Table of Contents

બીએસઈ સેન્સેક્સમાં વર્ષોથી વૃદ્ધિ

શા માટે ઇક્વિટી લાંબા ગાળા માટે સારી છે?

જ્યારે પણ આપણે ઇક્વિટી રોકાણ વિશે સાંભળીએ છીએ, ત્યારે સૌથી પહેલી વાત એ છે કે ઇક્વિટી લાંબા ગાળાના રોકાણ માટે સારી છે. જો કે, વિવિધ લોકો ઇક્વિટી રોકાણના સંદર્ભમાં નકારાત્મક વિચારો ધરાવે છે. તેથી, ચાલો સમજીએ કે શા માટે અને કેવી રીતે ઇક્વિટી લાંબા ગાળા માટે સારું રોકાણ છે, ઇક્વિટી રોકાણ પાછળની દંતકથાઓ અને જ્યારે તપાસવાના પરિમાણોરોકાણ ઇક્વિટી અને ખ્યાલમાંઇક્વિટી ફંડ્સ.

સેન્સેક્સના ભૂતકાળના પ્રદર્શનને સમજવું

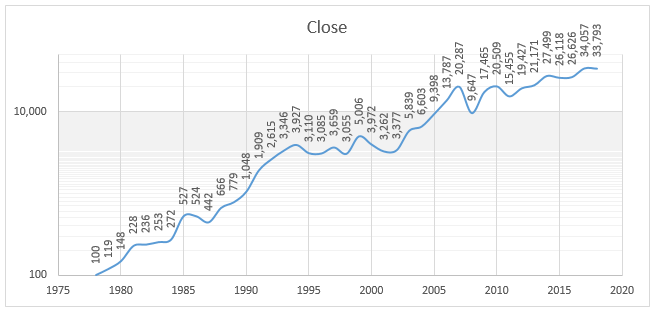

હવે, ચાલો નીચે આપેલા ગ્રાફની મદદથી સેન્સેક્સની શરૂઆતથી તેની કામગીરી પર ધ્યાન કેન્દ્રિત કરીએ.

(3જી જાન્યુઆરી, 2018 ના રોજ, સ્ત્રોત- BSE લિમિટેડ)

સેન્સેક્સનો આપેલ ગ્રાફ દર્શાવે છે કે 1979 માં તેની શરૂઆતથી અત્યાર સુધીમાં તેમાં એકંદરે વધારો થયો છે. જે તારીખ પર ડેટા લેવામાં આવ્યો છે તે 03 જાન્યુઆરી, 2018 છે. 1979 થી અત્યાર સુધી,ચક્રવૃદ્ધિ વાર્ષિક વૃદ્ધિ દર (CAGR) આશરે 16.39% છે. જો કે, તેનો અર્થ એ નથી કે સેન્સેક્સમાં માત્ર ઉપરની ગતિ જોવા મળી છે.જો કે, સેન્સેક્સમાં સૌથી મોટી વૃદ્ધિ 1979-1994ના સમયગાળા દરમિયાન જોવા મળી હતી જ્યારે બજારો 100 થી 3,927 પોઈન્ટ સુધી વધ્યા હતા.. જે લોકોએ આ સમયગાળા દરમિયાન રોકાણ કર્યું હશે તેઓને નોંધપાત્ર નફો થયો હશે. વધુમાં, આ રોકાણકારોને પણ અન્યોની જેમ વધુ નકારાત્મક વળતરનો સામનો કરવો પડ્યો નથી. પરિણામે, આ લોકોએ ચોક્કસપણે કમાણી કરી હશે.બીજો શ્રેષ્ઠ તબક્કો જેમાં રોકાણકારોએ વળતર મેળવ્યું હતું તે 2003-2007 દરમિયાન હતું, પરંતુ આ સમયગાળા દરમિયાન વધારો પ્રથમ તબક્કા જેટલો અસરકારક ન હતો.

તો, શું તમને લાગે છે કે ધબજાર હંમેશા સારી ગતિ સાક્ષી છે?તેમાં મંદી પણ જોવા મળી છે. સપ્ટેમ્બર 1994 - 1999, 2000 - 2003 અને 2008 - 2010 દરમિયાન સેન્સેક્સ મંદી દર્શાવતો હતો તેવા કેટલાક સૌથી ખરાબ સ્પેલ હતા. કોઈપણ વ્યક્તિ કે જેણે આ સમયગાળા દરમિયાન રોકાણ કર્યું હશે તે ચોક્કસપણે નકારાત્મક હશે. જો કે, ફરીથી, જો આ રોકાણકારોએ તેમના રોકાણોને લાંબા સમય સુધી રોકી રાખ્યા હોત, તો તેઓ ચોક્કસપણે નફો કમાયા હોત. આપણે નકશામાં જોઈ શકીએ છીએ તેમ, મંદીનો સમયગાળો બહુ દેખાતો નથી.

તેથી, ઇક્વિટી વિશેની માન્યતાઓને સમજ્યા પછી, ચાલો હવે જોઈએ કે સ્ટોક કેવી રીતે પસંદ કરવો.

ઇક્વિટી ઇન્વેસ્ટમેન્ટ પાછળની સામાન્ય માન્યતાઓ

અગાઉ ઉલ્લેખ કર્યો છે તેમ, ઇક્વિટી રોકાણ તેની સાથે સંકળાયેલી અનેક માન્યતાઓ ધરાવે છે. તેથી, ચાલો ઇક્વિટી રોકાણ પાછળની કેટલીક પ્રચલિત માન્યતાઓ જોઈએ.

