INR 500 Cr to INR 1000 Cr, and a market cap of the small cap could be less than INR 500 Cr.

Companies

Infosys, Unilever, Reliance Industries, Birla, etc., are a few well-known large cap companies in India. Some of the most emerging, i.e. mid-cap companies in India are Bata India Ltd, City Union Bank, PC Jeweller Ltd, etc. And some of the well-known small-cap companies in India are Indiabulls, Indian Overseas Bank, Just Dial, etc.

Risks

Mid cap and small cap funds are more volatile than Large cap funds. Large cap mutual funds tend to outperform both mid and small cap funds during the bull market.

Who Should Invest in Mid Cap Equity Funds?

Mid-cap funds have a high volatility. They carry more risk than large-cap funds. That’s why, an investor who can bear high-risk in their investment should only prefer investing in this fund. Also, at the end of the day returns also depends on your tenure. The longer you invest, the higher will be the returns.

Historically, mid-caps have shown to perform better than large-caps in a blooming market, but they can fall when the markets dip. Ideally, investors who want to invest in mid-caps or equities should take a SIP (Systematic Investment plan) route to bolster long term market return.

Once you begin investing monthly in a SIP for a longer period of time, your money starts growing every day (being invested in the stock market). Systematic Investment Plan helps you to average your purchase cost and maximise returns. When an investor invests regularly over a period, irrespective of the market conditions, he would get more units when the market is low & less units when the market is high. This averages out the purchase cost of your mutual fund units.

Tax on Mid Cap Funds

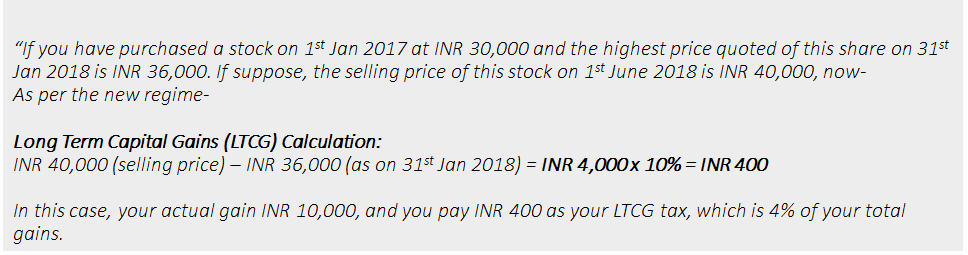

The short-term and long-term Capital Gains offered by mutual funds are taxed at different rates.

| Fund Type | Short-Term Capital Gains | Long-Term Capital Gains |

|---|---|---|

| Equity funds | 15% + cess + surcharge | Up to Rs. 1 lakh a year is tax-exempt. Any gains above Rs. 1 lakh are taxed at 10% + cess + surcharge |

How to Invest in Mid Cap Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Best Mid Cap Mutual Funds in India 2024

Top-performing Mid-cap Funds in India with AUM above 200 Cr are as follows:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Motilal Oswal Midcap 30 Fund Growth ₹82.6461

↓ -0.49 ₹8,987 12.3 31 60.4 36.5 27.2 41.7 Edelweiss Mid Cap Fund Growth ₹81.634

↓ -0.21 ₹5,115 7.2 29.2 52.9 27 25.8 38.4 PGIM India Midcap Opportunities Fund Growth ₹55.71

↓ -0.24 ₹9,924 5 16.2 30.3 19.3 25.6 20.8 SBI Magnum Mid Cap Fund Growth ₹211.374

↓ -0.88 ₹16,856 7.7 19.4 39.9 24.3 24.1 34.5 Kotak Emerging Equity Scheme Growth ₹110.403

↓ -0.03 ₹39,685 9.4 21.5 43.6 23.8 23.9 31.5 BNP Paribas Mid Cap Fund Growth ₹90.6357

↓ -0.20 ₹1,790 8.1 26.5 49.5 23.9 23.9 32.6 TATA Mid Cap Growth Fund Growth ₹392.364

↓ -0.45 ₹3,348 8.6 26.5 55.5 25.4 23.4 40.5 Invesco India Mid Cap Fund Growth ₹135.95

↓ -0.85 ₹4,280 7.2 27 49.6 25.2 23.3 34.1 UTI Mid Cap Fund Growth ₹264.389

↓ -1.09 ₹9,944 4.6 18 41.1 21.3 22.3 30.5 ICICI Prudential MidCap Fund Growth ₹254.8

↓ -0.94 ₹5,517 7 33.7 54.2 25.4 21.9 32.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 3 May 24

(Erstwhile Motilal Oswal MOSt Focused Midcap 30 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by investing in a maximum of 30 quality mid-cap companies having long-term competitive advantages and potential for growth. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Midcap 30 Fund is a Equity - Mid Cap fund was launched on 24 Feb 14. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Midcap 30 Fund Returns up to 1 year are on (Erstwhile Edelweiss Mid and Small Cap Fund ) The investment objective is to seek to generate long-term capital appreciation from a portfolio that predominantly invests in equity and equity-related securities of Mid Cap companies.

