Table of Contents

Aadhaar Based eKYC Returns! Makes Mutual Fund Investments Easy!

The circular released by the Securities and Exchange Board of India (SEBI) on November 5, 2019, revived Aadhaar-based eKYC for Mutual Funds. This means that the KYC process, which is mandatory for mutual funds, can now be exercised electronically (eKYC) using Aadhaar for domestic investors.

As per the circular, direct investors can simply go to the mutual fund company's website and use Aadhaar to do the eKYC process. However, mutual fund distributors as a sub KUA will have to enter into an agreement with the KUA to complete Aadhaar based eKYC formalities. They should also get themselves registered with UIDAI (Unique Identification Authority of India) as sub-KUAs.

Previously Aadhaar based eKYC holders were allowed to invest up to Rs 50,000 in a financial year, however, this circular does not specify any upper limit on such investments.

Investors can either complete the eKYC Mutual Fund Online by themselves or get assistance from the distributor as well.

eKYC Process- Online Procedure for Residents

Step 1- Visit the portal of KUA

Investors need to visit the portal of KUA (KYC User Agency) or the SEBI-registered intermediary, which is also a Sub-KUA, to register and open an account through an intermediary.

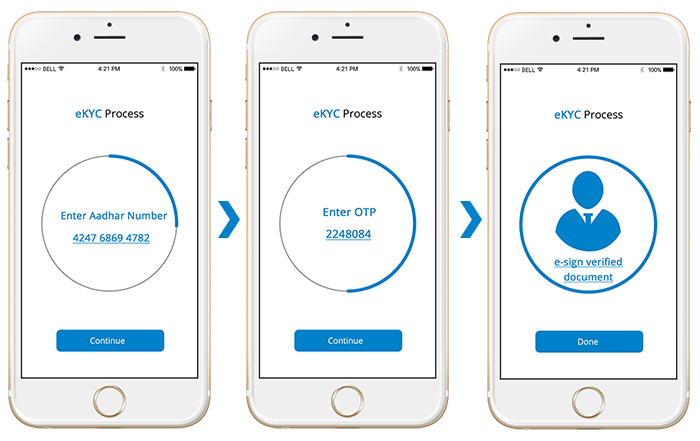

Step 2- Enter Aadhaar number

Investors need to enter their Aadhaar number or virtual Id and provide consent on the KUA portal.

Step 3- Enter the OTP

After this, investors will receive OTP (one-time password) from UIDAI in the registered- mobile number with Aadhaar. Investors need to enter the OTP on KUA portal and fill additional details as required under KYC format.

Step 4- Aadhaar authentication

Upon successful Aadhaar authentication, KUA will receive the eKYC details from UIDAI, which will be further forwarded to sub-KUA in an encrypted format and will be displayed to the investor on the portal.

Alternative eKYC Process Via Assistance

Step 1- Approach mutual distributors

Investors can approach any of the SEBI-registered entity or sub-KUA, i.e. mutual fund distributors or other appointed people for Aadhaar based eKYC process.

Step 2- eKYC Registration

Sub-KUAas will perform e-KYC using registered/whitelisted devices with KUAs. The KUA will ensure that all devices & device operators of sub-KUA are registered/whitelisted devices with them.

Step 4- Enter Aadhaar number

Investors will enter their Aadhaar number or virtual Id and provides consent on the registered device.

Step 5: Biometric process

Investors provide biometric on the registered device. Following this, SEBI-registered intermediary (sub-KUA) fetches the e-KYC details through the KUA from UIDAI, which will be displayed to investors on the registered device.

Step 6: Provide additional details

To complete the process, investors have to provide additional details as required for eKYC.

How eKYC is Different from the Regular Process

The regular KYC process relies on physical document verification. The eKYC process allows KYC to be done electronically using a webcam. In this process, the intermediary can accept electronic documents and uses a webcam to verify the investor’s identity. Ideally, the most cost-effective and easy method is the eKYC with Aadhaar, which is now revived by SEBI after its discontinuation in September 2018.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.