+91-22-48913909

+91-22-48913909

Table of Contents

- रिटर्न द्वारा शीर्ष 10 बैलेंस्ड म्युचुअल फंड

- बैलेंस्ड एडवांटेज फंड में ऑनलाइन निवेश कैसे करें?

Top 10 Funds

- Sundaram Equity Hybrid Fund

- SBI Dynamic Asset Allocation Fund

- DSP BlackRock Equity and Bond Fund

- Baroda Pioneer Hybrid Equity Fund

- Axis Dynamic Equity Fund

- SBI Equity Hybrid Fund

- Franklin India Multi - Asset Solution Fund

- IDFC Hybrid Equity Fund

- IDBI Hybrid Equity Fund

- DSP BlackRock Dynamic Asset Allocation Fund

बेस्ट बैलेंस्ड म्यूचुअल फंड्स 2022 रिटर्न्स द्वारा

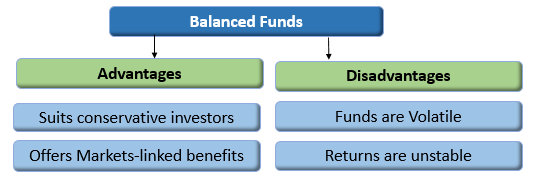

सर्वोत्तम संतुलित लाभ निधि हैंम्यूचुअल फंड्स जो अपनी संपत्ति का 65% से अधिक निवेश करते हैंइक्विटीज और ऋण उपकरणों में शेष संपत्ति अच्छा समग्र रिटर्न प्राप्त करने के लिए। बैलेंस्ड म्युचुअल फंड उन निवेशकों के लिए फायदेमंद होते हैं जो एक लेने के इच्छुक हैंमंडी कुछ निश्चित रिटर्न की तलाश में भी जोखिम। इक्विटी और स्टॉक में निवेश की गई संपत्ति बाजार से जुड़े रिटर्न की पेशकश करती है जबकि डेट इंस्ट्रूमेंट में निवेश की गई संपत्ति निश्चित रिटर्न देती है। इक्विटी और डेट दोनों का संयोजन होने के कारण, निवेशकों को बहुत सावधान रहना चाहिए जबनिवेश इन निधियों में। निवेशकों को सलाह दी जाती है कि वे टॉप की तलाश करेंबैलेंस्ड फंड बैलेंस्ड म्यूचुअल फंड में निवेश करने से पहले। हमने नीचे शीर्ष संतुलित म्यूचुअल फंड सूचीबद्ध किए हैं।

Talk to our investment specialist

रिटर्न द्वारा शीर्ष 10 बैलेंस्ड म्युचुअल फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sundaram Equity Hybrid Fund Growth ₹135.137

↑ 0.78 ₹1,954 0.5 10.5 27.1 16 14.2 SBI Dynamic Asset Allocation Fund Growth ₹15.9463

↑ 0.03 ₹655 3.9 6.2 25.1 6.9 8.3 DSP BlackRock Equity and Bond Fund Growth ₹347.018

↑ 3.55 ₹9,795 3.5 -0.7 18 14.8 19.6 17.7 Baroda Pioneer Hybrid Equity Fund Growth ₹81.2894

↑ 0.36 ₹389 -3.5 -0.8 14.8 14.3 11.2 Axis Dynamic Equity Fund Growth ₹20.35

↑ 0.18 ₹2,625 1.9 -0.6 13.5 13.3 14.3 17.5 SBI Equity Hybrid Fund Growth ₹284.788

↑ 3.13 ₹68,440 4.7 1 13.4 11.6 17.8 14.2 Franklin India Multi - Asset Solution Fund Growth ₹20.3093

↑ 0.17 ₹62 6 4.9 12.8 11.3 9.7 11.7 IDFC Hybrid Equity Fund Growth ₹24.156

↑ 0.27 ₹752 0.4 -3.8 12.4 12.5 20.1 21 IDBI Hybrid Equity Fund Growth ₹17.1253

↓ -0.01 ₹179 7.8 9.8 12.1 14.4 7.1 DSP BlackRock Dynamic Asset Allocation Fund Growth ₹26.762