However, there can be no assurance that the investment objective of the Scheme will be realised. Edelweiss Mid Cap Fund is a Equity - Mid Cap fund was launched on 26 Dec 07. It is a fund with High risk and has given a Below is the key information for Edelweiss Mid Cap Fund Returns up to 1 year are on The primary objective of the Scheme is to achieve long-term capital appreciation by predominantly investing in equity & equity related instruments of mid cap companies. However, there is no assurance that the investment objective of the Scheme will be realized. PGIM India Midcap Opportunities Fund is a Equity - Mid Cap fund was launched on 2 Dec 13. It is a fund with High risk and has given a Below is the key information for PGIM India Midcap Opportunities Fund Returns up to 1 year are on To provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme by investing predominantly in a well diversified basket of equity stocks of Midcap companies. SBI Magnum Mid Cap Fund is a Equity - Mid Cap fund was launched on 29 Mar 05. It is a fund with Moderately High risk and has given a Below is the key information for SBI Magnum Mid Cap Fund Returns up to 1 year are on The investment objective of the scheme is to generate long-term capital appreciation from a portfolio of equity and equity related securities, by investing predominantly in mid and small cap companies. Kotak Emerging Equity Scheme is a Equity - Mid Cap fund was launched on 30 Mar 07. It is a fund with Moderately High risk and has given a Below is the key information for Kotak Emerging Equity Scheme Returns up to 1 year are on The Investment objective of the scheme is to seek to generate long-term capital appreciation by investing primarily in companies with high growth opportunities in

the middle and small capitalization segment, defi ned as ‘Future Leaders’. The fund will emphasize on companies that appear to offer opportunities for long-term growth and will be inclined towards companies that are driven by dynamic style of management and entrepreneurial fl air. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. BNP Paribas Mid Cap Fund is a Equity - Mid Cap fund was launched on 2 May 06. It is a fund with High risk and has given a Below is the key information for BNP Paribas Mid Cap Fund Returns up to 1 year are on To provide income distribution and / or medium to long term capital gains. Investments would be focused towards mid-cap stocks. TATA Mid Cap Growth Fund is a Equity - Mid Cap fund was launched on 1 Jul 94. It is a fund with Moderately High risk and has given a Below is the key information for TATA Mid Cap Growth Fund Returns up to 1 year are on The Scheme seeks to provide long term capital appreciation by investing in a portfolio that is predominantly constituted of equity and equity related instruments of mid cap companies. However, there can be no assurance that the funds objectives will be achieved. Invesco India Mid Cap Fund is a Equity - Mid Cap fund was launched on 19 Apr 07. It is a fund with Moderately High risk and has given a Below is the key information for Invesco India Mid Cap Fund Returns up to 1 year are on Investment objective is "capital appreciation" by investing primarily in mid cap stocks. UTI Mid Cap Fund is a Equity - Mid Cap fund was launched on 7 Apr 04. It is a fund with Moderately High risk and has given a Below is the key information for UTI Mid Cap Fund Returns up to 1 year are on To generate capital appreciation by actively investing in diversified mid cap stocks. ICICI Prudential MidCap Fund is a Equity - Mid Cap fund was launched on 28 Oct 04. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential MidCap Fund Returns up to 1 year are on 1. Motilal Oswal Midcap 30 Fund

CAGR/Annualized return of 23% since its launch. Ranked 27 in Mid Cap category. Return for 2023 was 41.7% , 2022 was 10.7% and 2021 was 55.8% . Motilal Oswal Midcap 30 Fund

Growth Launch Date 24 Feb 14 NAV (03 May 24) ₹82.6461 ↓ -0.49 (-0.60 %) Net Assets (Cr) ₹8,987 on 31 Mar 24 Category Equity - Mid Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.45 Sharpe Ratio 3.98 Information Ratio 1.03 Alpha Ratio 18.76 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹8,186 30 Apr 21 ₹12,917 30 Apr 22 ₹18,440 30 Apr 23 ₹20,416 30 Apr 24 ₹32,923 Returns for Motilal Oswal Midcap 30 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 2.4% 3 Month 12.3% 6 Month 31% 1 Year 60.4% 3 Year 36.5% 5 Year 27.2% 10 Year 15 Year Since launch 23% Historical performance (Yearly) on absolute basis

Year Returns 2023 41.7% 2022 10.7% 2021 55.8% 2020 9.3% 2019 9.7% 2018 -12.7% 2017 30.8% 2016 5.2% 2015 16.5% 2014 Fund Manager information for Motilal Oswal Midcap 30 Fund