1. જો કોઈ શેરે ભૂતકાળમાં સારું કામ કર્યું હોય, તો તે ભવિષ્યમાં પણ સારું કામ કરશે

શેરમાં રોકાણ કરતી વખતે લોકો જે પ્રથમ માન્યતા માને છે તે છે; જો કોઈ કંપનીએ ભૂતકાળમાં સારો દેખાવ કર્યો હોય, તો તે ભવિષ્યમાં પણ સારો દેખાવ કરશે. જો કે આ વિચાર હજુ સુધી કેટલાક આરામ સ્તર આપી શકે છે; તે સંપૂર્ણપણે સાચું નથી. તે કારણ કે; કંપનીની સફળતા હંમેશા તેના પર નિર્ભર કરે છે કે તે કેવા વાતાવરણમાં પ્રદર્શન કરે છે અને તે બદલાતી વ્યાપારી પરિસ્થિતિઓમાં પોતાને અનુકૂલિત કરવામાં સક્ષમ છે કે કેમ. જો તે આમ કરવા સક્ષમ ન હોય તો; કંપની ભવિષ્યમાં પ્રદર્શન કરવાની સ્થિતિમાં રહેશે નહીં.

તેથી, લોકોએ કોઈપણ કંપનીના શેરમાં રોકાણ કરતા પહેલા સ્વ-વિશ્લેષણ કરવું જોઈએ. તેઓએ કંપનીની ભૂતકાળની કામગીરી, તેની ભાવિ સંભાવનાઓ, તે જે ઉદ્યોગની પરિસ્થિતિઓમાં તે પ્રદર્શન કરે છે અને અન્ય સંબંધિત પરિમાણોને તપાસવા જોઈએ.

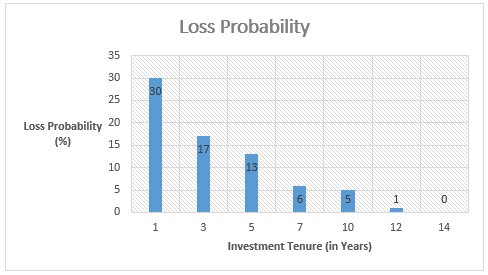

2. હું ઇક્વિટીઝ દ્વારા ઝડપથી વળતર મેળવવા માટે સક્ષમ નથી કારણ કે તે સંપૂર્ણ નસીબ છે

બીજી ધારણા લોકોને લાગે છે કે તેઓ ઇક્વિટી રોકાણ દ્વારા કમાણી કરી શકતા નથી કારણ કે તે સંપૂર્ણ નસીબ પર આધારિત છે. જો કે, અગાઉના ફકરામાં જણાવ્યા મુજબ, લોકોએ એ સમજવાની જરૂર છે કે સરેરાશ વળતરની વિવિધતા હોલ્ડિંગની મુદતમાં વધારા સાથે ઘટે છે. આનું કારણ એ છે કે, લાંબા ગાળામાં, ટૂંકા ગાળાની અસ્થિરતાની વધઘટ ઓછી થાય છે અને નુકસાન થવાની શક્યતાઓ પણ ઓછી હોય છે. પરિણામે, માં ભિન્નતાકમાણી કાર્યકાળમાં વધારા સાથે ઘટવાનું શરૂ કરો. આ ખ્યાલ નીચે આપેલા કોષ્ટકની મદદથી સમજાવવામાં આવ્યો છે.

| રોકાણનો કાર્યકાળ | સરેરાશ વળતર (%) | સરેરાશથી વળતરનું વિચલન (%) |

|---|---|---|

| 1 વર્ષ | 18 | ± 34 |

| 3 વર્ષ | 13 | ± 16% |

| 5 વર્ષ | 13 | ± 13% |

| 7 વર્ષ | 13 | ± 10% |

| 10 વર્ષ | 13 | ± 9% |

| 12 વર્ષ | 13 | ± 8% |

| 14 વર્ષ | 12 | ± 7% |

3. ઇક્વિટી માર્કેટ અસ્થિર હોવાથી માત્ર થોડા જ શેર બજારોમાં કમાણી કરી રહ્યા છે

તે વ્યક્તિઓમાં પ્રચલિત દંતકથાઓમાંની એક છે. ઘણા લોકોને લાગે છે કે તેઓ શેરમાં રોકાણ કરીને કમાણી કરી શકતા નથી. ઘણા બધા કિસ્સાઓમાં વ્યક્તિઓ અનુભવે છે; જોકે શેર બજારો અપટ્રેન્ડ દર્શાવે છે; છતાં હું મારું નસીબ બનાવી શકતો નથી. જો કે, આ સાચું નથી.

*એ સમજવું જોઈએ કે ઈક્વિટી રોકાણ એ શૂન્ય રકમની રમત છે. તેથી, એક વ્યક્તિનો નફો એ બીજી વ્યક્તિનું નુકસાન છે. જો કે, તમે નફો કર્યો છે કે નુકસાનમાં સમાપ્ત થયું છે તેનું પરિણામ તમે બજારમાં પ્રવેશો અને બહાર નીકળો ત્યારે નક્કી કરવામાં આવે છે. *

તે ફરીથી પુનરાવર્તિત કરવામાં આવશે કે, ઇક્વિટી રોકાણમાં સફળતાની ચાવી તેનું લાંબા ગાળાનું હોલ્ડિંગ છે. વિશ્વના પ્રખ્યાત પૈકી એકરોકાણકાર વોરન બફેટે પોતાનું સામ્રાજ્ય માત્ર રોકાણને કારણે નહીં બનાવ્યું. તેના બદલે, તેણે લાંબા ગાળા માટે રોકાણને પકડી રાખવાને કારણે સંપત્તિ મેળવી છે. લાંબા ગાળાના રોકાણના કિસ્સામાં, રોકાણ કરેલ નાની રકમ પણ મોટું વળતર આપે છે. જે લોકો ખૂબ લાંબા સમય સુધી રોકાણ કરે છે તેઓ નાના રોકાણથી પણ સંપત્તિ મેળવી શકે છે. નીચેનો ગ્રાફ બતાવે છે કે રોકાણની મુદતમાં વધારા સાથે નુકસાનની સંભાવના કેવી રીતે ઘટે છે.