↑ 0.14 ₹3,106 2.5 0.6 12 10.8 12.1 12.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21

शीर्ष 10 बैलेंस्ड एडवांटेज म्यूचुअल फंड

(Erstwhile Sundaram Balanced Fund) The scheme seeks to generate capital appreciation and current income through a judicious mix of investments in equities and fixed income securities. Sundaram Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 23 Jun 00. It is a fund with Moderately High risk and has given a Below is the key information for Sundaram Equity Hybrid Fund Returns up to 1 year are on The objective of the fund will be to provide investors with an opportunity to invest in a portfolio of a mix of equity and equity related securities and fixed income instruments. The allocation between fixed income and equity instruments will be managed dynamically so as to provide investors with long term capital appreciation However, there can be no assurance that the investment objective of the Scheme will be achieved. SBI Dynamic Asset Allocation Fund is a Hybrid - Dynamic Allocation fund was launched on 26 Mar 15. It is a fund with Moderately High risk and has given a Below is the key information for SBI Dynamic Asset Allocation Fund Returns up to 1 year are on Seeks to generate long term capital appreciation and current income from a portfolio constituted of equity and equity related securities as well as fixed income securities. DSP BlackRock Equity and Bond Fund is a Hybrid - Hybrid Equity fund was launched on 27 May 99. It is a fund with Moderately High risk and has given a Below is the key information for DSP BlackRock Equity and Bond Fund Returns up to 1 year are on (Erstwhile Baroda Pioneer Balance Fund) The scheme is targeted for long-term capital appreciation along with stability through a well balanced portfolio comprising of equity,equity related instruments, money market instrument and debt securities. Baroda Pioneer Hybrid Equity Fund is a Hybrid - Hybrid Equity fund was launched on 12 Sep 03. It is a fund with Moderately High risk and has given a Below is the key information for Baroda Pioneer Hybrid Equity Fund Returns up to 1 year are on To generate capital appreciation by investing in a portfolio of equity or equity linked securities while secondary objective is to generate income through investments in debt and money market instruments. It also aims to manage risk through active asset allocation. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Axis Dynamic Equity Fund is a Hybrid - Dynamic Allocation fund was launched on 1 Aug 17. It is a fund with Moderately High risk and has given a Below is the key information for Axis Dynamic Equity Fund Returns up to 1 year are on (Erstwhile SBI Magnum Balanced Fund) To provide investors long term capital appreciation along with the liquidity of open-ended scheme by investing in a mix of debt and equity. The scheme will invest in a diversified portfolio of equities of high growth companies and balance the risk through investing the rest in a relatively safe portfolio of debt. SBI Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 19 Jan 05. It is a fund with Moderately High risk and has given a Below is the key information for SBI Equity Hybrid Fund Returns up to 1 year are on The Fund seeks to achieve capital appreciation and diversification through a mix of strategic and tactical allocation to various asset classes such as equity, debt, gold and cash by investing in funds investing in these asset classes. However, there is no assurance or guarantee that the objective of the scheme will be achieved. Franklin India Multi - Asset Solution Fund is a Hybrid - Dynamic Allocation fund was launched on 28 Nov 14. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Multi - Asset Solution Fund Returns up to 1 year are on (Erstwhile IDFC Balanced Fund) The Fund seeks to generate long term capital appreciation along with current income by investing in a mix of equity and equity related securities, debt securities and money market instruments. There is no assurance or guarantee that the objectives of the scheme will be realised. IDFC Hybrid Equity Fund is a Hybrid - Hybrid Equity fund was launched on 30 Dec 16. It is a fund with Moderately High risk and has given a Below is the key information for IDFC Hybrid Equity Fund Returns up to 1 year are on (Erstwhile IDBI Prudence Fund) The investment objective of the scheme would be to generate opportunities for capital appreciation along with income by investing in a diversified basket of equity and equity related instruments, debt and money market instruments. However, there can be no assurance that the investment objective of the scheme will be realized. IDBI Hybrid Equity Fund is a Hybrid - Hybrid Equity fund was launched on 24 Oct 16. It is a fund with Moderately High risk and has given a Below is the key information for IDBI Hybrid Equity Fund Returns up to 1 year are on The investment objective of the Scheme is to seek capital appreciation by managing the asset allocation between specified equity mutual fund schemes and debt mutual fund schemes of DSP BlackRock Mutual Fund. The Scheme will dynamically manage the asset allocation between the specified equity mutual funds schemes and debt mutual funds schemes of DSP BlackRock Mutual Fund based on the relative valuation of equity and debt markets. The Scheme may also invest a certain portion of its corpus in money market securities and/ or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. DSP BlackRock Dynamic Asset Allocation Fund is a Hybrid - Dynamic Allocation fund was launched on 6 Feb 14. It is a fund with Moderate risk and has given a Below is the key information for DSP BlackRock Dynamic Asset Allocation Fund Returns up to 1 year are on 1. Sundaram Equity Hybrid Fund