Name Since Tenure Niket Shah 1 Jul 20 3.75 Yr. Ankush Sood 11 Nov 22 1.39 Yr. Rakesh Shetty 22 Nov 22 1.36 Yr. Data below for Motilal Oswal Midcap 30 Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Technology 19.44% Industrials 19% Consumer Cyclical 18.26% Financial Services 12.18% Real Estate 7.56% Health Care 7.38% Communication Services 5.81% Basic Materials 3.84% Asset Allocation

Asset Class Value Cash 6.54% Equity 93.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity Jio Financial Services Ltd (Financial Services)

Equity, Since 31 Aug 23 | 54394012% ₹1,061 Cr 30,000,000 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 29 Feb 24 | 54327810% ₹877 Cr 20,500,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 23 | PERSISTENT9% ₹797 Cr 2,000,000

↑ 50,000 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 31 Jul 20 | 5407628% ₹753 Cr 2,015,172

↓ -9,828 Prestige Estates Projects Ltd (Real Estate)

Equity, Since 31 Jul 23 | 5332746% ₹527 Cr 4,500,000 Coforge Ltd (Technology)

Equity, Since 31 Mar 23 | 5325416% ₹495 Cr 900,000

↑ 100,000 Balkrishna Industries Ltd (Consumer Cyclical)

Equity, Since 28 Feb 23 | BALKRISIND4% ₹400 Cr 1,725,000 Indus Towers Ltd Ordinary Shares (Communication Services)

Equity, Since 31 Mar 24 | 5348164% ₹390 Cr 13,383,920

↑ 13,383,920 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 Mar 21 | 5000934% ₹371 Cr 6,850,000

↓ -3,150,000 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 24 | 5432204% ₹369 Cr 4,500,000

↑ 4,500,000 2. Edelweiss Mid Cap Fund

CAGR/Annualized return of 13.7% since its launch. Ranked 22 in Mid Cap category. Return for 2023 was 38.4% , 2022 was 2.4% and 2021 was 50.3% . Edelweiss Mid Cap Fund

Growth Launch Date 26 Dec 07 NAV (03 May 24) ₹81.634 ↓ -0.21 (-0.25 %) Net Assets (Cr) ₹5,115 on 31 Mar 24 Category Equity - Mid Cap AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 2.1 Sharpe Ratio 3.13 Information Ratio -0.46 Alpha Ratio 1.84 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹8,856 30 Apr 21 ₹15,222 30 Apr 22 ₹19,068 30 Apr 23 ₹20,339 30 Apr 24 ₹31,178 Returns for Edelweiss Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 3.1% 3 Month 7.2% 6 Month 29.2% 1 Year 52.9% 3 Year 27% 5 Year 25.8% 10 Year 15 Year Since launch 13.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 38.4% 2022 2.4% 2021 50.3% 2020 26.4% 2019 5.2% 2018 -15.7% 2017 52.3% 2016 2.5% 2015 9.4% 2014 83.4% Fund Manager information for Edelweiss Mid Cap Fund

Name Since Tenure Trideep Bhattacharya 1 Oct 21 2.5 Yr. Sahil Shah 24 Dec 21 2.27 Yr. Data below for Edelweiss Mid Cap Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Financial Services 23.18% Consumer Cyclical 17.98% Industrials 17.79% Technology 11.82% Basic Materials 11.57% Health Care 7.73% Real Estate 3.38% Utility 2.28% Consumer Defensive 1.94% Energy 0.51% Asset Allocation

Asset Class Value Cash 1.82% Equity 98.18% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity Persistent Systems Ltd (Technology)

Equity, Since 31 Mar 21 | PERSISTENT4% ₹228 Cr 572,512 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Jul 21 | 5002514% ₹191 Cr 484,903

↓ -92,604 Power Finance Corp Ltd (Financial Services)

Equity, Since 30 Sep 23 | 5328104% ₹190 Cr 4,874,635

↑ 462,000 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Jan 20 | 5406994% ₹180 Cr 240,705 Indian Bank (Financial Services)

Equity, Since 31 Jan 21 | 5328143% ₹172 Cr 3,298,021 Cummins India Ltd (Industrials)

Equity, Since 31 Dec 20 | 5004803% ₹156 Cr 517,473 Coforge Ltd (Technology)

Equity, Since 30 Jun 23 | 5325413% ₹151 Cr 274,464 Solar Industries India Ltd (Basic Materials)

Equity, Since 30 Sep 12 | SOLARINDS3% ₹149 Cr 169,704 The Federal Bank Ltd (Financial Services)

Equity, Since 31 Dec 18 | FEDERALBNK3% ₹145 Cr 9,637,857 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 30 Jun 22 | 5323433% ₹142 Cr 658,248 3. PGIM India Midcap Opportunities Fund

CAGR/Annualized return of 17.9% since its launch. Ranked 40 in Mid Cap category. Return for 2023 was 20.8% , 2022 was -1.7% and 2021 was 63.8% . PGIM India Midcap Opportunities Fund