Talk to our investment specialist

ઇક્વિટીમાં કેવી રીતે રોકાણ કરવું

તે સૌથી મહત્વપૂર્ણ પગલું છે. ઇક્વિટીમાં રોકાણ કરતી વખતે લોકોએ અમુક મૂળભૂત નિયમોને વળગી રહેવાની જરૂર છે. આમાંના કેટલાક નિયમો નીચે મુજબ સૂચિબદ્ધ છે.

તેના સંપૂર્ણ વિશ્લેષણ પછી સ્ટોક્સમાં રોકાણ કરો અને ટોળાના વર્તનને અનુસરશો નહીં

રોકાણનો પ્રાથમિક નિયમ છે; નાણાકીય સાધનોમાં રોકાણ કરો જે તમે સમજો છો અને જે તમે નથી સમજતા તેમાં નહીં. આથી, લોકોએ જે શેરમાં તેઓ રોકાણ કરવા માગે છે તેનું સંપૂર્ણ વિશ્લેષણ કરવું જોઈએ. તેઓએ તેના વાર્ષિક અહેવાલોમાંથી પસાર થવું જોઈએ, તેની ભાવિ સંભાવનાઓ તપાસવી જોઈએ અને તેથી વધુ. વધુમાં, કોઈએ તેમની સ્ટોક પસંદગી પ્રક્રિયામાં પક્ષપાત રાખવો જોઈએ નહીં. ઉપરાંત, જ્યારે રોકાણની વાત આવે છે ત્યારે ઘણા લોકો ટોળાના વર્તનને અનુસરે છે, જે કેસ ન હોવો જોઈએ. તે એક સારો વિચાર નથી. ટોળાનો ભાગ બનેલા લોકો, જ્યારે બજાર તેની ટોચ પર હોય ત્યારે પ્રવેશ કરે છે અને જ્યારે તે તળિયે બનાવે છે ત્યારે વેચે છે. તેથી, સાવચેત રહો કે જ્યારે બધા ખરીદી દાખલ કરી રહ્યા હોય ત્યારે તમે શેર ન ખરીદોકૉલ કરો અને જ્યારે દરેક વ્યક્તિ વેચાણની પળોજણમાં જાય ત્યારે વેચશો નહીં.

વૈવિધ્યકરણ એ સફળતાની ચાવી છે

રોકાણના કિસ્સામાં મહત્વની ભૂમિકા વૈવિધ્યકરણની છે, જે સફળતાની ચાવી છે કારણ કે તે જોખમના સ્તરને ઘટાડવામાં મદદ કરે છે. જેમ યોગ્ય રીતે ટાંક્યું છે"તમારા બધા ઈંડાને એક ટોપલીમાં ન કાઢો;" એ જ રીતે તમારું રોકાણ પૂર્વવ્યાખ્યાયિત ગુણોત્તરમાં અસંખ્ય શેરોમાં વહેંચવું જોઈએ. આ સંદર્ભમાં વૈવિધ્યકરણનો અર્થ એ છે કે લોકો મૂડીકરણ, ક્ષેત્રો અને અન્ય પરિમાણોના સંદર્ભમાં વિવિધ કંપનીઓના વિવિધ શેરોમાં કોર્પસનું રોકાણ કરે છે. આ એટલા માટે છે કારણ કે ત્યાં પરિસ્થિતિઓ છે જ્યાંમિડ-કેપ શેર્સ લાર્જ-કેપ શેરોને પાછળ રાખી દે છે. તેથી, શેર કેવું પ્રદર્શન કરી રહ્યું છે તેના પર સતત નજર રાખવાની જરૂર છે.

તમારા પોર્ટફોલિયોને સમયસર રિબેલેન્સ કરો

સાચું જ કહેવાયું છે કે, ભૂલ કરવી એ માણસ છે. તેવી જ રીતે, શેરબજારમાં રોકાણ કરતી વખતે, ઘણા લોકો ભૂલો કરે છે. આ સંદર્ભમાં ભૂલ એ શેરોમાં રોકાણ કરવાની છે જ્યાં તમારી પાસે ખરાબ સોદા છે. જો કે, તમારા પોર્ટફોલિયોને ફરીથી સંતુલિત કરીને ખોટા રોકાણને સુધારવાનો સૌથી મહત્વનો ભાગ છે. તમારા ઇક્વિટી રોકાણ પર સમયસર દેખરેખ રાખવી મહત્વપૂર્ણ છે. આનાથી ઓળખવામાં મદદ મળશે કે કયા સ્ટોકને વેચવા અને કયાને જાળવી રાખવા. પોર્ટફોલિયોને પુનઃસંતુલિત કરવાથી હંમેશા ખરાબ સ્ટોકમાંથી છુટકારો મેળવવામાં મદદ મળે છે અને તેના કારણે લોકો વધુ કમાણી કરી શકે છેઆવક.

