Table of Contents

What is Qstick Indicator?

The Qstick indicator or the QuickStick indicator is a technical indicator that makes analysis of the stock prices easier by providing some numerical figures. By definition, it is calculated by taking an ‘n’ period Moving Average of the closing minus opening prices of a particular stock.

This moving average can either be a Simple Moving Average (SMA) or Exponential Moving Average (EMA). In short, it establishes a numerical relationship between the differences in opening and closing prices of stocks or securities and their moving averages (EMA/SMA) over a period of time.

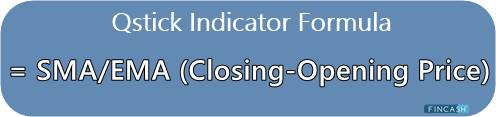

Qstick Indicator Formula

The formula for the Qstick indicator is as follows:

Qstick Indicator = SMA/EMA (Closing-Opening Price)

This can be calculated for any period of time, ‘n’ as it may seem fit for the person who is making the analysis. The period also depends on the purpose for which you are using the indicator.

How to Calculate Using Qstick Indicator?

Calculating the Qstick indicator is not a difficult task. It involves the following steps:

- Decide the period for which the indicator has to be calculated

- Record the close and open prices of the shares and calculate their differences

- Calculate the moving average from the differences. A moving average can be a Simple Moving Average (SMA) or Exponential Moving Average (EMA)

- Calculate the Qstick indicator using the formula

Talk to our investment specialist

Interpretation

The indicator gives transaction signals whenever it crosses the zero line; this means if the indicator goes above or below zero, it indicates to either buy or sell. It can be understood as follows:

When the indicator's value is more than 0, it indicates buying pressure; that is, it gives buying signals. Buying pressure means the demand for stocks is high, and people are willing to pay more

When the indicator's value is below 0, it indicates selling pressure, giving a selling signal. Selling pressure means there is a greater supply of stocks and securities. It is the exact opposite of buying pressure

Difference Between Qstick indicator and ROC

Rate Of Change (ROC) measures the change between the current and past prices of stocks in percentage terms. It is calculated as follows:

Closing price - opening price/closing price x 100

The value can be either above or below zero; that is, the value can be positive or negative. A positive value indicates buying pressure, and a negative value indicates selling pressure in the Market.

The major difference between the Qstick indicator and ROC is that the Qstick indicator takes the average of the differences in closing and opening prices. At the same time, ROC measures it in percentage terms. The indicators are calculated using almost the same variables but indicated slightly differently.

Is It Reliable?

The biggest question to anybody’s mind is whether this indicator is reliable. Here’s an answer to it:

- Qstick indicator, like any other stock market indicator, is not completely reliable when deciding to buy or sell stocks or securities

- Next, it depends on the past prices of stocks, so the predictability Factor is ruled out in most situations. Future predictions of the prices of stocks and securities are impossible with the Qstick indicator

- Only a combination of indicators can help you make a better decision, not just one indicator

Conclusion

The stock market is a very volatile place. Efforts are being made to simplify and understand the uncertainty and complexity of the markets. This has been made possible by developing various indicators and their analysis, the Qstick indicator being one of them. No doubt, these indicators do not provide a definite solution to any trading problems, but they help to a great extent in making big and even small buying and selling decisions. Using a combination of these indicators, one can make better and more informed decisions.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.