Table of Contents

Acquisition Premium

What is Acquisition Premium?

An acquisition premium is a difference between the exact price paid to obtain a company and the approx value of the obtained company prior to the acquisition.

Usually, it is recorded as goodwill on the Balance Sheet as an intangible asset.

Acquisition Premium Formula

You can get the acquisition value with the help of the acquisition premium formula. The acquiring company must determine the real value of the target company, which can be done using Enterprise Value or equity valuation.

There is a simple way to calculate the acquisition premium by taking the difference between the price paid per share for the larger company and the target's current stock price and divide it by the target’s current stock price to get a percentage amount.

Acquisition Premium= DP-SP/SP

DP: Deal Price per share of the target company

SP: Current Price per share of the target company

Ready to Invest?

Talk to our investment specialist

Reasons for Acquisition Premium

There are some reasons where an acquiring company may pay a premium are as follows:

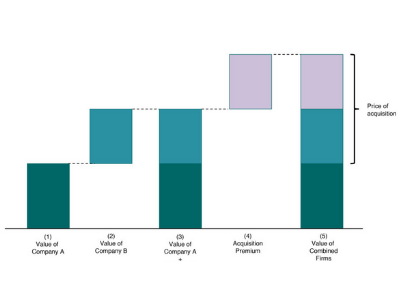

Synergy

The merger or acquisition should create synergies where the combined companies are more valuable than the sum of its parts. Usually, synergies come in two forms - hard synergies and soft synergies.

Hard Synergies refer to cost reduction from Economies of Scale, while soft synergies refers to revenue increases from the extended Market share, increasing pricing power, etc.

Growth

The authorities and management of the company are under pressure to generate steady revenue. However, it can be done organically, it may be faster and less risky to grow externally via mergers and acquisitions.

Tax

At times, it may be an advantage for a profitable acquirer to acquire or merge with a target company with large tax losses, where the acquirer can lower its Tax Liability.

Management Personal Motives

Management can be personally motivated to maximize the size of the company for greater power or more reputation.

Diversification

Diversification can be viewed from the company’s Portfolio of investments in other companies. Therefore, the variability of cash flow from the company can be reduced if the company is diversified to other industries.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.