આમ, ઉપરોક્ત નિર્દેશો પરથી એવું કહી શકાય કે જ્યારે પણ તમે ઇક્વિટીમાં રોકાણ કરવાનું પસંદ કરો છો, ત્યારે તમારે બજારના સમયને બદલે શેરબજારમાં ઘણો સમય વિતાવવાની જરૂર છે. ઉપરાંત, લોકોએ હંમેશા તેના શેરમાં રોકાણ કરતા પહેલા કંપનીને સમજવી જોઈએ જેથી કરીને તેમના રોકાણના નાણાં સુરક્ષિત રહે અને સંપત્તિ સર્જનનો માર્ગ મોકળો થાય.

લાંબા ગાળાના રોકાણ માટે ટોચના 10 ઇક્વિટી મ્યુચ્યુઅલ ફંડ

*માટે અસ્કયામતોનું સંચાલન કરતા ટોચના ફંડોની યાદી5 વર્ષ ઉપરોક્ત અને શ્રેષ્ઠ વાર્ષિક વળતર (CAGR) પરત કર્યા છે.

The primary objective of the Scheme is to achieve long-term capital appreciation by investing in equity & equity related instruments of mid cap & small cap companies. Principal Emerging Bluechip Fund is a Equity - Large & Mid Cap fund was launched on 12 Nov 08. It is a fund with Moderately High risk and has given a Below is the key information for Principal Emerging Bluechip Fund Returns up to 1 year are on (Erstwhile Sundaram Select Midcap Fund) To achieve capital appreciation by investing

in diversified stocks that are generally termed

as mid-caps. Sundaram Mid Cap Fund is a Equity - Mid Cap fund was launched on 30 Jul 02. It is a fund with Moderately High risk and has given a Below is the key information for Sundaram Mid Cap Fund Returns up to 1 year are on (Erstwhile Motilal Oswal MOSt Focused Midcap 30 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by investing in a maximum of 30 quality mid-cap companies having long-term competitive advantages and potential for growth. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Midcap 30 Fund is a Equity - Mid Cap fund was launched on 24 Feb 14. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Midcap 30 Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments HDFC Long Term Advantage Fund is a Equity - ELSS fund was launched on 2 Jan 01. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on An Open-ended growth scheme with the objective of long term growth of capital, through a portfolio with a target allocation of 90% equity and 10% debt and money market securities. Aditya Birla Sun Life Equity Fund is a Equity - Multi Cap fund was launched on 27 Aug 98. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Equity Fund Returns up to 1 year are on The primary objective for Franklin IndiaTaxshield is to provide medium to long term growth of capital along with income tax rebate Franklin India Taxshield is a Equity - ELSS fund was launched on 10 Apr 99. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Taxshield Returns up to 1 year are on An Open ended Growth Scheme with the objective to achieve long term growth of capital at controlled level of risk by investing primarily in ‘Mid-Cap’ Stocks. The level of risk is somewhat higher than a fund focused on large and liquid stocks. Concomitantly, the aim is to generate higher returns than a fund focused on large and liquid stocks. Aditya Birla Sun Life Midcap Fund is a Equity - Mid Cap fund was launched on 3 Oct 02. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Midcap Fund Returns up to 1 year are on The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Nippon India Small Cap Fund is a Equity - Small Cap fund was launched on 16 Sep 10. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Small Cap Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek to generate continuous returns by actively investing in equity and equity related securities of

companies in the Banking Sector and companies engaged in allied activities related to Banking Sector. The AMC will have the discretion to completely or

partially invest in any of the type of securities stated above with a view to maximize the returns or on defensive considerations. However, there can be no

assurance that the investment objective of the Scheme will be realized, as actual market movements may be at variance with anticipated trends. Nippon India Banking Fund is a Equity - Sectoral fund was launched on 26 May 03. It is a fund with High risk and has given a Below is the key information for Nippon India Banking Fund Returns up to 1 year are on The primary investment objective of the scheme is to seek to generate consistent returns by investing in equity and equity related or fixed income securities of Pharma and other associated companies. Nippon India Pharma Fund is a Equity - Sectoral fund was launched on 5 Jun 04. It is a fund with High risk and has given a Below is the key information for Nippon India Pharma Fund Returns up to 1 year are on 1. Principal Emerging Bluechip Fund

CAGR/Annualized return of 24.8% since its launch. Ranked 1 in Large & Mid Cap category. . Principal Emerging Bluechip Fund

Growth Launch Date 12 Nov 08 NAV (31 Dec 21) ₹183.316 ↑ 2.03 (1.12 %) Net Assets (Cr) ₹3,124 on 30 Nov 21 Category Equity - Large & Mid Cap AMC Principal Pnb Asset Mgmt. Co. Priv. Ltd. Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 2.08 Sharpe Ratio 2.74 Information Ratio 0.22 Alpha Ratio 2.18 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,552 Returns for Principal Emerging Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 2.9% 3 Month 2.9% 6 Month 13.6% 1 Year 38.9% 3 Year 21.9% 5 Year 19.2% 10 Year 15 Year Since launch 24.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Principal Emerging Bluechip Fund

Name Since Tenure Data below for Principal Emerging Bluechip Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. Sundaram Mid Cap Fund

CAGR/Annualized return of 23.5% since its launch. Ranked 13 in Mid Cap category. Return for 2024 was 32% , 2023 was 40.4% and 2022 was 4.8% . Sundaram Mid Cap Fund

Growth Launch Date 30 Jul 02 NAV (04 Apr 25) ₹1,205.01 ↓ -30.66 (-2.48 %) Net Assets (Cr) ₹10,451 on 28 Feb 25 Category Equity - Mid Cap AMC Sundaram Asset Management Company Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.8 Sharpe Ratio -0.05 Information Ratio -0.12 Alpha Ratio 4.15 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,480 31 Mar 22 ₹21,162 31 Mar 23 ₹21,693 31 Mar 24 ₹33,395 31 Mar 25 ₹37,537 Returns for Sundaram Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 5.1% 3 Month -13.6% 6 Month -13.4% 1 Year 6.7% 3 Year 19.4% 5 Year 30.4% 10 Year 15 Year Since launch 23.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 32% 2022 40.4% 2021 4.8% 2020 37.5% 2019 11.8% 2018 -0.3% 2017 -15.4% 2016 40.8% 2015 11.3% 2014 11.2% Fund Manager information for Sundaram Mid Cap Fund

