Table of Contents

Defining Open Offer in Stock Market

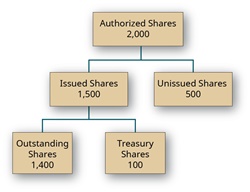

When a business purchases up to 15% of the outstanding shares of another listed company, it is said to have initiated an open offer. As a result, the acquiring business must offer to buy an additional 20% of the company's shares from current shareholders.

Like a rights issue, an open offer refers to a secondary Market Offering. Herein, a shareholder is permitted to buy the stock below the going rate on the market. Such an offer aims to raise Capital for the business effectively.

Open Offer in India

Investors cannot transfer the rights that come with their purchases in an open offer, which is how it differs from a rights issue. In a classic right offering, shares and transferable rights are traded on the exchange where the issuer's common stock is currently traded (e.g., NYSE or Nasdaq). Additionally, these may be sold Over the Counter (OTC). Due to the stock dilution it produces, some investors view a secondary market offering as a sign of ill things to come. The open offer can also hint that the market is currently overvaluing a firm stock.

A firm enables current shareholders to acquire additional shares from the company directly in proportion to what they already own in both a rights issue and an open offer. This is done to protect current stockholders from being diluted. In contrast to conventional equity issues and secondary offerings, such a case does not need shareholder approval due to the lack of dilution. This is true if the case represents less than 20% of the total number of outstanding shares.

Talk to our investment specialist

Open Offer SEBI

An open offer is often activated in India when a company buys up to 15% of the shares of another listed company. In such circumstances, an open offer to buy 20% of the company's shares will be made to the current shareholders.

If current shareholders of the acquired company anticipate potential hazards due to changes in the management and business, they are also granted the benefit of an exit option. The acquiring corporation must publish a public statement in the newspaper after deciding on the offer price. The takeover code is governed by the Securities and Exchange Board of India (SEBI); therefore, the announcement will also be accessible there.

The stakeholders of the company being bought will get an offer letter with information on the purpose, offer price, and management of the acquiring company. The processes for receiving the shareholders' tendered shares will also be mentioned in the addressed letter.

Open Offer vs Right Issue

The purpose of a rights issue is to raise money, whereas an open offer results in a cash outflow. The rights issue price is typically less than the going rate on the secondary market. An open offer's price is set based on the six-month average cost and is typically higher than the going market rate, incentivising present shareholders to sell their shares.

Shares acquired through an open offer, as opposed to a rights issue, are not exchanged on a secondary market. While a rights issue raises the number of shares held by general shareholders, an open offer reduces their holdings.

Open Offer Price

The actual price that the acquirer pays to current promoters is one of the criteria the market regulator has laid forth to determine the open offer price. However, this price should be higher than the volume-weighted average price for the previous 26, 52, or 60 days, whichever comes first, before the decision to buy the share is made public or when the acquisition is finalised whichever comes first.

Open Offer in Law

There are two types of open offers in law, as follows:

Mandatory Open Offer

A mandatory offer, also known as a mandatory tender offer or mandatory open offer, is the one that is made to the target company's current shareholders when the acquirer or any Person Acting in Concert (PAC) seeks to acquire at least 26% (15% under the SAST Regulations, 1997) of the target's shares.

Voluntary Open Offer

According to the Regulation 6, a voluntary open offer is made by a party alone or via other collaborating parties, if any, who possess at least 25% of the voting rights or shares in the target firm but not more than the maximum allowable non-public shareholding limit

Conclusion

An acquirer must make a public announcement before making an open offer. This announcement must include the offer price, the number of shares that will be purchased from the public, the reason for the acquisition, the acquirer's identity, future plans, information about the target company, the process for accepting the shares, and the timeframe for this. Within 15 days of the offer's closure, the purchaser must pay the consideration to the shareholders. The acquirer is liable to pay interest on the amount for any delays.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.