Growth Launch Date 2 Dec 13 NAV (03 May 24) ₹55.71 ↓ -0.24 (-0.43 %) Net Assets (Cr) ₹9,924 on 31 Mar 24 Category Equity - Mid Cap AMC Pramerica Asset Managers Private Limited Rating ☆ Risk High Expense Ratio 1.95 Sharpe Ratio 1.98 Information Ratio -0.96 Alpha Ratio -6.25 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹9,318 30 Apr 21 ₹18,251 30 Apr 22 ₹23,095 30 Apr 23 ₹23,749 30 Apr 24 ₹31,212 Returns for PGIM India Midcap Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 1.7% 3 Month 5% 6 Month 16.2% 1 Year 30.3% 3 Year 19.3% 5 Year 25.6% 10 Year 15 Year Since launch 17.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 20.8% 2022 -1.7% 2021 63.8% 2020 48.4% 2019 3.6% 2018 -16.1% 2017 37% 2016 -1.3% 2015 7.9% 2014 42.8% Fund Manager information for PGIM India Midcap Opportunities Fund

Name Since Tenure Vinay Paharia 1 Apr 23 1 Yr. Puneet Pal 16 Jul 22 1.71 Yr. Utsav Mehta 1 Nov 23 0.41 Yr. Vivek Sharma 15 Apr 24 0 Yr. Data below for PGIM India Midcap Opportunities Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Consumer Cyclical 18.18% Industrials 17.92% Financial Services 17.82% Health Care 12.11% Basic Materials 11.35% Technology 9.55% Real Estate 2.55% Consumer Defensive 2.52% Utility 2.03% Communication Services 1.36% Asset Allocation

Asset Class Value Cash 4.41% Equity 95.39% Debt 0.2% Top Securities Holdings / Portfolio

Name Holding Value Quantity Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 30 Nov 22 | 5432203% ₹324 Cr 3,946,055

↓ -200,000 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Apr 23 | 5406993% ₹298 Cr 399,033 Phoenix Mills Ltd (Real Estate)

Equity, Since 31 Jan 23 | 5031003% ₹253 Cr 910,832

↓ -91,386 Persistent Systems Ltd (Technology)

Equity, Since 30 Nov 21 | PERSISTENT2% ₹243 Cr 609,968 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Jan 22 | CHOLAFIN2% ₹240 Cr 2,073,090 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 30 Apr 23 | 5407622% ₹219 Cr 585,145

↓ -40,928 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Jun 23 | KOTAKBANK2% ₹213 Cr 1,193,854 Solar Industries India Ltd (Basic Materials)

Equity, Since 30 Apr 23 | SOLARINDS2% ₹208 Cr 236,523 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 23 | HDFCBANK2% ₹207 Cr 1,428,000 UNO Minda Ltd (Consumer Cyclical)

Equity, Since 30 Apr 23 | 5325392% ₹204 Cr 2,981,370 4. SBI Magnum Mid Cap Fund

CAGR/Annualized return of 17.3% since its launch. Ranked 28 in Mid Cap category. Return for 2023 was 34.5% , 2022 was 3% and 2021 was 52.2% . SBI Magnum Mid Cap Fund

Growth Launch Date 29 Mar 05 NAV (03 May 24) ₹211.374 ↓ -0.88 (-0.42 %) Net Assets (Cr) ₹16,856 on 31 Mar 24 Category Equity - Mid Cap AMC SBI Funds Management Private Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.88 Sharpe Ratio 2.97 Information Ratio -0.48 Alpha Ratio 2.34 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹8,195 30 Apr 21 ₹15,072 30 Apr 22 ₹19,385 30 Apr 23 ₹20,670 30 Apr 24 ₹29,053 Returns for SBI Magnum Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 1.7% 3 Month 7.7% 6 Month 19.4% 1 Year 39.9% 3 Year 24.3% 5 Year 24.1% 10 Year 15 Year Since launch 17.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 34.5% 2022 3% 2021 52.2% 2020 30.4% 2019 0.1% 2018 -18% 2017 33.5% 2016 5% 2015 14.9% 2014 71.9% Fund Manager information for SBI Magnum Mid Cap Fund

Name Since Tenure Bhavin Vithlani 1 Apr 24 0 Yr. Pradeep Kesavan 1 Apr 24 0 Yr. Data below for SBI Magnum Mid Cap Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Consumer Cyclical 28.05% Financial Services 17.04% Industrials 13.93% Basic Materials 9.02% Health Care 8.31% Real Estate 4.57% Utility 4.16% Consumer Defensive 3.09% Communication Services 2.04% Technology 1.63% Asset Allocation

Asset Class Value Cash 8.15% Equity 91.85% Top Securities Holdings / Portfolio

Name Holding Value Quantity CRISIL Ltd (Financial Services)

Equity, Since 30 Apr 21 | 5000924% ₹707 Cr 1,395,281

↓ -4,719 Torrent Power Ltd (Utilities)

Equity, Since 30 Jun 19 | 5327794% ₹702 Cr 5,169,750 Thermax Ltd (Industrials)

