Table of Contents

GDP Price Deflator

What is GDP Price Deflator?

Also known as the implicit price deflator or the GDP deflator, the GDP price deflator helps to measure the alterations in prices for all the services and goods produced in an Economy.

Explaining GDP Price Deflator

Gross Domestic Product (GDP) showcases the total output of products and services in an economy. But, with a rise and fall in GDP, the metric doesn’t regard the effect of rising prices or Inflation on the results of GDP.

On the contrary, the GDP deflator displays the extent of changes in price on GDP by establishing a Base Year and then comparing current prices to those in the base year. In simple words, the GDP price deflator represents the amount of change that GDP got with changes in the level of prices.

This metric also comprises prices paid by the consumers, government and businesses. Furthermore, when it comes to comparing nominal to real GDP over different periods, the GDP deflator assists in measuring the price changes.

This deflator is quite essential as executing a comparison of GDP between two varying years can provide a deceptive result, if there has been a change in the level of price between these two years. In case an economy is experiencing price inflation, it will appear as growing in terms of money - if there is no method to account for price changes.

But the similar economy may show little or no growth; however, with a rise in prices, the total output figures may appear higher than what has been produced in reality.

Talk to our investment specialist

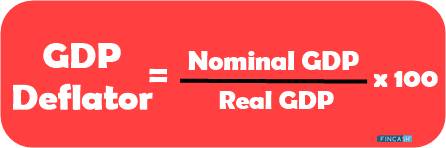

GDP Price Deflator Calculation

Below mentioned is the GDP price deflator formula to calculate this metric:

GDP Price Deflator = (Nominal GDP / Real GDP) x 100

Let’s take an example here now. Suppose our economy has a nominal GDP of Rs. 10 billion and its real GDP is Rs. 8 billion. Now, the GDP price deflator of the company will be calculated as:

Rs. 10 billion / Rs. 8 billion x 100 = 125

With this result, it can be figured out that the aggregate price level has increased at a rate of 25% in the current year from the base year. This happened because the real GDP of the economy is calculated by multiplying the current output with its prices from the base year.

Thus, this way, GDP deflator assists in discovering the amount of inflation the prices have gone through over a certain period of time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.