The Fisher Effect Explained

The Fisher effect, often referred to as the Fisher Hypothesis, is an economic theory proposed by Irving Fisher, an American Economist in the 1930s. The actual interest rate, according to this theory, is unaffected by monetary indicators like the nominal interest rate and projected Inflation rate.

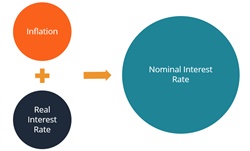

Fisher effect explains the link between inflation and both real and nominal interest rates. The Real Interest Rate is equal to the difference between the nominal and anticipated inflation rates. As a result, a rise in inflation leads to a reduction in real interest rates.

Fisher Effect Examples

The banking Industry is a real-world example of this concept. For example, if an investor's Savings Account has a nominal interest rate of 10% and a projected inflation rate of 8%, the money in his account is actually growing at 2% per year. This means that, from the standpoint of his buying power, the rate of growth of his savings accounts is determined by the real interest rate. The higher the actual interest rate, the more time taken by deposits to grow, and vice versa.

Fisher Effect Formula

In the fisher effect equation, all rates are treated as a composite which means they are seen as a whole rather than as distinct parts. To get the real interest rate, subtract the projected inflation rate from the nominal interest rate.

It also implies that the real rate remains constant, causing the nominal rate to fluctuate point-by-point as the inflation rate rises or falls. The assumption of a constant real rate means that monetary events like monetary policy measures have no impact on the real Economy.

The following is a mathematical equation describes the relationship:

(1+N) = (1+R) x (1+E)

In which,

- N = Nominal interest rate

- R = Real interest rate

- E = Expected inflation rate

International Fisher Effect

The International Fisher Effect (IFE) is the name for the fisher effect in currency markets. It's an international finance hypothesis that claims nominal interest rate differentials across nations, indicating projected changes in the spot exchange rate.

The mathematical formula to calculate the spot exchange rate is as follow:

Futures Spot Rate = Spot rate * (1 + D) / (1 + F)

Where,

- D = Nominal interest rate in the domestic currency

- F = Nominal interest rate in the foreign currency

A spot exchange rate is anticipated to fluctuate equally in the opposite direction of the interest rate differential, according to the theory. As a result, the higher nominal interest rate country's currency is projected to devalue versus the lower nominal interest rate country's currency. As higher nominal interest rates indicate that inflation is expected, this is the case.

Importance of Fisher Effect

The Fisher Effect looks to be much more than a mathematical formula. Its influence illustrates the money supply's simultaneous effect on the interest rate and inflation rate. For example, if a country's inflation rate rises by 15% as a result of a change in its central Bank's monetary policy, the nominal interest rate in that country's economy will climb by 15% as well. A change in the money supply is assumed to have no effect on the real interest rate in this perspective. Nonetheless, changes in the nominal interest rate will be displayed in real-time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.