Equity, Since 31 Dec 13 | THERMAX4% ₹634 Cr 1,511,202 Sundaram Finance Ltd (Financial Services)

Equity, Since 30 Sep 22 | SUNDARMFIN4% ₹617 Cr 1,490,000 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 31 Dec 20 | 5407623% ₹523 Cr 1,400,000 Indian Hotels Co Ltd (Consumer Cyclical)

Equity, Since 31 Oct 18 | 5008503% ₹513 Cr 8,682,397 Schaeffler India Ltd (Consumer Cyclical)

Equity, Since 28 Feb 14 | SCHAEFFLER3% ₹456 Cr 1,623,740 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 30 Sep 21 | 5432203% ₹451 Cr 5,500,000

↑ 1,000,000 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 31 Oct 22 | 5328893% ₹438 Cr 5,260,011

↑ 984,735 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Dec 23 | 5000343% ₹435 Cr 600,000

↑ 200,000 5. Kotak Emerging Equity Scheme

CAGR/Annualized return of 15.1% since its launch. Ranked 12 in Mid Cap category. Return for 2023 was 31.5% , 2022 was 5.1% and 2021 was 47.3% . Kotak Emerging Equity Scheme

Growth Launch Date 30 Mar 07 NAV (03 May 24) ₹110.403 ↓ -0.03 (-0.02 %) Net Assets (Cr) ₹39,685 on 31 Mar 24 Category Equity - Mid Cap AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.46 Sharpe Ratio 2.98 Information Ratio -1.02 Alpha Ratio 0.94 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-2 Years (1%),2 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹8,751 30 Apr 21 ₹15,195 30 Apr 22 ₹19,030 30 Apr 23 ₹20,104 30 Apr 24 ₹28,863 Returns for Kotak Emerging Equity Scheme

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 4.2% 3 Month 9.4% 6 Month 21.5% 1 Year 43.6% 3 Year 23.8% 5 Year 23.9% 10 Year 15 Year Since launch 15.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 31.5% 2022 5.1% 2021 47.3% 2020 21.9% 2019 8.9% 2018 -11.7% 2017 43% 2016 10.4% 2015 8.4% 2014 87.3% Fund Manager information for Kotak Emerging Equity Scheme

Name Since Tenure Atul Bhole 22 Jan 24 0.19 Yr. Arjun Khanna 30 Apr 22 1.92 Yr. Data below for Kotak Emerging Equity Scheme as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 22.33% Basic Materials 18.81% Consumer Cyclical 18.79% Financial Services 13.36% Technology 9.21% Health Care 6.9% Real Estate 2.98% Energy 2.74% Consumer Defensive 0.77% Utility 0.71% Communication Services 0.24% Asset Allocation

Asset Class Value Cash 3.17% Equity 96.83% Top Securities Holdings / Portfolio

Name Holding Value Quantity Solar Industries India Ltd (Basic Materials)

Equity, Since 31 Jul 11 | SOLARINDS5% ₹1,808 Cr 2,059,015 Cummins India Ltd (Industrials)

Equity, Since 31 Oct 19 | 5004804% ₹1,763 Cr 5,863,399 Supreme Industries Ltd (Industrials)

Equity, Since 28 Feb 15 | 5099304% ₹1,540 Cr 3,637,719

↓ -110 Persistent Systems Ltd (Technology)

Equity, Since 31 Jul 13 | PERSISTENT4% ₹1,405 Cr 3,526,444 Oberoi Realty Ltd (Real Estate)

Equity, Since 31 Mar 15 | 5332733% ₹1,182 Cr 8,010,973 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Dec 18 | BEL3% ₹1,110 Cr 55,087,745 Thermax Ltd (Industrials)

Equity, Since 31 Mar 17 | THERMAX3% ₹1,096 Cr 2,614,094

↓ -224,796 Schaeffler India Ltd (Consumer Cyclical)

Equity, Since 31 Mar 14 | SCHAEFFLER3% ₹1,046 Cr 3,720,463 PI Industries Ltd (Basic Materials)

Equity, Since 30 Apr 18 | PIIND3% ₹1,041 Cr 2,691,208 Power Finance Corp Ltd (Financial Services)

Equity, Since 31 Jan 24 | 5328102% ₹966 Cr 24,765,029

↑ 3,000,000 6. BNP Paribas Mid Cap Fund

CAGR/Annualized return of 13% since its launch. Ranked 18 in Mid Cap category. Return for 2023 was 32.6% , 2022 was 4.7% and 2021 was 41.5% . BNP Paribas Mid Cap Fund