Name Since Tenure S. Bharath 24 Feb 21 4.1 Yr. Ratish Varier 24 Feb 21 4.1 Yr. Data below for Sundaram Mid Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Consumer Cyclical 19.48% Financial Services 19.47% Industrials 13.59% Health Care 10.64% Basic Materials 10.07% Technology 6.6% Consumer Defensive 3.88% Communication Services 3.62% Real Estate 3.42% Utility 1.95% Energy 1.65% Asset Allocation

Asset Class Value Cash 5.63% Equity 94.37% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity Cummins India Ltd (Industrials)

Equity, Since 31 Dec 17 | 5004803% ₹345 Cr 1,270,127

↑ 8,529 The Federal Bank Ltd (Financial Services)

Equity, Since 31 Dec 18 | FEDERALBNK3% ₹342 Cr 19,247,362 Coromandel International Ltd (Basic Materials)

Equity, Since 30 Nov 10 | 5063953% ₹291 Cr 1,747,182 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 Mar 21 | KALYANKJIL3% ₹278 Cr 6,016,821 Lupin Ltd (Healthcare)

Equity, Since 31 Jan 23 | 5002572% ₹257 Cr 1,350,321 Persistent Systems Ltd (Technology)

Equity, Since 30 Apr 22 | PERSISTENT2% ₹257 Cr 484,892 Indian Bank (Financial Services)

Equity, Since 31 Jul 23 | 5328142% ₹242 Cr 4,738,175

↓ -158,971 Fortis Healthcare Ltd (Healthcare)

Equity, Since 31 Dec 21 | 5328432% ₹238 Cr 3,879,249 Mahindra & Mahindra Financial Services Ltd (Financial Services)

Equity, Since 31 Jan 24 | M&MFIN2% ₹229 Cr 8,478,867 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 31 Oct 20 | 5406112% ₹216 Cr 3,817,491 3. Motilal Oswal Midcap 30 Fund

CAGR/Annualized return of 21.7% since its launch. Ranked 27 in Mid Cap category. Return for 2024 was 57.1% , 2023 was 41.7% and 2022 was 10.7% . Motilal Oswal Midcap 30 Fund

Growth Launch Date 24 Feb 14 NAV (04 Apr 25) ₹88.9378 ↓ -2.28 (-2.50 %) Net Assets (Cr) ₹23,704 on 28 Feb 25 Category Equity - Mid Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.66 Sharpe Ratio 0.43 Information Ratio 0.72 Alpha Ratio 16.87 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,888 31 Mar 22 ₹23,342 31 Mar 23 ₹25,677 31 Mar 24 ₹41,172 31 Mar 25 ₹48,151 Returns for Motilal Oswal Midcap 30 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 0.1% 3 Month -21.5% 6 Month -16% 1 Year 9.7% 3 Year 25.4% 5 Year 37.3% 10 Year 15 Year Since launch 21.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 57.1% 2022 41.7% 2021 10.7% 2020 55.8% 2019 9.3% 2018 9.7% 2017 -12.7% 2016 30.8% 2015 5.2% 2014 16.5% Fund Manager information for Motilal Oswal Midcap 30 Fund

Name Since Tenure Ajay Khandelwal 1 Oct 24 0.41 Yr. Niket Shah 1 Jul 20 4.67 Yr. Rakesh Shetty 22 Nov 22 2.27 Yr. Sunil Sawant 1 Jul 24 0.67 Yr. Data below for Motilal Oswal Midcap 30 Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Technology 34.02% Consumer Cyclical 16.09% Industrials 11.09% Health Care 5% Communication Services 3.44% Real Estate 2.8% Basic Materials 2.32% Utility 2.06% Financial Services 0.09% Asset Allocation

Asset Class Value Cash 28.33% Equity 71.67% Top Securities Holdings / Portfolio

Name Holding Value Quantity Coforge Ltd (Technology)

Equity, Since 31 Mar 23 | COFORGE10% ₹2,349 Cr 3,190,000

↑ 340,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 23 | PERSISTENT10% ₹2,254 Cr 4,249,800

↑ 249,800 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 29 Feb 24 | KALYANKJIL7% ₹1,619 Cr 35,027,075

↑ 26,975 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Mar 23 | DIXON7% ₹1,581 Cr 1,134,324

↑ 134,324 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 24 | MAXHEALTH4% ₹975 Cr 9,969,361

↑ 1,913,231 One97 Communications Ltd (Technology)

Equity, Since 30 Sep 24 | 5433964% ₹934 Cr 13,066,359

↑ 3,065,359 Trent Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | 5002514% ₹873 Cr 1,800,000

↓ -820,200 Polycab India Ltd (Industrials)

Equity, Since 30 Sep 23 | POLYCAB3% ₹825 Cr 1,750,000

↓ -100,000 Bharti Hexacom Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIHEXA3% ₹815 Cr 6,250,000

↑ 174,429 KEI Industries Ltd (Industrials)

Equity, Since 30 Nov 24 | KEI3% ₹768 Cr 2,500,000

↑ 1,250,000 4. HDFC Long Term Advantage Fund

CAGR/Annualized return of 21.4% since its launch. Ranked 23 in ELSS category. . HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,787

