Table of Contents

Defining Authorized Stock

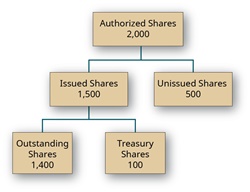

Authorized stocks, also referred to as authorized shares or the authorized Capital stock, are the maximum shareholdings that any corporation can legally issue, as mentioned in the company's charter.

Authorized stocks are listed in the Balance Sheet's capital accounts section. These are different from the outstanding shares: the number of shares the company or the corporation actually issued and held by the public.

Why do Corporations Avoid Issuing all the Authorized Stocks?

The number of authorized stocks is mostly higher than the number issued to the public. It allows the organization to offer or sell more shares in the future if it aims to raise added funds.

For example, suppose any company has 10 lakh authorized shares. In that case, it might only sell 5 lakhs of the shares in the Initial Public Offering (IPO) and reserve the other 50,000 as the stock options for attracting and retaining the employees. Then, in the Secondary Offering, the company might again share 1.5 lakh more to raise money. Finally, the unissued stock will then be retained in the treasury account of the company:

10,00,000- 5,00,000 – 50,000 – 1,50,000 = 3,00,000

A company might also avoid issuing all of its authorized shares for maintaining a controlling interest and prevent the company from experiencing a hostile takeover.

Talk to our investment specialist

Need of Unissued Authorized Stock

Having unissued authorized stocks is advisable, preferable, and beneficial due to various reasons. Here are some reasons why having a portion of unauthorized stocks is preferred and recommended:

Helps while Issuing the Share Options and Warrants

Periodically, several companies compensate their employees for participating in the company's Employee Stock Option Plan. To issue these shares, which then transforms into outstanding shares, the company must have access to a sufficient portion of the unissued Authorized Stock.

Requirement of Raising Capital on Short Notice

For most companies, issuing new shares holds minor importance when they require capital. However, in some instances, a company might issue some added shares on short notice. It is beneficial to have unissued authorized stock at that period as the management doesn’t have to go through the entire process of receiving approval from shareholders for increasing the authorized stock before the company moves ahead with the process.

Costs Imposed on the Company While Increasing the Authorized Stock

There is no added cost of increasing authorized stock in many parts of the world apart from the high cost of holding any meeting for the shareholders and other transaction-related costs. However, in some regions, including India, companies must pay an added stamp duty for increasing the authorized stock. This stamp duty across India ranges between 0.15% and 0.20 % of the increase in authorized stock.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.