+91-22-48913909

+91-22-48913909

Table of Contents

MFOnline: Investing Made Easy

Have you heard the term MFOnline? Well, for those who already know it and for those who don't, this article will simplify and elaborate the concept of MFOnline. MFOnline or mutual fund online means Investing in Mutual Funds through paperless means. Individuals can choose MFOnline to invest in mutual fund schemes by visiting the mutual fund company’s website or other web portals. The advancements in the field of technology has been so considerable that a person can invest and trade in mutual funds sitting at any place and at any time. So, let us understand the various aspects of MFOnline like the concept of mutual funds, fund houses having online investment Facility, for instance, UTI Mutual Funds, the process of investing online in mutual funds for first timers, methods of online mutual fund investment, and online SIP.

Talk to our investment specialist

MFOnline: Online Investments for the First Timers

With the improvement in technology, MFOnline process has become easy and simple. However, first timers need to complete an additional procedure of Know Your Customer (KYC) requirements before they begin investing. This can be done with the help of eKYC. eKYC is a paperless technique to complete the KYC process. One of the entities performing the eKYC activity is known as Computer Age Management Services Pvt. Ltd. fondly known as CAMS. The eKYC process can be completed by providing the UID (Aadhar) number and enter the OTP received.

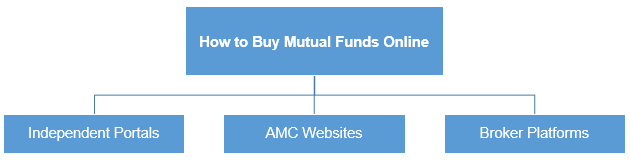

MFOnline: How to Buy Mutual Funds Online

Investment in mutual funds through MFOnline online can be done in three ways. They are:

Independent Portals

Independent portals of Mutual Fund Distributors is one of the channels through which people can invest in Mutual Funds. One of the highlighting points of these portals is that they do not levy any transaction fee from the individuals. In addition, they also provide in-depth analysis for various mutual fund schemes. Independent portals also act like aggregators wherein individuals can invest in various mutual fund schemes just by visiting one website. The advantages and limitations of buying the mutual funds through independent portals are:

Advantages:

- No transaction charges

- In-depth analysis of various mutual fund schemes helps to understand in which scheme to invest

Disadvantages:

- If an individual’s Bank does not have a tie up with portal then, access to net banking may not be available.

AMC Websites

Individuals can purchase mutual funds directly from the mutual fund company or AMC’s website with just a click of a button through MFOnline mode. This is considered to be an easy option since individuals can purchase the mutual fund schemes from the fund house itself. Some of the advantages and limitations of purchasing mutual fund schemes directly from the fund houses are:

Advantages

- Simple registration and investing process

- No transaction fee payable to the fund house or any agent

Disadvantages

- Individuals need to complete the registration formalities for each mutual fund if they are planning to invest in different mutual fund schemes run by various fund houses

- Individuals need to complete all the formalities

Broker Platforms

Broker platforms is another medium that an individual can choose for investing online in mutual funds. Individuals having a Demat account for online trading in stocks can use the same demat account to invest in mutual funds. Most of these broker accounts are linked to mutual funds exchange platform of either BSE or NSE. Individuals need to login into their accounts from the broker terminal, select the scheme in which they prefer to invest, and invest the money. The units are credited to their demat account. The advantages and disadvantages of buying mutual funds through broker platforms are:

Advantages

- By opening one account with the broker individuals can invest in numerous financial instruments like stocks, Bonds, shares, along with mutual fund schemes

- Hassle free as all the investments are at one place

Disadvantages

- High brokerage charges

- Not convenient for short-term investors as individuals might end up with less profits due to high brokerage

The image given below show the three channels of buying Mutual Funds Online.

Online SIP

Systematic Investment plan or SIP means a situation where individuals invest small amounts in mutual fund schemes at regular intervals. Investors can opt for SIP mode instead of lump sum mode of investment in mutual funds. Individuals can opt for MFOnline mode of SIP where they don't need to visit the fund house office at regular intervals to deposit the amount. Here, the amount can be deposited at the click of a button. Hence, this method becomes easy for individuals to invest in mutual funds.

