Table of Contents

General Equilibrium Theory

What is General Equilibrium Theory?

Also known as Walrasian general equilibrium, the General equilibrium theory attempts to describe the functions of the macroeconomy as a whole instead of collections of specific Market phenomena. This theory was developed in the late 19th century by a French Economist Leon Walras.

Also, this theory contradicts the paradigms of the partial equilibrium theory, which on evaluates specific sectors or markets.

Explaining General Equilibrium Theory

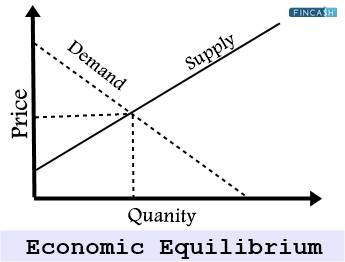

Walras created the general equilibrium theory with an intention to solve a debated problem in the subject of Economics. Up to this point, most of the economic evaluations only described partial equilibrium, which spoke about the price at which supply equalled demand and markets clear, in individual sectors or market.

However, such analysis didn’t show that the equilibrium could be there for all markets, in aggregate, at the same time. On the contrary, the general equilibrium theory tried showing why and how all free markets move toward equilibrium in the long run.

The essential trust here was that markets necessarily didn’t reach the point of equilibrium, only moved toward it. Furthermore, the general equilibrium theory develops on the coordinating process of the system of a few market prices, which was first popularized by the Wealth of Nations, written by Adam Smith in 1776.

This system talks about how traders create transactions by purchasing and selling products in a bidding process along with other traders. These transaction prices also acted as signals to other consumers and producers to align their activities and resources with more profitable lines.

A talented and skilled mathematician that he was, Walras believed that he proved that any individual market was in equilibrium if all the other markets were in the same position. This started being famous as the Walras’s Law.

Talk to our investment specialist

Certain Considerations

There are several assumptions, unrealistic and realistic, inside the framework of general equilibrium. Every Economy has a finite number of products in a finite number of agents. Every agent has a consistent and concave utility function with possession of a single product that is pre-existing.

To increase the utility, every agent must trade his produced goods for other products that can be consumed. There is a certain and restricted set of market prices for products in this theoretical economy.

Every agent depends on such prices to maximize utility; thus, creating demand and supply for varying products. Much like most of the equilibrium models, markets lack innovation, imperfect knowledge and uncertainty.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.