Table of Contents

What is Wealth Management?

Wealth Management has always been associated with the high-net-worth individuals (HNWIs). However, this is a myth. Wealth management strategies should be employed by the working class as well, to plan and meet their Financial goals. In this article, we shall look into the definition of wealth management, its comparison with asset management and private banking, how to choose a wealth manager, wealth management products, and wealth management in India.

Wealth Management Definition

Wealth management can be defined as a professional service that combines Accounting and taxation services, estate and Retirement planning, financial and legal advice for a set fee. Wealth managers coordinate with financial experts and at times, with the client’s agent or Accountant to determine and accomplish an ideal wealth plan for the client.

Asset Management Vs Wealth Management Vs Private Banking

Asset and wealth are often used as synonyms for each other. The management of both these terms is to invest and grow Income. Though they mean similar things, they have some differences. Also, private banking offers many services similar to that of wealth management but the former generally caters to high-profile clientele.

Asset management can be defined as services offered by various banks and financial institutions for managing the assets of its clients. The assets could be ranging from Bonds, stocks, Real Estate, etc. It is usually done by high Net worth individuals, large corporates, and governments (Sovereign Funds/Pension Funds). Asset managers employ strategies like studying past data, identifying assets having high-return potential, risk analysis, etc. to maximise returns.

Wealth management is a broader term that includes asset management, real estate planning, investment and financial advice, Tax Planning, etc. The definition is subjective. Wealth management could mean financial advice or tax planning for some, whereas, it could mean Asset Allocation for some. This service is used by HNIs and large corporates, and also the working class and small corporations.

Private banking or private wealth management is done by public or private banks when they employ staff that offers personalised management services to individuals. The clients are high-priority clients and are given exclusive treatment. Generally, banks offer private banking services only if a person has some minimum required net worth, say $2,50,000 or INR 1 crore and in some cases the required maybe much higher (a couple of million dollars!)

Talk to our investment specialist

How to Choose a Wealth Manager

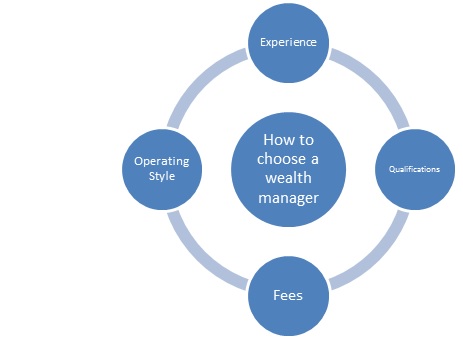

Choosing a wealth manager is not a decision you should take hastily. After all, you are trusting them with them with your hard-earned money. According to research, wealth manager/advisor and client relationship is directly correlated to the client’s satisfaction with the firm’s services. The following points should be kept in mind while choosing the best wealth manager/ financial advisor:

Wealth Management Product and Services

The main aim of wealth management is to manage and multiply wealth. In order to achieve this, they provide various products and services. These products differ from client to client, depending on the risk level. Low-risk clients are subjected to low-risk/safe products and vice versa. It is essential for an individual to set his financial goals clearly while discussing with his wealth manager. Some common wealth management products are:

- Mutual Funds

- ETFs

- Bonds

- Real Estate

- Commodities, etc.

In order to attract clients and retain them, firms provide top-class services. The services include customised Portfolio restructuring, Risk assessment, exposure to global investment opportunities, etc.

Wealth Management in India

Still, at a growing level in India, wealth management is yet to reach its potential. India is a promising Market due to increasing income levels and a projection of a strong Economy in the next few years. There are, however, there are some obstacles that the firms face in India.

Regulations

Wealth management is relatively new in India. In India, distributors of Mutual funds are governed by AMFI (Association of Mutual Funds in India), there are clear guidelines for advisory and anyone Offering investment advice has to become a Registered Investment Advisor (RIA) with SEBI (Securities & Exchange Board of India). For insurance advisory, a license is required to be obtained from IRDA (Insurance Regulatory Development Authority) for soliciting insurance products. Similarly, for stock broking, licenses are required from SEBI. Financial Advisors need to obtain certifications before they can approach clients for all wealth management products in India. National Insititute of Securities Markets (NISM), Insurance Institute of India etc. are some of the institutes that provide courses and certification on wealth management products.

Financial Literacy

There is a lack of Financial Literacy among the target investors. The current penetration of Mutual Funds in India is around 1% of the population, developed markets have a penetration of 50% or more (for e.g. the United States). India still has a long way to go in terms of achieving penetration amongst the masses for wealth management products.The precursor to increasing penetration is ensuring financial literacy increases.

Gaining Trust

One major challenge for management firms is to gain investor trust. Investors are extremely cautious about Investing money in uncommon sources due to the recent scams. This affects the investor’s trust on the market.

Wealth management in India is an untapped Industry which is set to boom in a few years. With technological developments and the advent of the internet, wealth management services are offered online as well. Do your research well, choose your wealth manager wisely and read about the fees before investing. So start your research today and secure your hard-earned money and your future!