Growth Launch Date 2 May 06 NAV (03 May 24) ₹90.6357 ↓ -0.20 (-0.22 %) Net Assets (Cr) ₹1,790 on 31 Mar 24 Category Equity - Mid Cap AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk High Expense Ratio 2.19 Sharpe Ratio 3.34 Information Ratio -0.76 Alpha Ratio 3.57 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹9,114 30 Apr 21 ₹15,247 30 Apr 22 ₹18,687 30 Apr 23 ₹19,283 30 Apr 24 ₹28,929 Returns for BNP Paribas Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 4.4% 3 Month 8.1% 6 Month 26.5% 1 Year 49.5% 3 Year 23.9% 5 Year 23.9% 10 Year 15 Year Since launch 13% Historical performance (Yearly) on absolute basis

Year Returns 2023 32.6% 2022 4.7% 2021 41.5% 2020 23.1% 2019 5.2% 2018 -17.5% 2017 49% 2016 -1.2% 2015 15.3% 2014 65.6% Fund Manager information for BNP Paribas Mid Cap Fund

Name Since Tenure Shiv Chanani 13 Jul 22 1.72 Yr. Miten Vora 1 Dec 22 1.33 Yr. Data below for BNP Paribas Mid Cap Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Financial Services 20.81% Consumer Cyclical 19.49% Industrials 13.24% Health Care 13.17% Technology 10.71% Basic Materials 5.75% Consumer Defensive 5.14% Utility 4.13% Real Estate 2.72% Energy 1.06% Asset Allocation

Asset Class Value Cash 3.23% Equity 96.23% Debt 0.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity Indian Hotels Co Ltd (Consumer Cyclical)

Equity, Since 31 Oct 21 | 5008503% ₹59 Cr 1,000,000 PB Fintech Ltd (Financial Services)

Equity, Since 28 Feb 23 | 5433903% ₹56 Cr 500,000 NHPC Ltd (Utilities)

Equity, Since 31 Mar 22 | 5330983% ₹54 Cr 6,000,000 Lupin Ltd (Healthcare)

Equity, Since 28 Feb 22 | 5002573% ₹52 Cr 320,000 Phoenix Mills Ltd (Real Estate)

Equity, Since 31 Oct 22 | 5031003% ₹49 Cr 175,000 Zydus Lifesciences Ltd (Healthcare)

Equity, Since 31 Mar 23 | 5323213% ₹47 Cr 467,529

↓ -7,471 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | 5328143% ₹47 Cr 900,000 Thermax Ltd (Industrials)

Equity, Since 31 Dec 19 | THERMAX3% ₹46 Cr 110,000 Sundaram Finance Ltd (Financial Services)

Equity, Since 31 May 16 | SUNDARMFIN3% ₹46 Cr 110,000 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Jan 19 | 5002513% ₹45 Cr 115,000 7. TATA Mid Cap Growth Fund

CAGR/Annualized return of 13.1% since its launch. Ranked 31 in Mid Cap category. Return for 2023 was 40.5% , 2022 was 0.6% and 2021 was 40% . TATA Mid Cap Growth Fund

Growth Launch Date 1 Jul 94 NAV (03 May 24) ₹392.364 ↓ -0.45 (-0.12 %) Net Assets (Cr) ₹3,348 on 31 Mar 24 Category Equity - Mid Cap AMC Tata Asset Management Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.15 Sharpe Ratio 3.26 Information Ratio -0.74 Alpha Ratio 3.31 Min Investment 5,000 Min SIP Investment 150 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹8,904 30 Apr 21 ₹14,402 30 Apr 22 ₹17,348 30 Apr 23 ₹18,105 30 Apr 24 ₹28,288 Returns for TATA Mid Cap Growth Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 4.1% 3 Month 8.6% 6 Month 26.5% 1 Year 55.5% 3 Year 25.4% 5 Year 23.4% 10 Year 15 Year Since launch 13.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 40.5% 2022 0.6% 2021 40% 2020 24.3% 2019 6.5% 2018 -13% 2017 49.8% 2016 -2.2% 2015 10.8% 2014 80% Fund Manager information for TATA Mid Cap Growth Fund

Name Since Tenure Satish Mishra 9 Mar 21 3.06 Yr. Data below for TATA Mid Cap Growth Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 35.27% Financial Services 16.28% Health Care 10.59% Basic Materials 9.87% Consumer Cyclical 9.1% Real Estate 6.38% Technology 3.73% Consumer Defensive 2.31% Energy 1.49% Communication Services 1.41% Utility 1.37% Asset Allocation

Asset Class Value Cash 2.19% Equity 97.81% Top Securities Holdings / Portfolio

Name Holding Value Quantity Thermax Ltd (Industrials)

Equity, Since 30 Apr 21 | THERMAX4% ₹122 Cr 292,162

↓ -4,356 Cummins India Ltd (Industrials)

Equity, Since 31 Mar 21 | 5004803% ₹114 Cr 380,000 Aurobindo Pharma Ltd (Healthcare)

Equity, Since 30 Jun 23 | AUROPHARMA3% ₹109 Cr 1,000,000 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 22 | 5001033% ₹104 Cr 4,200,000 PI Industries Ltd (Basic Materials)