CAGR/Annualized return of 12.8% since its launch. Ranked 25 in Hybrid Equity category. . Sundaram Equity Hybrid Fund

Growth Launch Date 23 Jun 00 NAV (31 Dec 21) ₹135.137 ↑ 0.78 (0.58 %) Net Assets (Cr) ₹1,954 on 30 Nov 21 Category Hybrid - Hybrid Equity AMC Sundaram Asset Management Company Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 2.64 Information Ratio -0.12 Alpha Ratio 5.81 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,627 Returns for Sundaram Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.8% 3 Month 0.5% 6 Month 10.5% 1 Year 27.1% 3 Year 16% 5 Year 14.2% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Sundaram Equity Hybrid Fund

Name Since Tenure Data below for Sundaram Equity Hybrid Fund as on 30 Nov 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. SBI Dynamic Asset Allocation Fund

CAGR/Annualized return of 7.7% since its launch. . SBI Dynamic Asset Allocation Fund

Growth Launch Date 26 Mar 15 NAV (02 Jul 21) ₹15.9463 ↑ 0.03 (0.18 %) Net Assets (Cr) ₹655 on 31 May 21 Category Hybrid - Dynamic Allocation AMC SBI Funds Management Private Limited Rating Risk Moderately High Expense Ratio 2.07 Sharpe Ratio 2.59 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,256 Returns for SBI Dynamic Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1% 3 Month 3.9% 6 Month 6.2% 1 Year 25.1% 3 Year 6.9% 5 Year 8.3% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for SBI Dynamic Asset Allocation Fund

Name Since Tenure Data below for SBI Dynamic Asset Allocation Fund as on 31 May 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. DSP BlackRock Equity and Bond Fund

CAGR/Annualized return of 14.7% since its launch. Ranked 9 in Hybrid Equity category. Return for 2024 was 17.7% , 2023 was 25.3% and 2022 was -2.7% . DSP BlackRock Equity and Bond Fund

Growth Launch Date 27 May 99 NAV (17 Apr 25) ₹347.018 ↑ 3.55 (1.03 %) Net Assets (Cr) ₹9,795 on 28 Feb 25 Category Hybrid - Hybrid Equity AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.37 Information Ratio 0.55 Alpha Ratio 7.45 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,199 31 Mar 22 ₹17,138 31 Mar 23 ₹17,023 31 Mar 24 ₹21,867 31 Mar 25 ₹25,577 Returns for DSP BlackRock Equity and Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 6% 3 Month 3.5% 6 Month -0.7% 1 Year 18% 3 Year 14.8% 5 Year 19.6% 10 Year 15 Year Since launch 14.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 17.7% 2022 25.3% 2021 -2.7% 2020 24.2% 2019 17% 2018 14.2% 2017 -5.1% 2016 27.6% 2015 8.3% 2014 4.8% Fund Manager information for DSP BlackRock Equity and Bond Fund

