Table of Contents

What is an Oil Refinery?

An Oil Refinery is known as the industrial plant that refines or transforms crude oil into a variety of usable petroleum products, like heating oils, gasoline, and diesel.

Essentially, oil refineries serve as the second stage in the production process of crude oil.

Explaining Oil Refineries

Oil refineries cater to an essential role in the development of transportation and other types of fuel. Once separated, the components of crude oil can be sold to a variety of industries for an extensive Range of reasons. While lubricants, after distillation, can be sold to industrial plants; however, other products would need more refining before getting to the end-user. Significant refineries have the size to process a massive amount of crude oil barrels every single day.

In the Industry, the process of oil refining is commonly known as the downstream, and the production of raw crude oil is called the upstream. Basically, the downstream is linked with the concept that oil goes down the product Value Chain to process an oil refinery into fuel. The stage of downstream also comprises the real sale of petroleum products to other companies, individuals or governments. Moreover, more than a dozen or two other petroleum products are produced in refineries as well.

To make a gamut of plastics and chemicals, the petroleum refineries create liquids that are used by the petrochemical industry.

Talk to our investment specialist

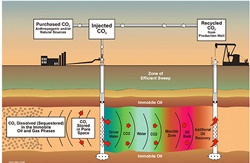

Cracking Crude Oil

Put simply; an oil refinery operates 24 hours and 365 days. It needs massive amounts of employees. However, to undergo periodic repair and seasonal maintenance, these refineries go offline for a few weeks in a year. In terms of the size, one single refinery can obtain as much Land as a lot of football fields, together, would do. Kock Pipeline Company is one of the famous and largest oil refining companies along with others.

To establish a margin for refining, crack spread or crack – a Trading Strategy – gets used in the energy futures. For the Earnings of oil refining companies, crack is one essential indicator. It enables refining firms to hedge against risks linked with petroleum products and crude oil. By consistently selling petroleum product futures and simultaneously buying crude oil futures, a trader attempts to establish the artificial position in the oil refinement, which is created through a spread.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.