Table of Contents

What is Annual Turnover?

Annual turnover ratio is the term used to define the rate at which an investment changes ownership in 12 months. In a business context, the annual turnover is for inventories, bill payables and Receivables, and fixed assets of the company. In an investment context, the term is used for Mutual Funds and other investment instruments. If we put it in simple terms, the annual turnover is used to calculate the annual trading activity of investment.

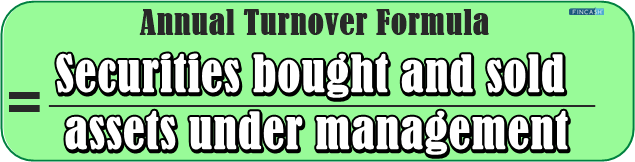

Annual Turnover Formula

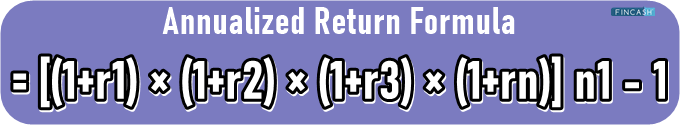

It tells us the securities that are being traded within the exchange-traded funds as well as mutual funds Portfolio. It is important to note that every time the mutual fund purchases or sells, the annual turnover of the company will grow. The higher annual turnover ratio indicates an actively managed mutual fund, while the low ratio suggests that the funds are being passively managed. The formula for calculating the annual turnover ratio is as follows:

Annual Turnover = Securities bought and sold / assets under management

In order to calculate the turnover ratio of the funds, you are supposed to add the total holdings bought and sold and divide the result with the assets under management. You will get the answer in percentage and it will simply indicate the total securities that have been traded over the course of a year.

Now, if you get a 100% annual turnover ratio of a fund, then it indicates that all holdings were traded in the past year. In simple terms, the turnover ratio measurement gives you a clear picture of the changes that occurred in the securities trading over the previous year.

Why is the Calculation of Annual Turnover Important?

It is extremely important for the investors to calculate the annual turnover ratio of the exchange-traded funds as well as mutual funds before making any decision. That’s because only the turnover ratio can tell you whether the funds you are Investing in are actively or passively managed. Of course, you are going to want to invest in Mutual Funds that are actively managed as there is a high chance they can bring good returns on investment.

The calculation is also important to establish the additional cost the investor might incur over the course of the investment. For example, brokerage fees and other additional costs could affect the turnover ratio significantly. With that said, it is important that you calculate the annual turnover ratio of the mutual fund or ETF before making any decision. Let’s understand the concept with an example.

Talk to our investment specialist

Example of Annual Turnover Ratio in Investment Context

Suppose a mutual fund buys 200 shares from a company and over the past year, around 150 of these shares get replaced. This gives us an annual turnover ratio of 75%, which is quite high. Now, this means that it is an actively managed fund.

While most people believe that a high turnover ratio implies a successful fund, the turnover ratio does not really have anything to do with the quality as well as the performance of the mutual fund.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.