Table of Contents

Average Age of Inventory Meaning

Often known as the number of Days' Sales in Inventory (DSI), the average age of inventory is the number of days a company takes to sell out its inventory. It is a parameter used by analysts to determine the effectiveness of sales.

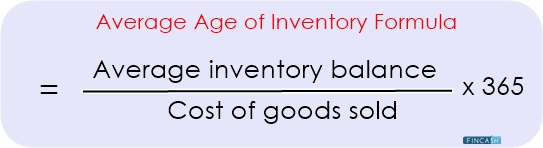

Average Age of Inventory Formula

The average age of inventory is computed for a year. The Cost of Goods Sold (COGS) for the period is divided by the Average Inventory Balance (AIB), and the result is multiplied by 365 days to determine the average age of the inventory.

The formula for the average age of inventory is:

Average age of inventory = (average inventory balance / cost of goods sold) x 365

Where:

- Average inventory balance is the arithmetic mean of the inventory balances at the start and the end of the year

- The cost of goods sold is the direct expenses incurred by a business in Manufacturing goods for sale. It also includes direct labour and Raw Materials utilised to make the goods

Average Age of Inventory Example

Let's understand the concept better with an example. Assume you are a potential investor choosing between two retail food businesses, Company A and Company B:

- The average inventory and COGS for Company A are Rs. 2,00,000 and Rs. 10,00,000 respectively

- Company B reports an average COGS of Rs. 15,00,000 and an inventory cost of Rs. 1,00,000

Assuming all other factors are the same, which company is a better investment?

- The average age of Company A's inventory = (Rs. 2,00,000 / Rs. 10,00,000) x 365 = 73.0 days

- Company B's average age of inventory = (Rs. 1,00,000 / Rs. 15,00,000) x 365 = 24.3 days

Company B has an inventory that has a substantially lower average age as compared to Company A. What does it say, exactly?

Given the possibility of product spoiling in the food retail sector, it is preferable to aim for a lower average age of inventory to reduce the likelihood of ruined food products.

As a result, Company B seems like a better investment option.

Company A's management can consider lowering product pricing or coming up with discounts and promotions to move their inventory more quickly.

Advantages of Average Age of Inventory

Here are the advantages of the average age of inventory:

1. Management Analysis

The management and effectiveness of the two businesses can be easily compared using the age of inventory analysis. Using the example mentioned above, the average age of inventory for the first firm was 73 days, whereas it was just 24.3 days for the second company. Consequently, it can be concluded that the second business is more adept at maximising sales and accelerating the depletion of its inventory. The measurement is true even if the comparison involves two similar stores in two different sectors, one from the urban area and the other from the rural. This is because each store will begin with an extra level of inventory.

2. Risk Evaluation

Assessing the exposure of a store to Market risk can be done by looking at the average age of its inventory. A store that takes too long to sell an item risks having to write off the item as obsolete. However, it is essential to keep in mind that this risk evaluation approach only functions while comparing two stores of a similar type.

Average Age of Inventory – High or Low

How well the retail Industry is doing is shown by the average age of the inventory. The value of this metric indicates how profitable a retail business is and vice versa. The company hasn't been particularly successful if the average age of the inventory is high.

Inventory Turnover and Average Age of Inventory

The cost of the sold products divided by the average inventory is known as the inventory turnover. The average age of inventory provides a rough estimation of how long it takes to sell one unit of a certain commodity. One benefit of this analysis is how simple it is to calculate.

Conclusion

The average age of inventory influences managers' pricing decisions, such as whether to give a discount on existing inventory and increase cash flow. It also influences purchasing agents' decisions on what to acquire. A firm's exposure to Obsolescence Risk develops as the average age of its inventory rises. The risk of becoming obsolete is the possibility that inventories will depreciate over time or in a weak market. If it cannot sell its inventory, a company can take an inventory write-off for a sum less than the indicated value on the Balance Sheet.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.