Name Since Tenure Abhishek Singh 1 Mar 24 1 Yr. Shantanu Godambe 1 Aug 24 0.58 Yr. Data below for DSP BlackRock Equity and Bond Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 6.04% Equity 68.79% Debt 25.17% Equity Sector Allocation

Sector Value Financial Services 31.37% Consumer Cyclical 8.45% Health Care 7.7% Consumer Defensive 6.17% Basic Materials 4.71% Technology 3.74% Industrials 2.87% Communication Services 1.45% Utility 1.35% Energy 1% Debt Sector Allocation

Sector Value Government 16.63% Corporate 8.54% Cash Equivalent 6.04% Credit Quality

Rating Value AA 9.93% AAA 90.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 14 | HDFCBANK8% ₹740 Cr 4,270,582 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 15 | ICICIBANK5% ₹444 Cr 3,688,426 7.34% Govt Stock 2064

Sovereign Bonds | -4% ₹363 Cr 34,500,000

↑ 5,000,000 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 Mar 24 | M&M3% ₹341 Cr 1,317,286

↑ 96,216 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | 5322153% ₹328 Cr 3,227,520

↑ 504,984 Cipla Ltd (Healthcare)

Equity, Since 31 May 24 | 5000873% ₹304 Cr 2,156,479 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Apr 24 | SBILIFE3% ₹284 Cr 1,984,938

↑ 145,622 7.14% Madhya Pradesh SDL 2043

Sovereign Bonds | -3% ₹258 Cr 25,000,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 24 | ITC3% ₹250 Cr 6,335,914

↑ 889,196 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | KOTAKBANK2% ₹241 Cr 1,268,082 4. Baroda Pioneer Hybrid Equity Fund

CAGR/Annualized return of 12% since its launch. Ranked 21 in Hybrid Equity category. . Baroda Pioneer Hybrid Equity Fund

Growth Launch Date 12 Sep 03 NAV (11 Mar 22) ₹81.2894 ↑ 0.36 (0.45 %) Net Assets (Cr) ₹389 on 31 Jan 22 Category Hybrid - Hybrid Equity AMC Baroda Pioneer Asset Management Co. Ltd. Rating ☆☆☆ Risk Moderately High Expense Ratio 2.48 Sharpe Ratio 2.59 Information Ratio -0.07 Alpha Ratio 6.53 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,320 Returns for Baroda Pioneer Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month -2.8% 3 Month -3.5% 6 Month -0.8% 1 Year 14.8% 3 Year 14.3% 5 Year 11.2% 10 Year 15 Year Since launch 12% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Baroda Pioneer Hybrid Equity Fund

Name Since Tenure Data below for Baroda Pioneer Hybrid Equity Fund as on 31 Jan 22

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. Axis Dynamic Equity Fund

CAGR/Annualized return of 9.7% since its launch. Return for 2024 was 17.5% , 2023 was 20% and 2022 was -0.4% . Axis Dynamic Equity Fund

Growth Launch Date 1 Aug 17 NAV (17 Apr 25) ₹20.35 ↑ 0.18 (0.89 %) Net Assets (Cr) ₹2,625 on 28 Feb 25 Category Hybrid - Dynamic Allocation AMC Axis Asset Management Company Limited Rating Risk Moderately High Expense Ratio 2.05 Sharpe Ratio 0.18 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹12,407 31 Mar 22 ₹13,733 31 Mar 23 ₹13,762 31 Mar 24 ₹17,632 31 Mar 25 ₹19,610 Returns for Axis Dynamic Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 3.8% 3 Month 1.9% 6 Month -0.6% 1 Year 13.5% 3 Year 13.3% 5 Year 14.3% 10 Year 15 Year Since launch 9.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 17.5% 2022 20% 2021 -0.4% 2020 15.7% 2019 10.1% 2018 5.9% 2017 2.7% 2016 2015 2014 Fund Manager information for Axis Dynamic Equity Fund

