Table of Contents

What is Asset Coverage Ratio?

The asset coverage ratio is known as the financial metric that helps to measure how efficient a firm is to repay the debts by either liquidating or selling its assets. This ratio is essential as it assists analysts, investors and lenders to measure the company’s financial solvency. Often, creditors and banks lookout for a minimum asset coverage ratio while lending the money.

Explaining Asset Coverage Ratio

As mentioned above, this ratio offers investors and creditors the ability to assess the risk level linked with Investing the money into a company. Once this ratio is evaluated, it is then compared to the ratios of other companies working in a similar sector or Industry.

It is essential to keep in mind that the ratio could be less dependable when comparing it to organizations and companies working in different sectors. The reason behind this is because firms within a specific industry may carry more debt on the Balance Sheet than others.

For instance, let’s take a comparison between a software company and an oil producer. Since the oil producers would be more Capital intensive, they have more debt than the software company.

How to Calculate Asset Coverage Ratio?

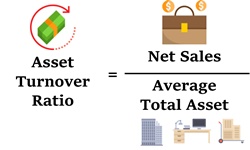

To calculate the asset coverage ratio, the above formula will be used. Here, assets are referred to as total assets. Intangible assets would be the ones that cannot be touched physically, such as patents or goodwill. And, Current Liabilities are the ones that are due in a year. Short-term debt is referred to as the debt that is due in a year. Lastly, total debt refers to the combination of both long-term and short-term debts.

Talk to our investment specialist

Asset Coverage Ratio Example

To understand this concept in a better way, let’s take an example here. Suppose there is a company called ABC, working in the technology sector. ABC has 1.5 as the asset coverage ratio. This means that it has 1.5x’s of more assets than its debts.

Now, there is another company, XYZ, working in the same industry and has an asset coverage ratio of 1.4. If XYZ is showing its 1.4 ratios in this current period, this means that the firm has enhanced the balance sheet by either increasing the assets of deleveraging their debts. Thus, it is not enough to only assess the asset coverage ratio of one period.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.