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. Aditya Birla Sun Life Equity Fund

CAGR/Annualized return of 21% since its launch. Ranked 16 in Multi Cap category. Return for 2024 was 18.5% , 2023 was 26% and 2022 was -1.1% . Aditya Birla Sun Life Equity Fund

Growth Launch Date 27 Aug 98 NAV (04 Apr 25) ₹1,606.18 ↓ -30.15 (-1.84 %) Net Assets (Cr) ₹20,080 on 28 Feb 25 Category Equity - Multi Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.69 Sharpe Ratio -0.15 Information Ratio -0.24 Alpha Ratio 3.45 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,397 31 Mar 22 ₹21,099 31 Mar 23 ₹20,222 31 Mar 24 ₹27,766 31 Mar 25 ₹30,687 Returns for Aditya Birla Sun Life Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 4.8% 3 Month -7% 6 Month -10.1% 1 Year 5.9% 3 Year 11.4% 5 Year 25.7% 10 Year 15 Year Since launch 21% Historical performance (Yearly) on absolute basis

Year Returns 2023 18.5% 2022 26% 2021 -1.1% 2020 30.3% 2019 16.1% 2018 8.5% 2017 -4.1% 2016 33.5% 2015 15.2% 2014 2.9% Fund Manager information for Aditya Birla Sun Life Equity Fund

Name Since Tenure Harish Krishnan 3 Nov 23 1.41 Yr. Dhaval Joshi 21 Nov 22 2.36 Yr. Data below for Aditya Birla Sun Life Equity Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 33.46% Consumer Cyclical 11.39% Industrials 10.38% Technology 9.94% Basic Materials 9.45% Health Care 7.48% Consumer Defensive 7.44% Energy 5.39% Communication Services 3.13% Real Estate 0.58% Asset Allocation

Asset Class Value Cash 1.25% Equity 98.75% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 16 | ICICIBANK8% ₹1,626 Cr 13,500,000 Infosys Ltd (Technology)

Equity, Since 30 Apr 05 | INFY5% ₹1,074 Cr 6,365,588

↓ -134,412 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK5% ₹936 Cr 5,404,179

↑ 372,810 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 28 Feb 19 | KOTAKBANK4% ₹868 Cr 4,563,682

↑ 63,682 Reliance Industries Ltd (Energy)

Equity, Since 31 May 19 | RELIANCE4% ₹815 Cr 6,789,998 HCL Technologies Ltd (Technology)

Equity, Since 30 Nov 11 | HCLTECH3% ₹567 Cr 3,600,000 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Dec 18 | SUNPHARMA3% ₹536 Cr 3,365,000

↓ -867,179 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Nov 17 | BHARTIARTL3% ₹531 Cr 3,382,814

↓ -153,374 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Jan 15 | CHOLAFIN2% ₹469 Cr 3,350,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 23 | LT2% ₹445 Cr 1,407,458

↓ -292,542 6. Franklin India Taxshield

CAGR/Annualized return of 20.8% since its launch. Ranked 28 in ELSS category. Return for 2024 was 22.4% , 2023 was 31.2% and 2022 was 5.4% . Franklin India Taxshield

Growth Launch Date 10 Apr 99 NAV (04 Apr 25) ₹1,344.48 ↓ -23.08 (-1.69 %) Net Assets (Cr) ₹5,986 on 28 Feb 25 Category Equity - ELSS AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆ Risk Moderately High Expense Ratio 1.83 Sharpe Ratio -0.19 Information Ratio 1.13 Alpha Ratio 2.84 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,793 31 Mar 22 ₹21,613 31 Mar 23 ₹22,171 31 Mar 24 ₹32,145 31 Mar 25 ₹35,012 Returns for Franklin India Taxshield

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 3.5% 3 Month -9.4% 6 Month -9.9% 1 Year 4.9% 3 Year 15.3% 5 Year 29.4% 10 Year 15 Year Since launch 20.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 22.4% 2022 31.2% 2021 5.4% 2020 36.7% 2019 9.8% 2018 5.1% 2017 -3% 2016 29.1% 2015 4.7% 2014 4% Fund Manager information for Franklin India Taxshield

Name Since Tenure R. Janakiraman 2 May 16 8.84 Yr. Rajasa Kakulavarapu 1 Dec 23 1.25 Yr. Data below for Franklin India Taxshield as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 30.86% Consumer Cyclical 13.13% Technology 10.95% Industrials 9.83% Health Care 6.41% Communication Services 5.59% Consumer Defensive 5.31% Basic Materials 4.65% Utility 4.03% Energy 3.03% Real Estate 1.63% Asset Allocation

Asset Class Value Cash 3.86% Equity 96.14% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 07 | HDFCBANK9% ₹565 Cr 3,260,417 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK9% ₹547 Cr 4,546,914 Infosys Ltd (Technology)

Equity, Since 29 Feb 12 | INFY5% ₹325 Cr 1,922,741 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 07 | BHARTIARTL5% ₹308 Cr 1,963,637

↓ -250,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 19 | LT5% ₹280 Cr 883,853 HCL Technologies Ltd (Technology)

Equity, Since 31 Oct 21 | HCLTECH4% ₹230 Cr 1,462,587 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 14 | 5322154% ₹229 Cr 2,252,948 Zomato Ltd (Consumer Cyclical)

Equity, Since 30 Nov 21 | 5433203% ₹167 Cr 7,500,000 United Spirits Ltd (Consumer Defensive)

Equity, Since 31 Oct 18 | UNITDSPR3% ₹164 Cr 1,276,457

↓ -298,543 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Nov 17 | KOTAKBANK3% ₹161 Cr 843,530 7. Aditya Birla Sun Life Midcap Fund