Name Since Tenure Devang Shah 5 Apr 24 0.99 Yr. Hardik Shah 31 Jan 22 3.17 Yr. Jayesh Sundar 28 Sep 23 1.51 Yr. Data below for Axis Dynamic Equity Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 21.77% Equity 51.02% Debt 27.21% Equity Sector Allocation

Sector Value Financial Services 22.61% Energy 7.25% Consumer Cyclical 6.97% Technology 6.95% Health Care 5.52% Industrials 4.65% Basic Materials 3.56% Communication Services 3% Consumer Defensive 2.45% Utility 2.11% Real Estate 0.35% Debt Sector Allocation

Sector Value Cash Equivalent 22.54% Government 18.41% Corporate 8.02% Credit Quality

Rating Value A 1.36% AA 19.16% AAA 79.47% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.34% Govt Stock 2064

Sovereign Bonds | -8% ₹198 Cr 19,359,500

↑ 12,500,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 17 | HDFCBANK6% ₹167 Cr 965,622

↑ 88,550 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 17 | RELIANCE6% ₹147 Cr 1,228,062 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | ICICIBANK5% ₹121 Cr 1,005,251

↑ 122,500 Infosys Ltd (Technology)

Equity, Since 31 Dec 17 | INFY4% ₹101 Cr 600,028 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 Jul 20 | M&M3% ₹76 Cr 294,477 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Aug 17 | 5000343% ₹71 Cr 82,944 Future on Reliance Industries Ltd

Derivatives | -3% -₹69 Cr 575,000

↓ -58,500 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Nov 22 | BHARTIARTL2% ₹64 Cr 409,337

↑ 4,816 State Bank of India (Financial Services)

Equity, Since 31 May 21 | SBIN2% ₹63 Cr 909,831 6. SBI Equity Hybrid Fund

CAGR/Annualized return of 14.9% since its launch. Ranked 10 in Hybrid Equity category. Return for 2024 was 14.2% , 2023 was 16.4% and 2022 was 2.3% . SBI Equity Hybrid Fund

Growth Launch Date 19 Jan 05 NAV (17 Apr 25) ₹284.788 ↑ 3.13 (1.11 %) Net Assets (Cr) ₹68,440 on 28 Feb 25 Category Hybrid - Hybrid Equity AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.46 Sharpe Ratio 0.16 Information Ratio -0.16 Alpha Ratio 4.49 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,546 31 Mar 22 ₹17,147 31 Mar 23 ₹16,695 31 Mar 24 ₹21,256 31 Mar 25 ₹23,666 Returns for SBI Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 5.4% 3 Month 4.7% 6 Month 1% 1 Year 13.4% 3 Year 11.6% 5 Year 17.8% 10 Year 15 Year Since launch 14.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 14.2% 2022 16.4% 2021 2.3% 2020 23.6% 2019 12.9% 2018 13.5% 2017 -0.1% 2016 27.7% 2015 3.7% 2014 7.4% Fund Manager information for SBI Equity Hybrid Fund

Name Since Tenure R. Srinivasan 1 Jan 12 13.25 Yr. Rajeev Radhakrishnan 1 Dec 23 1.33 Yr. Mansi Sajeja 1 Dec 23 1.33 Yr. Pradeep Kesavan 1 Dec 23 1.33 Yr. Data below for SBI Equity Hybrid Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 4.53% Equity 69.79% Debt 25.33% Equity Sector Allocation

Sector Value Financial Services 21.17% Industrials 9.51% Basic Materials 8.73% Technology 5.94% Consumer Cyclical 5.35% Communication Services 4.7% Health Care 4.57% Consumer Defensive 3.69% Energy 3.1% Utility 1.27% Real Estate 0.76% Debt Sector Allocation

Sector Value Government 13.02% Corporate 12.25% Cash Equivalent 4.17% Securitized 0.77% Credit Quality