Equity, Since 31 Dec 15 | PIIND3% ₹97 Cr 250,000 CreditAccess Grameen Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Nov 22 | 5417703% ₹86 Cr 600,000 AIA Engineering Ltd (Industrials)

Equity, Since 31 Oct 13 | AIAENG3% ₹86 Cr 220,000

↑ 2,000 Lupin Ltd (Healthcare)

Equity, Since 31 Dec 22 | 5002572% ₹81 Cr 500,000 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Jul 22 | BEL2% ₹81 Cr 4,000,000 Kajaria Ceramics Ltd (Industrials)

Equity, Since 30 Jun 22 | 5002332% ₹80 Cr 693,950

↑ 23,950 8. Invesco India Mid Cap Fund

CAGR/Annualized return of 16.5% since its launch. Ranked 38 in Mid Cap category. Return for 2023 was 34.1% , 2022 was 0.5% and 2021 was 43.1% . Invesco India Mid Cap Fund

Growth Launch Date 19 Apr 07 NAV (03 May 24) ₹135.95 ↓ -0.85 (-0.62 %) Net Assets (Cr) ₹4,280 on 31 Mar 24 Category Equity - Mid Cap AMC Invesco Asset Management (India) Private Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2.08 Sharpe Ratio 3.46 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹9,157 30 Apr 21 ₹14,308 30 Apr 22 ₹17,559 30 Apr 23 ₹18,717 30 Apr 24 ₹28,157 Returns for Invesco India Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 2.7% 3 Month 7.2% 6 Month 27% 1 Year 49.6% 3 Year 25.2% 5 Year 23.3% 10 Year 15 Year Since launch 16.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 34.1% 2022 0.5% 2021 43.1% 2020 24.4% 2019 3.8% 2018 -5.3% 2017 44.3% 2016 1.1% 2015 6.4% 2014 77% Fund Manager information for Invesco India Mid Cap Fund

Name Since Tenure Aditya Khemani 9 Nov 23 0.39 Yr. Amit Ganatra 1 Sep 23 0.58 Yr. Data below for Invesco India Mid Cap Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Consumer Cyclical 28.28% Financial Services 19.69% Industrials 14.79% Health Care 13.42% Technology 8.27% Real Estate 6.16% Basic Materials 4.6% Utility 2% Consumer Defensive 1.86% Asset Allocation

Asset Class Value Cash 0.93% Equity 99.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity Trent Ltd (Consumer Cyclical)

Equity, Since 30 Apr 21 | 5002515% ₹216 Cr 546,046 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Dec 22 | 5432204% ₹184 Cr 2,246,434 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Mar 21 | CHOLAFIN4% ₹183 Cr 1,580,991

↑ 43,415 The Federal Bank Ltd (Financial Services)

Equity, Since 31 Oct 22 | FEDERALBNK4% ₹172 Cr 11,480,924 L&T Finance Holdings Ltd (Financial Services)

Equity, Since 31 Dec 23 | 5335194% ₹156 Cr 9,883,840 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 Dec 23 | 5432784% ₹154 Cr 3,611,063 Dixon Technologies (India) Ltd (Technology)

Equity, Since 28 Feb 22 | 5406993% ₹143 Cr 190,577 Prestige Estates Projects Ltd (Real Estate)

Equity, Since 30 Nov 23 | 5332743% ₹140 Cr 1,197,383

↑ 62,997 Max Financial Services Ltd (Financial Services)

Equity, Since 30 Nov 23 | 5002713% ₹139 Cr 1,383,185 Mankind Pharma Ltd (Healthcare)

Equity, Since 30 Apr 23 | 5439043% ₹138 Cr 600,883 9. UTI Mid Cap Fund

CAGR/Annualized return of 18.3% since its launch. Ranked 36 in Mid Cap category. Return for 2023 was 30.5% , 2022 was -0.8% and 2021 was 43.1% . UTI Mid Cap Fund

Growth Launch Date 7 Apr 04 NAV (03 May 24) ₹264.389 ↓ -1.09 (-0.41 %) Net Assets (Cr) ₹9,944 on 31 Mar 24 Category Equity - Mid Cap AMC UTI Asset Management Company Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2 Sharpe Ratio 2.61 Information Ratio -1.55 Alpha Ratio -4.31 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹8,804 30 Apr 21 ₹15,095 30 Apr 22 ₹18,673 30 Apr 23 ₹19,097 30 Apr 24 ₹27,126 Returns for UTI Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 2.1% 3 Month 4.6% 6 Month 18% 1 Year 41.1% 3 Year 21.3% 5 Year 22.3% 10 Year 15 Year Since launch 18.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 30.5% 2022 -0.8% 2021 43.1% 2020 32.7% 2019 -0.2% 2018 -14.9% 2017 42% 2016 3.5% 2015 6.6% 2014 90.4% Fund Manager information for UTI Mid Cap Fund