CAGR/Annualized return of 20.7% since its launch. Ranked 16 in Mid Cap category. Return for 2024 was 22% , 2023 was 39.9% and 2022 was -5.3% . Aditya Birla Sun Life Midcap Fund

Growth Launch Date 3 Oct 02 NAV (04 Apr 25) ₹691.78 ↓ -19.76 (-2.78 %) Net Assets (Cr) ₹5,056 on 28 Feb 25 Category Equity - Mid Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.94 Sharpe Ratio -0.11 Information Ratio -1.19 Alpha Ratio 2.92 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,116 31 Mar 22 ₹23,680 31 Mar 23 ₹22,337 31 Mar 24 ₹32,732 31 Mar 25 ₹36,576 Returns for Aditya Birla Sun Life Midcap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 4.7% 3 Month -11.5% 6 Month -15.3% 1 Year 4.3% 3 Year 13.8% 5 Year 29.8% 10 Year 15 Year Since launch 20.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 22% 2022 39.9% 2021 -5.3% 2020 50.4% 2019 15.5% 2018 -3.7% 2017 -16% 2016 44.8% 2015 5.7% 2014 10.4% Fund Manager information for Aditya Birla Sun Life Midcap Fund

Name Since Tenure Vishal Gajwani 31 Oct 24 0.41 Yr. Dhaval Joshi 21 Nov 22 2.36 Yr. Data below for Aditya Birla Sun Life Midcap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 20.13% Basic Materials 17.17% Consumer Cyclical 15.68% Health Care 12.4% Industrials 11.14% Technology 7.36% Real Estate 3.6% Consumer Defensive 3.23% Utility 2.75% Communication Services 1.39% Energy 0.38% Asset Allocation

Asset Class Value Cash 3.75% Equity 96.25% Top Securities Holdings / Portfolio

Name Holding Value Quantity Fortis Healthcare Ltd (Healthcare)

Equity, Since 31 May 17 | 5328434% ₹180 Cr 2,938,828

↓ -161,172 Cholamandalam Financial Holdings Ltd (Financial Services)

Equity, Since 31 Dec 14 | CHOLAHLDNG3% ₹158 Cr 964,000 Torrent Power Ltd (Utilities)

Equity, Since 31 Oct 19 | 5327793% ₹139 Cr 1,100,000 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN3% ₹139 Cr 2,244,070 Gujarat Fluorochemicals Ltd Ordinary Shares (Basic Materials)

Equity, Since 30 Sep 19 | FLUOROCHEM3% ₹138 Cr 384,431 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 30 Nov 19 | 5406113% ₹136 Cr 2,407,000 Glenmark Pharmaceuticals Ltd (Healthcare)

Equity, Since 28 Feb 21 | 5322963% ₹128 Cr 1,000,000 United Breweries Ltd (Consumer Defensive)

Equity, Since 31 Jul 21 | 5324783% ₹127 Cr 652,792 Max Financial Services Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5002712% ₹122 Cr 1,225,565 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 31 Aug 20 | KPRMILL2% ₹120 Cr 1,500,000 8. Nippon India Small Cap Fund

CAGR/Annualized return of 20.3% since its launch. Ranked 6 in Small Cap category. Return for 2024 was 26.1% , 2023 was 48.9% and 2022 was 6.5% . Nippon India Small Cap Fund

Growth Launch Date 16 Sep 10 NAV (04 Apr 25) ₹147.907 ↓ -3.95 (-2.60 %) Net Assets (Cr) ₹50,826 on 28 Feb 25 Category Equity - Small Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.55 Sharpe Ratio -0.31 Information Ratio 0.66 Alpha Ratio 3.26 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹21,742 31 Mar 22 ₹31,334 31 Mar 23 ₹33,418 31 Mar 24 ₹51,907 31 Mar 25 ₹55,076 Returns for Nippon India Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 5.5% 3 Month -16.2% 6 Month -17% 1 Year 0.9% 3 Year 19.1% 5 Year 41% 10 Year 15 Year Since launch 20.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.1% 2022 48.9% 2021 6.5% 2020 74.3% 2019 29.2% 2018 -2.5% 2017 -16.7% 2016 63% 2015 5.6% 2014 15.1% Fund Manager information for Nippon India Small Cap Fund

Name Since Tenure Samir Rachh 2 Jan 17 8.16 Yr. Kinjal Desai 25 May 18 6.77 Yr. Data below for Nippon India Small Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 22.17% Consumer Cyclical 13.91% Financial Services 13.54% Basic Materials 12.14% Consumer Defensive 8.89% Technology 8.65% Health Care 8.16% Energy 2.03% Utility 1.98% Communication Services 1.54% Real Estate 0.54% Asset Allocation

Asset Class Value Cash 6.04% Equity 93.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 22 | HDFCBANK2% ₹1,152 Cr 6,650,000 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 21 | MCX2% ₹924 Cr 1,851,010 Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Oct 12 | KIRLOSBROS1% ₹714 Cr 4,472,130 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Nov 18 | DIXON1% ₹655 Cr 470,144 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5900031% ₹639 Cr 31,784,062 State Bank of India (Financial Services)

Equity, Since 31 Oct 19 | SBIN1% ₹627 Cr 9,100,000 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 30 Apr 18 | TIINDIA1% ₹615 Cr 2,499,222 NLC India Ltd (Utilities)

Equity, Since 31 Oct 22 | NLCINDIA1% ₹563 Cr 27,190,940 Adani Wilmar Ltd (Consumer Defensive)

Equity, Since 31 Jan 25 | 5434581% ₹553 Cr 22,483,343

↑ 183,343 Apar Industries Ltd (Industrials)