Rating Value A 5.74% AA 22.3% AAA 70.59% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.79% Government Of India (07/10/2034)

Sovereign Bonds | -9% ₹5,977 Cr 595,001,100

↑ 122,501,100 HDFC Bank Ltd (Financial Services)

Equity, Since 31 May 11 | HDFCBANK4% ₹2,945 Cr 17,000,000 ICICI Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | ICICIBANK4% ₹2,769 Cr 23,000,000

↓ -7,000,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 17 | BHARTIARTL4% ₹2,669 Cr 17,000,000

↓ -2,000,000 Infosys Ltd (Technology)

Equity, Since 31 Dec 17 | INFY4% ₹2,532 Cr 15,000,000 Divi's Laboratories Ltd (Healthcare)

Equity, Since 30 Apr 16 | DIVISLAB3% ₹2,357 Cr 4,301,362

↓ -415,121 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Sep 16 | 5000343% ₹2,303 Cr 2,700,000

↓ -400,000 Solar Industries India Ltd (Basic Materials)

Equity, Since 31 Jul 16 | SOLARINDS3% ₹2,236 Cr 2,567,093 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Sep 18 | 5003873% ₹2,155 Cr 790,000 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 21 | RELIANCE3% ₹2,124 Cr 17,700,000 7. Franklin India Multi - Asset Solution Fund

CAGR/Annualized return of 7% since its launch. Return for 2024 was 11.7% , 2023 was 14.9% and 2022 was 3.9% . Franklin India Multi - Asset Solution Fund

Growth Launch Date 28 Nov 14 NAV (17 Apr 25) ₹20.3093 ↑ 0.17 (0.83 %) Net Assets (Cr) ₹62 on 28 Feb 25 Category Hybrid - Dynamic Allocation AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating Risk Moderately High Expense Ratio 1.3 Sharpe Ratio 0.9 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-3 Years (1%),3 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹9,740 31 Mar 22 ₹11,990 31 Mar 23 ₹12,374 31 Mar 24 ₹14,533 31 Mar 25 ₹16,334 Returns for Franklin India Multi - Asset Solution Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 4.7% 3 Month 6% 6 Month 4.9% 1 Year 12.8% 3 Year 11.3% 5 Year 9.7% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2023 11.7% 2022 14.9% 2021 3.9% 2020 25.5% 2019 -14% 2018 8.2% 2017 0.4% 2016 11.1% 2015 7.8% 2014 0.8% Fund Manager information for Franklin India Multi - Asset Solution Fund

Name Since Tenure Venkatesh Sanjeevi 4 Oct 24 0.49 Yr. Rajasa Kakulavarapu 7 Feb 22 3.15 Yr. Data below for Franklin India Multi - Asset Solution Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 6.61% Equity 23.82% Debt 43.09% Other 26.47% Equity Sector Allocation

Sector Value Financial Services 8.38% Consumer Cyclical 3.45% Technology 3.34% Industrials 2.28% Consumer Defensive 1.65% Health Care 1.56% Energy 1.37% Basic Materials 0.75% Utility 0.69% Real Estate 0.35% Debt Sector Allocation

Sector Value Corporate 25.43% Government 17.67% Cash Equivalent 6.61% Credit Quality

Rating Value AA 15.73% AAA 84.27% Top Securities Holdings / Portfolio

Name Holding Value Quantity Nippon India ETF Gold BeES

- | -27% ₹16 Cr 2,318,066

↓ -160,000 Franklin India Bluechip Dir Gr

Investment Fund | -25% ₹15 Cr 153,283

↑ 9,445 ICICI Pru Short Term Dir Gr

Investment Fund | -23% ₹14 Cr 2,232,979 SBI Short Term Debt Dir Gr

Investment Fund | -23% ₹14 Cr 4,289,154 Franklin India S/T Income Dir Gr

Investment Fund | -0% ₹0 Cr 49 Franklin India Liquid Sup Inst Dir Gr

Investment Fund | -0% ₹0 Cr 14 Franklin India S/T Inc Sgtd Ptf3DirRetGr

Investment Fund | -0% ₹0 Cr 23,974 Call, Cash & Other Assets

CBLO | -3% ₹2 Cr 8. IDFC Hybrid Equity Fund

CAGR/Annualized return of 11.2% since its launch. Return for 2024 was 21% , 2023 was 20.4% and 2022 was -1.1% . IDFC Hybrid Equity Fund

