Table of Contents

Defining Wash

Also known as a break-even proposition, a Wash is referred to a series of transactions that result in zero as the total sum gain. For instance, if you lost Rs. 100 on investment and gained Rs. 100 in another investment, it will be zero for you.

That is represented as a wash. However, the implications of tax could be quite complicated for you in this situation.

Wash Example

In a wash situation, two transactions cancel each other while efficiently creating a position of break-even. Suppose a company has spent. Rs. 1,00,000 to manufacture merchandise and sell the same for Rs. 1,00,000; the result will be a wash.

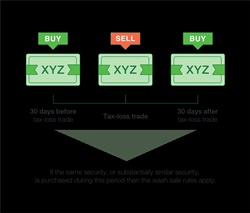

Another example of wash could be an investor losing Rs. 5000 upon selling an investment while simultaneously getting Rs. 5000 from selling another. The concept is quite simple and straightforward. However, there are certain complicated tax rules that are applied to selling actions taken by investors; thus, linked to the claim of losses on investments. In a precise manner, such rules prevent investors from claiming a loss in case they have sold a security at a loss and repurchased the same or a significantly similar one within 30 days.

Talk to our investment specialist

For instance, suppose you buy 100 shares of a stock for Rs. 10,000. Within six weeks, the value of these 100 shares decreases to Rs. 7,000. With a hope to deduct the Capital Loss of Rs. 3,000 at the time of filing Taxes, you decide you sell all 100 shares. However, after a week, you buy the same 100 shares again. Now, the loss that you had incurred earlier will not be claimed since you bought the same security within a restricted time interval. One good thing here is that a loss realized from a wash is not wasted completely.

You can apply the same loss to the cost Basis of your second purchase. This leads to an increase in the cost basis of the purchased security; therefore, decrease the size of future taxable gains while selling the stock. The advantages of wash get delayed but haven’t disappeared completely. Additionally, the holding period of wash securities gets added to the holding period of replacement securities. Also, the thing that must be noted here is that certain wash sales are considered illegal if they resemble any Pump and Dump scheme. For instance, being an investor, you cannot purchase stock through one brokerage firm and sell it through another to stimulate the interest of investors.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.