Table of Contents

What is Appraisal Management Company (AMC)?

Mortgage lenders never grant a loan application until they are sure that the borrower they are extending the mortgage is capable of repaying the loan in full and by the due date. Now, home loans are worth hundreds of thousands of bucks. It may not be possible for the banks to assess the ability of the homebuyer to repay the loan. That’s why banks use independent agencies to evaluate the value of the residential property that the buyer intends to invest in.

The Appraisal Management Company meaning helps the Bank or moneylender to estimate the value of the property. They use this data to determine the amount of loan they must extend to the buyer. This is also done to ensure that buyer isn’t asking for an amount that’s higher than what’s the property is worth. That’s because, in the case of Default, the bank has to recoup the outstanding balance by selling the property. So, the property must be worth the loan extended to the homebuyer.

Here, the appraisal management company is responsible for sending a qualified and trained appraiser for the assessment of the property in question. They take care of the entire appraisal process right from the valuation to sending the appraisal report to the bank. These independent agencies have several appraisers working for them. The individual appraiser inspects the property, including the exteriors, interiors, each room, terrace, alfresco, and the entire landscape to find out the value of the building.

How does AMC Work?

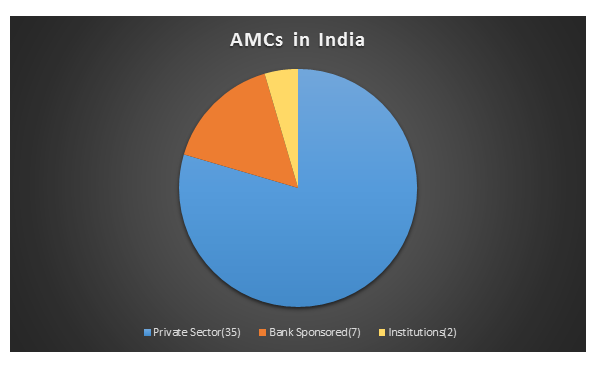

AMCs have been working in this Industry for over 5 decades now. While they have been operating for quite a few years now, the appraisal management company was not in the picture until the end of the financial crisis of 2009. The number of these companies in the States and other countries has grown significantly over the past 10 years. That’s mainly because the moneylenders are supposed to get the valuation of the property done before they accept any loan application. No matter how small the loan amount is, it is important that a certified appraiser inspects the property and creates a report of the same. The reports are to be submitted to the moneylender, who then decides if the loan application should be approved.

Talk to our investment specialist

The regulatory bodies wanted to avoid the connection between the appraisers and lenders so that the latter could not influence the appraiser’s valuation reports. It was believed that the housing crisis occurred because of the mortgage lenders that lent an amount that exceeded the property’s original value. In other words, home loans that were granted on the inflated appraisal values were the main cause behind the housing crisis. After these changes, the homeowners or mortgage lenders were no longer allowed to select the independent appraiser.

The Appraisal Management Company was established and the brokers had to request an appraisal from these organizations. The AMC would send an independent appraiser from their community. This reduced the risk of the seller influencing the appraiser for showing a high property value.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.