Growth Launch Date 30 Dec 16 NAV (17 Apr 25) ₹24.156 ↑ 0.27 (1.12 %) Net Assets (Cr) ₹752 on 28 Feb 25 Category Hybrid - Hybrid Equity AMC IDFC Asset Management Company Limited Rating Risk Moderately High Expense Ratio 2.4 Sharpe Ratio -0.09 Information Ratio 0.05 Alpha Ratio 2.89 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,665 31 Mar 22 ₹18,758 31 Mar 23 ₹18,610 31 Mar 24 ₹23,824 31 Mar 25 ₹26,594 Returns for IDFC Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 5.4% 3 Month 0.4% 6 Month -3.8% 1 Year 12.4% 3 Year 12.5% 5 Year 20.1% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 21% 2022 20.4% 2021 -1.1% 2020 30.8% 2019 13.9% 2018 4.7% 2017 -3.8% 2016 16.2% 2015 2014 Fund Manager information for IDFC Hybrid Equity Fund

Name Since Tenure Harshal Joshi 28 Jul 21 3.68 Yr. Brijesh Shah 10 Jun 24 0.81 Yr. Prateek Poddar 7 Jun 24 0.81 Yr. Ritika Behera 7 Oct 23 1.48 Yr. Gaurav Satra 7 Jun 24 0.81 Yr. Data below for IDFC Hybrid Equity Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 3.39% Equity 75.6% Debt 21.01% Equity Sector Allocation

Sector Value Financial Services 20.15% Technology 11.99% Consumer Cyclical 10.16% Health Care 7.67% Basic Materials 7.56% Industrials 6.29% Energy 3.52% Communication Services 2.81% Utility 2.44% Consumer Defensive 2.23% Real Estate 0.77% Debt Sector Allocation

Sector Value Government 12.36% Corporate 8.65% Cash Equivalent 3.39% Credit Quality

Rating Value AA 17.15% AAA 82.85% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.3% Govt Stock 2053

Sovereign Bonds | -10% ₹76 Cr 7,400,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | ICICIBANK5% ₹40 Cr 329,469 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 20 | RELIANCE4% ₹26 Cr 220,548

↑ 28,145 Bajaj Housing Finance Limited

Debentures | -3% ₹25 Cr 2,500,000 Infosys Ltd (Technology)

Equity, Since 31 Jan 17 | INFY3% ₹23 Cr 138,883

↓ -4,042 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 17 | 5322153% ₹22 Cr 212,675 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 31 May 24 | 8901573% ₹21 Cr 189,460

↓ -8,941 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Sep 24 | 5000343% ₹21 Cr 24,723 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK3% ₹21 Cr 119,125

↑ 31,819 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 May 24 | CHOLAFIN2% ₹18 Cr 131,963 9. IDBI Hybrid Equity Fund

CAGR/Annualized return of 8.3% since its launch. . IDBI Hybrid Equity Fund

Growth Launch Date 24 Oct 16 NAV (28 Jul 23) ₹17.1253 ↓ -0.01 (-0.05 %) Net Assets (Cr) ₹179 on 30 Jun 23 Category Hybrid - Hybrid Equity AMC IDBI Asset Management Limited Rating Risk Moderately High Expense Ratio 2.52 Sharpe Ratio 1.03 Information Ratio -1.03 Alpha Ratio -0.26 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,275 31 Mar 22 ₹16,558 31 Mar 23 ₹16,049 Returns for IDBI Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 2.1% 3 Month 7.8% 6 Month 9.8% 1 Year 12.1% 3 Year 14.4% 5 Year 7.1% 10 Year 15 Year Since launch 8.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for IDBI Hybrid Equity Fund

