Table of Contents

What is Aroon Indicator?

Developed by Tushar Chande in 1995, Aroon indicator comprises of two main indicators that are specifically developed to determine any upcoming trend or any major change in the current trend. It helps in finding out the popularity of a trending Market, determining the strength of the trend in question, and more.

There are mainly two Aroon indicators, i.e -

- Arron up - one moving upwards, and

- Arron down - one that goes downwards.

They are commonly known as bullish and bearish Aroon. As the name suggests, the up indicator is used for establishing the latest 25-day high, while the down indicator is mainly used for finding out the total days since the last 25-day low.

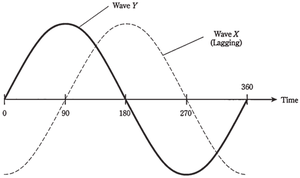

Aroon Up suggests the number of days it has been since the last new high was recorded. Likewise, Aroon down is used to report the number of days it has been since the new low was recorded. If the up indicator crosses the Aroon down, then the latest uptrend is about to begin. At the same time, if the down indicator crosses the Aroon up, then that indicates that a downtrend is about to begin.

Understanding Aroon Up & Down Indicator

The indicators are to be drawn in a different window from the main window, which reflects the price action. The value is to be measured in the percentage term. The value of Aroon up and downrange from 0 to 100. If we consider it with an example, then a new uptrend is highly likely to start as soon as the Aroon-up crosses 100.

The Aroon-up between 70 and 100 gives the indication that the uptrend will start soon.

If the Aroon-down crosses 70 and is about to reach 100, then that is the indication of the fact that a downtrend is about to start. There is also a time when both Aroon up and Aroon down go parallel. This suggests that the price is consolidating. So, the major purpose of using the Aroon indicators is to discover when the last highs and lows took place in the stock market.

Talk to our investment specialist

The higher the value of the indicator goes, the more recently the highs and lows occurred. Higher values showcase a strong trend, while the lower values indicate a weaker trend.

In simple terms, the Aroon indicator could be defined as the time between lows and highs over a specific period. The indicator is most commonly used to identify when the changes in the trend occur and when they do not. For the stock market and any form of asset, the indicator calculates the highs as well as the lows for 25 periods. It also records the total periods since the last major high and low. It notes these numbers and enters them into the Aroon Up and Down formula. As the value of the trend reaches close to 100, it will indicate a strong trend. On the other hand, when the value goes close to 0, it will reflect a weak trend.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.