Understanding Mutual Funds Online

Mutual fund refers to an investment vehicle that collects money from various individuals having the common objective of investing and trading in financial securities. Initially, individuals used to invest in mutual funds by visiting the offices of respective fund houses. However, with the passage of time, technological advancements have left its imprints on the mutual fund Industry. Today, mutual fund investment process has been so simplified that individuals can invest and trade in various funds just at the click of a button using devices like laptops, smartphones, and computers to invest in mutual funds.

Fund Houses Having Online Investment Facility

Currently, almost all the fund houses or Asset Management Companies (AMCs) provide the facility of MFOnline. Some of these mutual fund companies include UTI mutual funds, Reliance Mutual Funds, Tata Mutual Funds, and so on. A detailed description of these fund houses along with the best Mutual Fund schemes offered by them are as follows:

UTI Mutual Fund

Unit Trust of India, having its acronym as UTI, is the first mutual fund company in India. Formed in the year 1963, under the UTI Act 1963, UTI Mutual Fund was formed in the year 2003, post abolishment of the Act. UTI mutual funds offer online trading facility where individuals can invest in mutual funds through the online mode. They can purchase, sell, and invest units of mutual fund schemes, check their balances, check the performance of their mutual fund schemes, all with a click of the mouse.

Best UTI Mutual Fund Schemes 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Dynamic Bond Fund Growth ₹30.6734

↑ 0.02 ₹626 3.2 4.3 9.4 9.6 9.4 8.6 UTI Banking & PSU Debt Fund Growth ₹21.5703

↑ 0.03 ₹825 2.7 4.2 8.4 9 7.5 7.6 UTI Gilt Fund Growth ₹62.6806

↑ 0.05 ₹644 3.7 4.7 10.1 7.6 6.5 8.9 UTI Bond Fund Growth ₹72.8175

↑ 0.04 ₹312 3.4 4.6 9.7 9.9 9.3 8.5 UTI Regular Savings Fund Growth ₹67.0572

↑ 0.33 ₹1,610 1.2 0.1 9.1 8.9 12.2 11.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

Reliance Mutual Fund

Reliance Mutual Fund is one of the fast growing mutual fund companies in India. It is a joint venture between the Japanese company Nippon Life Insurance and Indian Company Reliance Capital. This company also provides the facility of MFOnline to individuals to encourage paperless investment in mutual funds. This fund house was established in the year 1995.

Best Reliance Mutual Fund Schemes 2025

No Funds available.

Tata Mutual Fund

Tata Mutual Fund is again a fund that encourages MFOnline method of investment. Individuals choosing to invest Tata Mutual Funds can invest in through the company’s website, or brokers, or independent portals. Set up in the year 1995, the main sponsors of this mutual fund are Tata Sons Ltd. and Tata Investment Corp. Ltd.

Best Tata Mutual Fund Schemes 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata Retirement Savings Fund-Moderate Growth ₹58.205

↑ 0.85 ₹1,908 -6.7 -10.2 4.1 11 17 19.5 Tata India Tax Savings Fund Growth ₹39.6618

↑ 0.85 ₹4,053 -7.3 -13 2.2 11.4 22.2 19.5 Tata Retirement Savings Fund - Progressive Growth ₹58.1296

↑ 1.00 ₹1,803 -9.3 -13.7 1.9 11.2 18.1 21.7 Tata Equity PE Fund Growth ₹317.273

↑ 5.64 ₹7,468 -4.9 -13.7 0.9 16.5 24.7 21.7 Tata Treasury Advantage Fund Growth ₹3,872.4

↑ 2.83 ₹2,366 2.3 3.9 7.7 6.6 6.1 7.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

ICICI Mutual Fund

icici mutual fund is one of the well-established and well-known fund houses in India. The company is a joint venture between ICICI Bank Limited and Prudential PLC. ICICI Mutual Fund also provides online mode of investment. Through online mode, people can invest in various schemes of ICICI either directly through the fund house's website or through other distributor's portal.

