Effective Duration

What is Effective Duration?

The effective duration is calculated based on the fact that your cash flow is likely to change or fluctuate owing to the changes in the interest rate. It is important to note that cash flow in the Bonds with embedded features is uncertain. It is not possible to calculate the exact rate of return as the interest rate tends to change from time to time.

In other words, the effective duration is the calculation of the impact of the changed interest rate on your cash flow. Bonds that come with embedded options increase the risk for an investor. As the interest rate can change in such types of investment, there is no way for an investor to know the rate of return.

Effective duration helps you ascertain the risks of changes in the interest rates and their impact on the cash flow. In simple terms, it helps you find out the appropriate cash flow from the bond investment. As compared to the maturity of the bond, the effective duration has a lower value. It is also an important measurement and Risk assessment tool.

Effective Duration Example

Bond with embedded features is considered as an option-free bond. It offers no additional benefit to the investor. So, even if there is a change in the yield, the cash flow of the bond will remain unchanged.

Let’s understand it with an example. If the current rate of interest is 10 percent and you are getting a 6% coupon from the Callable Bond, then the latter will be considered as an option-free security since it is not practically possible for the company to issue these bonds at a higher interest.

Talk to our investment specialist

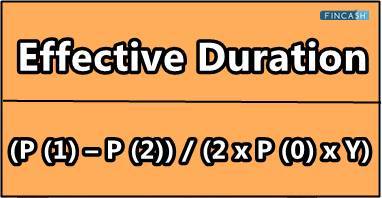

Calculation of Effective Duration

Let’s say someone purchases a bond for Rs.100. The yield is 8%. The cost of this security goes up to Rs.103 and the yields decline by 0.25 percent. Now, the effective duration of the bond will be computed with the following formula:

(P (1) – P (2)) / (2 x P (0) x Y)

Here,

- P (0) – The current price of the bond

- P (1) – The total value of the bond if the yield declines by a specific percentage

- P (2) – The total value of the bond in the case of an increase in yield

- Y – This stands for all the changes in yield

If we use this formula to calculate the effective duration of the above example, then we get:

103 – 98 / 2 x 100 x 0.0025 = 10

This means the changes in the interest rate by 1 percent will result in changes in the bond value by 10 percent. This formula is especially helpful for those who have purchased the callable bond. As mentioned before, the interest rate in such types of bonds tends to change every now and then. Based on the changes in the interest rate, you can calculate the effective duration using the above-mentioned formula and recall the bonds before the maturity period.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.