Understanding the Pump and Dump Scheme

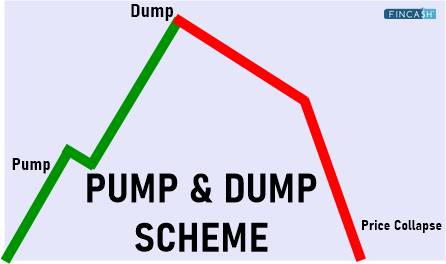

The Pump and Dump scheme is one of the most notorious forms of Market manipulation in the world of finance. Often seen in the stock market and cryptocurrency space, this scheme involves artificially inflating the price of an asset (the "pump") to sell it off at a higher price, then quickly selling it off, causing the price to collapse (the "dump"). These schemes can cause significant financial damage to unsuspecting investors. In this article, we will delve deep into what Pump and Dump schemes are, how they work, and how to avoid falling victim to them.

What is a Pump and Dump Scheme?

A Pump and Dump refers to the illegal act of artificially inflating the price of a stock or cryptocurrency, often through misleading or false statements, to attract buyers. Once the price reaches a certain level (the "pump"), the manipulators sell their holdings (the "dump"), leaving unsuspecting investors with worthless assets.

This type of scheme is most common in low-volume markets where price manipulation can easily be achieved. Although more commonly seen in the penny stocks market and cryptocurrency, the principle applies to various investment types.

How Does the Pump and Dump Scheme Work?

A typical Pump and Dump scheme involves a series of coordinated actions that artificially increase the demand for a particular asset:

The Pump

- Coordinators, often a group of individuals or institutions, spread false information or hype surrounding a specific stock or cryptocurrency. This can happen via social media, online forums, or group chats, such as on Reddit, Twitter, or Telegram.

- The purpose is to generate a buying frenzy, driving the price higher, often by suggesting that the asset will soar in value or has new, unrevealed developments.

The Dump

- Once the price has reached an artificially high point, the manipulators sell off their positions at a profit.

- The large sell-off causes the price to crash, leaving investors who bought in during the pump with assets worth much less than what they paid.

Talk to our investment specialist

Pump and Dump Examples

Cryptocurrency Example: BitConnect (2017-2018):

- BitConnect was a cryptocurrency project that was widely known for its Ponzi scheme aspects. However, it was also a prime example of a pump and dump in the crypto world. Promoters inflated the price by misleading potential investors and encouraged them to buy into the currency with false promises of huge returns.

- After the price peaked, the promoters dumped their holdings, causing BitConnect’s value to plummet and devastating its investors.

Stock Market Example: The "Boiler Room" Scam (1990s):

- In the 1990s, a series of stock manipulation schemes, often called "boiler rooms," involved brokers artificially inflating the prices of small cap stocks. These brokers would Call up unsuspecting individuals and pitch low-priced stocks, promising high returns.

- Once the price had been pumped up through the brokers' efforts, they would dump their shares, leaving the investors with worthless stock.

How to Spot a Pump and Dump Scheme?

Recognizing a Pump and Dump is crucial for protecting your investments. Here are a few signs to look out for:

Unusual Price Movements: If an asset’s price rises dramatically without any fundamental reason (such as company announcements, strong Earnings reports, or technological advancements), it may be manipulated.

Aggressive Promotion: If you encounter aggressive marketing through social media channels or emails, urging you to buy a particular stock or cryptocurrency, take caution. Often, these promotions will hype up the asset without providing any concrete backing or long-term value.

Lack of Transparency: Genuine assets have clear financials, audits, and real data backing them. Pump and Dump schemes often lack these or have manipulated reports to mislead investors.

Legal Implications of Pump and Dump Schemes

Engaging in a Pump and Dump is not only unethical but illegal. In many countries, including the United States, the Securities and Exchange Commission (SEC) has strict regulations against market manipulation. Penalties for being caught in such schemes can include:

Fines and Civil Penalties: Individuals involved in Pump and Dump operations can face hefty fines.

Criminal Charges: In severe cases, those caught manipulating the market can face criminal charges, including imprisonment.

Class-Action Lawsuits: Investors who are harmed by these schemes can file lawsuits against the manipulators.

How to Protect Yourself from Pump and Dump Schemes?

Do Your Research: Before Investing, always conduct thorough research on the company or asset. Check for financial transparency, news, earnings reports, and regulatory compliance.

Avoid "Too Good to Be True" Promises: If an investment promises sky-high returns with little risk, it is likely a scam. Remember, if something sounds too good to be true, it probably is.

Watch for Volatility: Be cautious about assets that are experiencing extreme Volatility, especially when no clear reason is provided for the change.

Use Reputable Platforms: Always buy stocks or cryptocurrencies through regulated exchanges or brokers. Avoid participating in unregulated or questionable platforms.

Pump and Dump Schemes in the Digital Age: The Role of Social Media

Social media plays a significant role in the rise of Pump and Dump schemes. Platforms like Twitter, Reddit, and Telegram have given individuals more power to influence the market. Specifically, groups like WallStreetBets on Reddit have become known for driving price surges, though not always with malicious intent.

However, some individuals exploit these platforms to deliberately pump assets to target retail investors, creating a dangerous environment for inexperienced traders.

Conclusion

The Pump and Dump scheme remains a serious threat to investors, particularly those who are new to trading or investing. As market manipulation tactics become more sophisticated, it is crucial for investors to educate themselves, stay informed, and always approach investment opportunities with caution. Understanding the signs of a Pump and Dump scheme, doing thorough research, and using reputable platforms can help safeguard your Portfolio from these fraudulent activities.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.