Table of Contents

Defining Black Monday

The term "Black Monday" applies to Mondays where unfavourable or chaotic occurrences have happened. Massacres, wars, and stock Market collapses have all been labelled with this word. On October 19, 1987, the Dow Jones Industrial Average (DJIA) lost nearly 22% in a single day, the stock market crash which came to be known as "Black Monday."

The incident marked the start of a major stock market downturn, and Black Monday became one of the most popular financial days in history. The same day, 23 big world markets suffered a significant drop. 8 markets fell by 20 to 29%, 3 by 30 to 39 % (Malaysia, Mexico, and New Zealand), and 3 by more than 40% when weighed in US dollars (Hong Kong, Australia and Singapore).

Austria was the least affected with a drop of 11.4%, while Hong Kong was the most affected with a drop of 45.8%. 19 of the 23 major industrial countries saw a downturn of more than 20%. A total of US$ 1.71 trillion are reported to have been lost globally. Fears of prolonged economic turmoil, or even a repeat of the Great Depression, arose as a result of the crash's magnitude.

What caused the stock market crash or black Monday?

Since no big news incident occurred the weekend before the crash, the cause of the massive stock price downturn cannot be traced to a single news event. However, a series of events conspired to generate panic among investors. The series of events were as follows:

- A series of monetary and international exchange deals that depreciated the US currency in order to adjust trade deficits and then managed to stabilize the dollar at its current lower value were both precursors to the crash.

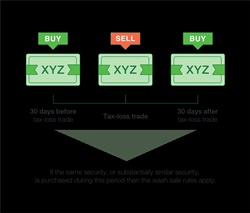

- The program/automated trading in which the buy or sell orders are created automatically based on the price levels of benchmark indices or individual stocks that were in use prior to the crash continued to provide good positive feedback, attracting more buy orders when prices were increasing and more sell orders when prices started to fall.

- Investors were still panicky as a result of crises taking place simultaneously, such as the standoff between Kuwait and Iran, which threatened to interrupt the oil supply.

Talk to our investment specialist

Conclusion

Although there are several hypotheses attempted to understand why the crash happened, the majority of experts believe that widespread chaos contributed to the crash's worsening. To avoid panic selling, the implementation of d a series of safeguards, including trade curbs and circuit breakers, allowed exchanges to temporarily halt trading in instances of exceptionally large price declines in some indexes. Investors should take preventative measures to cope with the risk of another financial market collapse akin to Black Monday.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.