Name Since Tenure Ankit Agarwal 30 Aug 19 4.59 Yr. Data below for UTI Mid Cap Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Consumer Cyclical 20.14% Financial Services 18.7% Industrials 18.48% Technology 10.71% Health Care 10.5% Basic Materials 6.67% Real Estate 2.52% Utility 2.41% Energy 2.24% Consumer Defensive 2% Communication Services 1.95% Asset Allocation

Asset Class Value Cash 3.52% Equity 96.32% Debt 0.16% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity Phoenix Mills Ltd (Real Estate)

Equity, Since 31 Jul 20 | 5031003% ₹251 Cr 901,028

↑ 15,000 The Federal Bank Ltd (Financial Services)

Equity, Since 30 Nov 10 | FEDERALBNK2% ₹227 Cr 15,092,781 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 30 Sep 17 | 5407622% ₹223 Cr 595,509

↓ -40,000 Oil India Ltd (Energy)

Equity, Since 31 Oct 23 | 5331062% ₹222 Cr 3,702,946

↓ -46,764 Oracle Financial Services Software Ltd (Technology)

Equity, Since 30 Nov 23 | 5324662% ₹217 Cr 246,853 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 23 | PERSISTENT2% ₹211 Cr 530,192 Bharat Forge Ltd (Consumer Cyclical)

Equity, Since 31 Aug 13 | 5004932% ₹211 Cr 1,868,064 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Apr 22 | BEL2% ₹207 Cr 10,290,464

↓ -1,200,000 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Apr 21 | SHRIRAMFIN2% ₹200 Cr 847,693 Alkem Laboratories Ltd (Healthcare)

Equity, Since 31 Jul 21 | ALKEM2% ₹195 Cr 394,405 10. ICICI Prudential MidCap Fund

CAGR/Annualized return of 18.1% since its launch. Ranked 35 in Mid Cap category. Return for 2023 was 32.8% , 2022 was 3.1% and 2021 was 44.8% . ICICI Prudential MidCap Fund

Growth Launch Date 28 Oct 04 NAV (03 May 24) ₹254.8 ↓ -0.94 (-0.37 %) Net Assets (Cr) ₹5,517 on 31 Mar 24 Category Equity - Mid Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.11 Sharpe Ratio 2.7 Information Ratio -0.57 Alpha Ratio -2.49 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹7,614 30 Apr 21 ₹13,485 30 Apr 22 ₹16,616 30 Apr 23 ₹17,183 30 Apr 24 ₹26,661 Returns for ICICI Prudential MidCap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 3 May 24 Duration Returns 1 Month 3% 3 Month 7% 6 Month 33.7% 1 Year 54.2% 3 Year 25.4% 5 Year 21.9% 10 Year 15 Year Since launch 18.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 32.8% 2022 3.1% 2021 44.8% 2020 19.1% 2019 -0.6% 2018 -10.8% 2017 42.9% 2016 4.8% 2015 5.1% 2014 87% Fund Manager information for ICICI Prudential MidCap Fund

Name Since Tenure Lalit Kumar 1 Jul 22 1.75 Yr. Sharmila D’mello 31 Jul 22 1.67 Yr. Data below for ICICI Prudential MidCap Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Basic Materials 22.38% Industrials 18.53% Consumer Cyclical 14.26% Real Estate 11.52% Health Care 10.5% Communication Services 5.68% Financial Services 4.28% Energy 4.28% Utility 2.56% Technology 0.69% Asset Allocation

Asset Class Value Cash 5.27% Equity 94.73% Top Securities Holdings / Portfolio

Name Holding Value Quantity Jindal Stainless Ltd (Basic Materials)

Equity, Since 31 Aug 22 | 5325084% ₹201 Cr 2,888,476

↑ 200,000 Hindustan Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 22 | HINDPETRO4% ₹199 Cr 4,183,076

↓ -286,200 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 22 | 5002574% ₹199 Cr 1,229,917

↓ -170,083 Phoenix Mills Ltd (Real Estate)

Equity, Since 31 May 20 | 5031004% ₹197 Cr 706,491

↓ -200 Jindal Steel & Power Ltd (Basic Materials)

Equity, Since 31 Jan 22 | 5322863% ₹185 Cr 2,179,227 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 31 Oct 18 | 5323433% ₹151 Cr 699,955 AIA Engineering Ltd (Industrials)

Equity, Since 30 Nov 17 | AIAENG3% ₹146 Cr 372,547

↑ 7,880 ACC Ltd (Basic Materials)

Equity, Since 31 Aug 22 | 5004103% ₹139 Cr 557,062 Cummins India Ltd (Industrials)

Equity, Since 31 Oct 22 | 5004802% ₹133 Cr 444,068 Oberoi Realty Ltd (Real Estate)

Equity, Since 31 May 23 | 5332732% ₹133 Cr 899,376

Conclusion

Mid-cap funds can be worth adding to your investment Portfolio. But, consider the returns that they can deliver. However, one thing you need to re-think on is— “Not every mid-cap can be tomorrow’s large cap."

So, choose your investment wisely!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.