Acquisition Cost

What is Acquisition Cost?

An acquisition cost is a cost of buying an asset that is generally used in three different contexts in business that includes mergers and acquisitions, fixed assets and customer acquisition.

In the context of mergers and acquisitions, it represents the value of compensation transferred from an acquiring company to the target company to acquire a portion of the target company.

In Fixed Asset, the acquisition cost describes the overall cost a company recognizes on its Balance Sheet for a Capital asset.

In customer acquisition, the acquisition cost represents the funds used to expose the new customers to company products in the hope to obtain the customer’s new business.

Talk to our investment specialist

Mergers & Acquisition

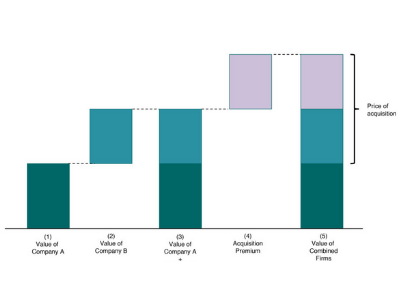

In mergers and acquisitions, an acquiring company can fully absorb another company by making a payment to the respective shareholders. The payment can be made with cash, securities or a combination of two.

In all cash-Offering, the cash can come from the acquiring company’s existing assets. And in a securities offering, the target shareholders get shares from the acquiring company’s common stock as compensation.

Acquisition cost (stock offering)= Exchange Ratio * No of shares outstanding (Target)

The total acquisition cost, the purchase price includes transaction cost. The transaction cost includes direct cost, fees for due diligence services, accountants, attorneys and investment bankers.

Fixed Assets

When buying fixed assets such as property, plant and equipment or other capital assets an organization is looking to get a physical asset to be used within the operations of the business. It includes lands, buildings, and other capital assets used to create a future economic benefit. The assets are acknowledged on the balance sheet of a company and are lessen by Depreciation over time.

Additionally, the actual price paid for an asset itself and the extra costs should be considered and recognized on the balance sheet as part of the fixed asset cost. The extra cost may include commission expenses, transaction fees, regulatory fees and legal fees.

Customer Acquisition

Customer acquisition costs are the cost that is incurred to introduce new customers to the company’s products to acquiring new business. To compute the customer acquisition cost using this formula given below:

Acquisition cost(customers)= Total Acquisition Cost/ Total No. of New Customers

The costs included in the total acquisition cost are marketing and advertising expenses, discounts and incentives along with the salaries of the staff. Acquisition cost can assist the customers to make marketing decisions such as future capital and allocations for budgeting.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.