Equity, Since 31 Mar 17 | APARINDS1% ₹521 Cr 899,271 9. Nippon India Banking Fund

CAGR/Annualized return of 20.3% since its launch. Ranked 15 in Sectoral category. Return for 2024 was 10.3% , 2023 was 24.2% and 2022 was 20.7% . Nippon India Banking Fund

Growth Launch Date 26 May 03 NAV (04 Apr 25) ₹571.563 ↓ -2.55 (-0.44 %) Net Assets (Cr) ₹6,129 on 28 Feb 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.94 Sharpe Ratio 0.04 Information Ratio 0.78 Alpha Ratio -6.77 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,796 31 Mar 22 ₹21,684 31 Mar 23 ₹23,468 31 Mar 24 ₹31,409 31 Mar 25 ₹35,338 Returns for Nippon India Banking Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 6.4% 3 Month 0.4% 6 Month -1.7% 1 Year 9.8% 3 Year 15.3% 5 Year 30.6% 10 Year 15 Year Since launch 20.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 10.3% 2022 24.2% 2021 20.7% 2020 29.7% 2019 -10.6% 2018 10.7% 2017 -1.2% 2016 44.1% 2015 11.5% 2014 -6% Fund Manager information for Nippon India Banking Fund

Name Since Tenure Vinay Sharma 9 Apr 18 6.98 Yr. Kinjal Desai 25 May 18 6.85 Yr. Bhavik Dave 18 Jun 21 3.79 Yr. Data below for Nippon India Banking Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 95.28% Technology 2.81% Asset Allocation

Asset Class Value Cash 1.91% Equity 98.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK21% ₹1,311 Cr 7,564,660

↓ -150,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK16% ₹953 Cr 7,915,358 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 17 | 53221510% ₹589 Cr 5,800,228 State Bank of India (Financial Services)

Equity, Since 31 Mar 14 | SBIN5% ₹307 Cr 4,459,330 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 May 19 | INDUSINDBK4% ₹260 Cr 2,627,608 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Jul 20 | SBICARD4% ₹228 Cr 2,720,827 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Oct 23 | 5329784% ₹215 Cr 1,146,038 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jul 23 | KOTAKBANK3% ₹201 Cr 1,055,000

↓ -455,000 Cholamandalam Financial Holdings Ltd (Financial Services)

Equity, Since 30 Apr 19 | CHOLAHLDNG3% ₹191 Cr 1,160,355 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Nov 20 | SBILIFE3% ₹186 Cr 1,300,170 10. Nippon India Pharma Fund

CAGR/Annualized return of 20.3% since its launch. Ranked 35 in Sectoral category. Return for 2024 was 34% , 2023 was 39.2% and 2022 was -9.9% . Nippon India Pharma Fund

Growth Launch Date 5 Jun 04 NAV (04 Apr 25) ₹468.829 ↓ -15.57 (-3.21 %) Net Assets (Cr) ₹7,637 on 28 Feb 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk High Expense Ratio 1.88 Sharpe Ratio -0.03 Information Ratio -0.33 Alpha Ratio -3.9 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,447 31 Mar 22 ₹20,234 31 Mar 23 ₹18,871 31 Mar 24 ₹29,909 31 Mar 25 ₹33,564 Returns for Nippon India Pharma Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 2.5% 3 Month -11.1% 6 Month -9.3% 1 Year 8.8% 3 Year 16.7% 5 Year 26.2% 10 Year 15 Year Since launch 20.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 34% 2022 39.2% 2021 -9.9% 2020 23.9% 2019 66.4% 2018 1.7% 2017 3.6% 2016 7.6% 2015 -10.6% 2014 19.4% Fund Manager information for Nippon India Pharma Fund

Name Since Tenure Sailesh Raj Bhan 1 Apr 05 20.01 Yr. Kinjal Desai 25 May 18 6.86 Yr. Data below for Nippon India Pharma Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Health Care 98.89% Asset Allocation

Asset Class Value Cash 1.11% Equity 98.89% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 09 | SUNPHARMA14% ₹1,045 Cr 6,556,349 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB9% ₹712 Cr 1,298,808

↓ -52,000 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 08 | 5002578% ₹590 Cr 3,098,126

↓ -102,567 Cipla Ltd (Healthcare)

Equity, Since 31 May 08 | 5000876% ₹450 Cr 3,200,000

↑ 100,000 Dr Reddy's Laboratories Ltd (Healthcare)

Equity, Since 30 Jun 11 | DRREDDY5% ₹409 Cr 3,662,170 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Sep 20 | APOLLOHOSP5% ₹393 Cr 648,795 Abbott India Ltd (Healthcare)

Equity, Since 31 May 11 | ABBOTINDIA4% ₹292 Cr 95,985

↑ 9,595 Vijaya Diagnostic Centre Ltd (Healthcare)

Equity, Since 30 Sep 21 | 5433503% ₹260 Cr 2,843,231 Medplus Health Services Ltd (Healthcare)

Equity, Since 30 Nov 22 | 5434273% ₹259 Cr 3,627,277

↑ 62,597 GlaxoSmithKline Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Aug 22 | GLAXO3% ₹250 Cr 1,011,921

↑ 179,134

અહીં આપેલી માહિતી સચોટ છે તેની ખાતરી કરવા માટેના તમામ પ્રયાસો કરવામાં આવ્યા છે. જો કે, ડેટાની શુદ્ધતા અંગે કોઈ ગેરંટી આપવામાં આવતી નથી. કોઈપણ રોકાણ કરતા પહેલા કૃપા કરીને સ્કીમ માહિતી દસ્તાવેજ સાથે ચકાસો.