Best ICICI Mutual Fund Schemes 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Long Term Plan Growth ₹36.5109

↑ 0.04 ₹14,049 3.2 4.8 9.6 7.9 7.6 8.2 ICICI Prudential Banking and Financial Services Fund Growth ₹120.72

↑ 1.32 ₹8,843 3.3 -2.2 8.8 12.7 23.2 11.6 ICICI Prudential MIP 25 Growth ₹72.7458

↑ 0.34 ₹3,086 1 1 7.9 9 10.8 11.4 ICICI Prudential Nifty Next 50 Index Fund Growth ₹53.9257

↑ 0.71 ₹6,083 -4.3 -18.6 -3.2 11.8 21.6 27.2 ICICI Prudential Long Term Bond Fund Growth ₹89.6313

↑ 0.07 ₹1,216 4 5.4 11.1 8.2 6.4 10.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

SBI Mutual Fund

SBI Mutual Fund is set up by India's one of the oldest and most reputed bank State Bank of India (SBI). SBI offers a large number of schemes in which people can invest as per their convenience through online mode of investment. Using online mode, people can invest as per their convenience at anytime and from any where. In online mode, people can either choose a Mutual Fund distributor's portal or the fund house's website to make the investment. Some of the top and best schemes of SBI are given below as follows.

Best SBI Mutual Fund Schemes 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Children's Benefit Plan Growth ₹106.471

↑ 0.63 ₹120 0.4 -0.5 12.5 11.6 15.1 17.4 SBI Debt Hybrid Fund Growth ₹69.8792

↑ 0.32 ₹9,580 0.8 -0.3 7.6 9.2 12.4 11 SBI Small Cap Fund Growth ₹155.34

↑ 3.46 ₹28,453 -8.8 -16.7 -0.7 13.2 29.2 24.1 SBI Magnum Constant Maturity Fund Growth ₹63.1571

↑ 0.03 ₹1,845 3.9 5.2 10.9 8.1 6.7 9.1 SBI Magnum Gilt Fund Growth ₹66.0278

↑ 0.07 ₹11,257 3.9 4.7 10.5 8.3 7.4 8.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

HDFC Mutual Fund

HDFC Mutual Fund was set up in the year 2000. It is again one of the well-reputed Mutual Fund companies in India. HDFC Mutual Fund like other Mutual Fund companies also offers online mode of investment. Online mode of investment is considered to be convenient for people. Through online mode, people can purchase and redeem Mutual Fund units, keep a track of their Portfolio, check how their schemes are performing, and other related activities. People can invest in HDFC schemes either through the fund house's website or through any distributor's portal. However, one of the advantages of investing through distributor is people can find a number of schemes under one portfolio.

Best HDFC Mutual Fund Schemes 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Corporate Bond Fund Growth ₹32.1261

↑ 0.04 ₹32,191 3 4.5 9.3 7.3 7.2 8.6 HDFC Banking and PSU Debt Fund Growth ₹22.6898

↑ 0.03 ₹5,837 2.9 4.4 8.8 6.9 6.8 7.9 HDFC Credit Risk Debt Fund Growth ₹23.6297

↑ 0.01 ₹7,252 2.3 3.9 8.4 6.8 7.4 8.2 HDFC Hybrid Debt Fund Growth ₹80.1555

↑ 0.38 ₹3,237 1.7 1 7.4 10 12.5 10.5 HDFC Balanced Advantage Fund Growth ₹483.042

↑ 5.72 ₹90,375 -1.4 -4.9 4.7 17.6 25.4 16.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

Conclusion

On the whole, it can be concluded that though there are a lot of advancements in the technology, nevertheless, individuals should always select and invest in mutual fund schemes that are in-line with the objectives. In addition, they should also have a holistic view about MFOnline so that their investment gives them the required results.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.