Table of Contents

Power of Compounding

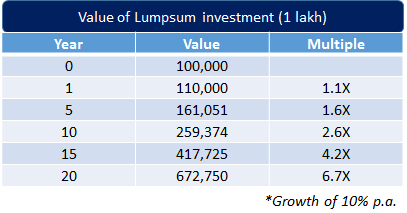

Compound Interest is often termed as one of the most powerful tools of an investor. The power of compounding is often spoken about when the topic of multiplying money comes up. In simple words, it means earning interest on interest. In this article, we shall learn about how it works, how different is it from simple interest, the compound interest formula, the compound interest calculator and the power compounding. The example below tells us how an invest of INR 1 lakh grows over time, in 10 years, its 2.6 times its value, in 15 years over 4 times and 20 nearly 7 times. Just imagine the difference if the number was 10 lakhs invested, then the number change 10 times. in 20 years this would be worth over 67 lakhs (at a 10% growth rate).

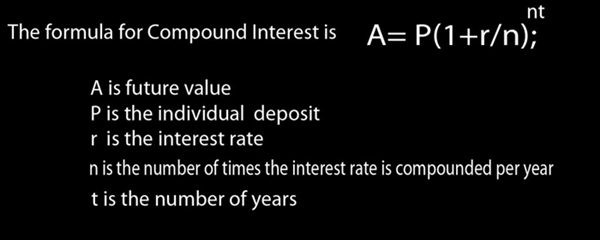

Compound Interest Formula

Compound interest is calculated on the principal and also the accumulated interest of the loan or deposit.

Compounding depends on mainly three factors, i.e. the amount or principal, the duration and the interest rate. Another key Factor is the frequency of compounding. It may be done continuously, daily, weekly, monthly, semi-annually, annually.

Compound Interest Calculator

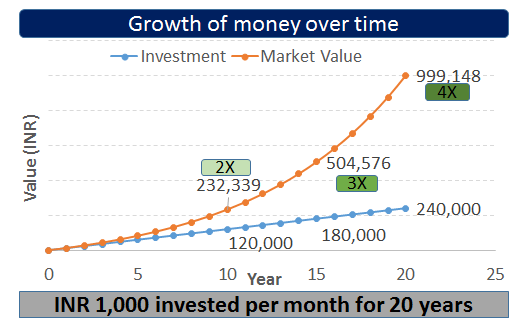

Calculating compound interest over time can be done using the above formula. Using various values, one can play around and see how the final value of their investment changes over time using the calculator. This will truly show the power of compounding. Take for example how a simple SIP for INR 1,000 over 20 years grows over time.

The Power of Compounding

The power of compounding is quite remarkable and is reflected on various aspects like time, compounding frequency and while comparing it with simple interest. It is the power of compounding which grows money over time and many times over.

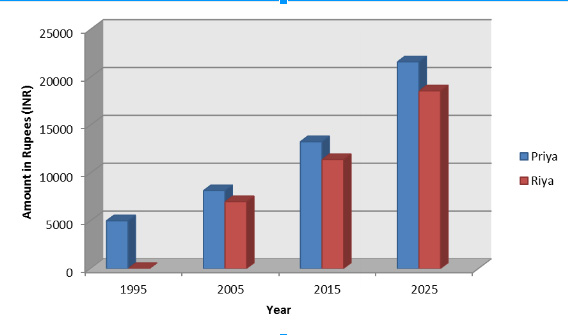

Time plays an important role, especially when it comes to compound interest. In the above example, Priya starts Investing in 1995, INR 5,000 @ 5% p.a. which is compounded annually for 30 years which by 2025, accumulates a sum of more than INR 20,000. Whereas, Riya starts investing INR 10,000 for the same rate of interest of 5%p.a. compounded annually for 20 years. But, in 2025, she accumulates only around INR 18,000. Therefore, the time factor can have a significant effect on an investment which helps in building a decent retirement fund, thus enabling a secure future. Hence it is quite evident that the earlier one starts investing, the better it is.

Talk to our investment specialist

Compounding Frequency

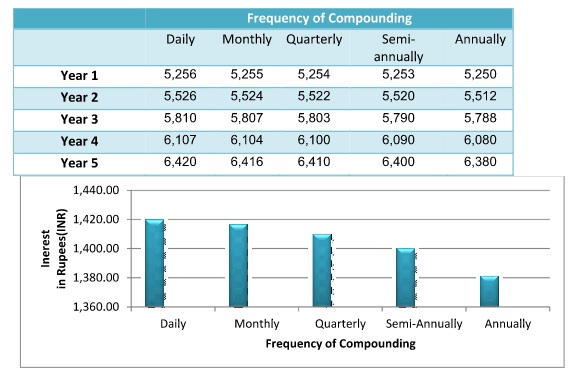

The frequency of compounding plays another major role in determining the returns on an investment. INR 5000 is invested @5% p.a. for a period of 5 years, in the example shown below. But, as you can see, at the end of 5 years, the values are different due to the frequency of compounding. It is observed that, higher the frequency, higher the returns on maturity and vice versa.

Though the difference in the amount of interest earned under the various scenarios is not large, an important thing to keep in mind is that you are not investing anything extra here. It is your invested money that is making more money. This concept is what makes the rich, richer.

Simple Interest Vs Compound Interest

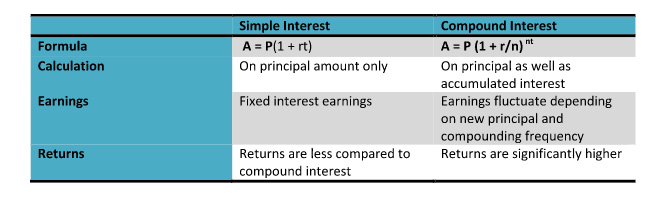

Simple interest is calculated only on the principal amount. On the other hand, compound interest is calculated on the principal amount as well as the interest accrued on such amount.

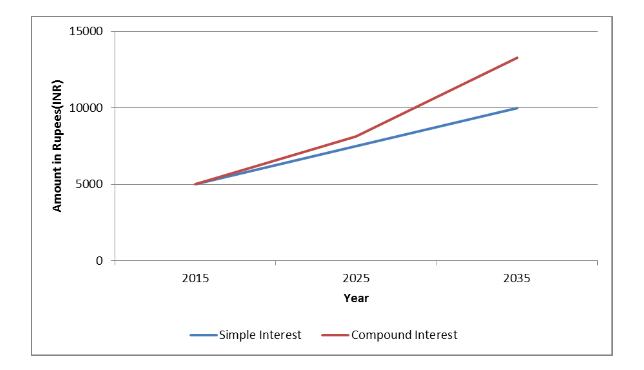

The power of compounding is even more pronounced when compared to simple interest. For example:

In the above example, INR 5000 is invested @5% p.a. for 20 years in both simple and compound interest schemes. But, as you can see, at the maturity of the investment, the growth and returns are significantly higher in the compound interest investment.

Investments like Savings accounts, Certificates of deposit (CDs) and reinvested dividend stocks utilise the benefits of compound interest. Hence it is clear that the effect of compound interest is dependent on time, the earlier one starts investing, the better it is and it is due to this time that the investor generates returns on his/her investment.

Toomuch knowledgeable articles