Table of Contents

Natural Gas ETF

What is Natural Gas ETF?

The Natural Gas ETF meaning is described as the practice of buying natural gas futures. It monitors the Market trends and prices of natural gas. In simple terms, Natural Gas ETF refers to the funds that are in charge of monitoring the fluctuating prices of natural gas. The best example is UNG (United States Natural Gas ETF). Note that the investors who choose the natural gas ETFs do not get any physical assets. They rather get the certificate of the futures contracts.

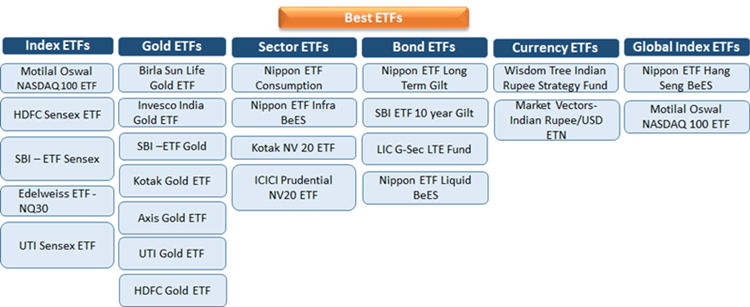

You can find the list of the ETFs that are listed on the exchanges. Like other securities, natural gas ETF is a volatile investment market. It comes with its share of risks. Your return depends on the performance of natural gas. It is important to monitor each ETF closely and go over their plans to see what all investment instruments they offer. You can invest in the Natural Gas ETF through options and futures.

How Does Natural Gas Exchange-Traded Funds Work?

As mentioned above, you don’t get to hold the gasoline and other physical commodities with the natural gas ETF. You will rather get a contract that helps track the movement of the prices of the gas. Some ETFs offer returns based on the performance of the particular commodity. Not all types of exchange-traded funds are used for tracking the performance of gasoline, petroleum, metals, and other commodities in the exchange market.

However, natural gas ETF is completely different from equities and other securities. It is used to monitor the price of gasoline. The price fluctuations of natural gas will determine the performance of this commodity in the market. Natural gas exchange-traded funds happen to be the most volatile financial products. Your returns depend solely on the Volatility of the Underlying asset. In addition to that, this investment involves futures, options, and swaps, which are considered quite risky.

Talk to our investment specialist

Is Natural Gas ETF a Safe Investment Instrument?

All kinds of investment instruments come with their share of risks, but the risk is higher when it comes to derivatives. That being said, natural gas ETFs are highly volatile. The market performed quite well when it started in America. However, the market is unstable recently. Note that commodity ETF isn’t the best investment option for all investors. It isn’t recommended for beginners. Unlike other securities, the weather has a great impact on the performance of natural gas.

The price of natural gas reduces as the weather gets warmer. Since 2016, the price of natural gas in the United States has not improved. In fact, investors believe that its price couldn’t get any lower. The condition is not expected to get better unless the States experience poor weather. The more gas the households use, the higher the price of this commodity will be. However, as mentioned above, a natural gas ETF is one of the most unstable investment markets out there. So, do your research before making a decision.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.