Name Since Tenure Data below for IDBI Hybrid Equity Fund as on 30 Jun 23

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 10. DSP BlackRock Dynamic Asset Allocation Fund

CAGR/Annualized return of 9.2% since its launch. Return for 2024 was 12.4% , 2023 was 17.1% and 2022 was 0.1% . DSP BlackRock Dynamic Asset Allocation Fund

Growth Launch Date 6 Feb 14 NAV (17 Apr 25) ₹26.762 ↑ 0.14 (0.52 %) Net Assets (Cr) ₹3,106 on 28 Feb 25 Category Hybrid - Dynamic Allocation AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆ Risk Moderate Expense Ratio 1.89 Sharpe Ratio 0.26 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,067 31 Mar 22 ₹13,846 31 Mar 23 ₹13,874 31 Mar 24 ₹16,631 31 Mar 25 ₹18,722 Returns for DSP BlackRock Dynamic Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 3.7% 3 Month 2.5% 6 Month 0.6% 1 Year 12% 3 Year 10.8% 5 Year 12.1% 10 Year 15 Year Since launch 9.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 12.4% 2022 17.1% 2021 0.1% 2020 9.3% 2019 12.9% 2018 8.8% 2017 3.6% 2016 12.5% 2015 7.7% 2014 4.5% Fund Manager information for DSP BlackRock Dynamic Asset Allocation Fund

Name Since Tenure Rohit Singhania 1 Nov 23 1.41 Yr. Dhaval Gada 1 Sep 22 2.58 Yr. Shantanu Godambe 1 Jan 25 0.24 Yr. Kaivalya Nadkarni 1 Oct 24 0.5 Yr. Data below for DSP BlackRock Dynamic Asset Allocation Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 39.98% Equity 29.33% Debt 30.69% Equity Sector Allocation

Sector Value Financial Services 24.33% Energy 7.62% Industrials 6.7% Basic Materials 6.69% Utility 4.58% Consumer Cyclical 4.51% Consumer Defensive 3.67% Technology 2.82% Health Care 2.34% Communication Services 1.67% Real Estate 0.58% Debt Sector Allocation

Sector Value Cash Equivalent 39.98% Corporate 16.6% Government 14.09% Credit Quality

Rating Value AA 13.32% AAA 86.68% Top Securities Holdings / Portfolio

Name Holding Value Quantity Future on HDFC Bank Ltd

Derivatives | -5% -₹161 Cr 925,100

↑ 29,700 HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 18 | HDFCBANK5% ₹160 Cr 925,758

↑ 29,700 7.32% Govt Stock 2030

Sovereign Bonds | -4% ₹110 Cr 10,500,000 Future on Adani Enterprises Ltd

Derivatives | -3% -₹92 Cr 436,500 Adani Enterprises Ltd (Energy)

Equity, Since 30 Apr 23 | 5125993% ₹91 Cr 436,500 State Bank of India (Financial Services)

Equity, Since 31 Mar 23 | SBIN3% ₹91 Cr 1,324,635

↓ -206,548 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | 5322153% ₹88 Cr 867,084

↑ 112,622 Future on Tata Power Co Ltd

Derivatives | -2% -₹70 Cr 2,070,900 Tata Power Co Ltd (Utilities)

Equity, Since 31 Oct 20 | 5004002% ₹70 Cr 2,070,900 Future on State Bank of India

Derivatives | -2% -₹65 Cr 937,500

बैलेंस्ड एडवांटेज फंड में ऑनलाइन निवेश कैसे करें?

Fincash.com पर आजीवन मुफ्त निवेश खाता खोलें।

अपना पंजीकरण और केवाईसी प्रक्रिया पूरी करें

Upload Documents (PAN, Aadhaar, etc.). और, आप निवेश करने के लिए तैयार हैं!

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।