Table of Contents

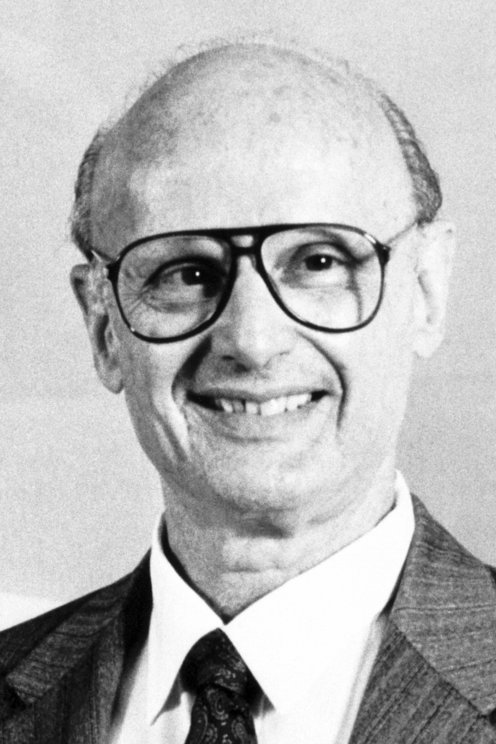

Harry Markowitz

Who is Harry Markowitz?

Known for winning the Nobel Prize, Harry Markowitz happens to be one of the famous economists. He got famous for formulating the modern Portfolio theory. Markowitz came up with several theories that were based on investment risks, portfolios, and the relation between different securities. Markowitz’s study on portfolio management has brought many changes in the securities investment Industry.

His studies and research made him achieve the Nobel Prize in Economics. Even though it has been quite a few decades since the modern theory was introduced, it still has a strong impact on modern investors. In fact, a majority of modern traders rely on Markowitz’s modern theory to build a lucrative investment portfolio.

He partnered with many economists, especially Miller and William F. Thanks to Harry Markowitz and his excellent theories. He revolutionized the way people trade securities. Markowitz alongside two other popular economists shared the Nobel Prize for being the world’s best economists.

Markowitz’s Modern Portfolio Theory

Harry Markowitz works as a tutor at the Rady School of Management. When asked about his inspiration, Harry mentioned that he learned a lot about investment portfolios and risks after reading a popular theory of John Burr William. It was the Theory of Investment Value, in which, John Burr mentioned that the stock’s value is equal to the value of its future dividends. Markowitz did not agree with this theory as he believed that the future dividend value is not certain. He suggested that people should rather calculate the value of the stock by using the expected dividend value than relying on the future value of the dividend.

Harry Markowitz theory explained the importance of Investing in different securities in order to enhance one’s investment portfolio. He doesn’t believe in the single security investment system. That’s when the modern portfolio theory was launched. This theory emphasized the diversification in investment portfolios.

Talk to our investment specialist

How Markowitz’s Theory help Minimizes the Risk of Investors?

Perfect investment does not exist. Even the experienced and professional investors have to face the risk when making an investment in the securities. Finding the perfect investment strategy that can maximize the Return on Investment, while reducing the risk of losses has become the main priority for investors. Many modern investors know the techniques to make the best of the investment. If Markowitz’s modern portfolio theory is used appropriately, then it has the power to transform your single security investment portfolio into a profitable and diverse portfolio.

According to Markowitz, diversifying your investment portfolio minimizes the Volatility. Usually, a single asset tends to be more volatile than a collection of securities. This means the investment in one security can impose a high risk as compared to the entire portfolio given that you choose to diversify your investment portfolio. Many modern investors and experts found Markowitz’s modern portfolio theory quite effective. The theory has proven profitable and effective for investors.

Currently, he is a professor at the University of California. He also works as a consultant. Markowitz explains the common investment concepts, including risk management and portfolio diversification.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.