Table of Contents

What is the Asset Turnover Ratio?

The asset turnover ratio measures the profit-making Efficiency of the assets of an organisation. This ratio is considered a major tool for financial statement analysis. It falls under the category of profitability ratios. The asset turnover ratio evaluates the value of revenues or sales generated by a company in relation to the value of the same company’s assets. This Factor is majorly used as an indicator to define whether the firm is using its assets efficiently to generate revenue. The higher the ratio, the more efficient is the company and vice versa.

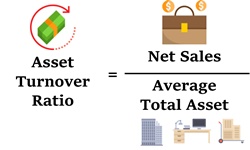

Asset Turnover Ratio Formula

The formula for asset turnover ratio is as follows:

Asset Turnover Ratio = Net Sales / Average Total Assets

- We get the net sales by subtracting sales return from the gross sales.

The formula for average total assets is as follows:

Average Total Assets = Closing Assets + Opening Assets / 2

Here, closing assets are the total assets at the end of the current year, and opening assets are the total assets at the end of the previous year or the beginning of the current year.

Talk to our investment specialist

What does the Asset Turnover Ratio Determines?

This ratio determines the amount of revenue generated per unit of an asset in monetary terms. Naturally, the asset turnover ratio gets calculated annually. A higher asset turnover ratio is a good indicator of the organisation’s performance. It means the assets are being utilised to full efficiency. A lower ratio means the production capacity is less, the organisation's inventory management is not good, or the company has excessive assets. Comparing different years’ asset turnover ratios can help a company determine it growth and decline.

For companies operating in specific sectors, the asset turnover ratio is higher in comparison to other sectors. For instance, retail companies generally have small asset bases but a higher volume of sales. Thus, they have the highest turnover ratio.

On the contrary, companies operating in the Real Estate sector have larger asset bases but lower turnover. Considering that this ratio may vary from one domain to another, comparing the asset turnover ratios of a retail company with that of a real estate firm will not yield productive results. In a way, comparisons only turn out to be meaningful when made between different firms operating in the same sector.

Ideal Asset Turnover Ratio

A higher asset turnover ratio is better for any business organisation. A higher ratio will mean the company can utilise its assets efficiently to generate profits. On the other hand, a lower ratio will mean the efficiency of the assets is not at par, and the organisation needs to work on it. There is no such ideal figure for asset turnover ratio that an organisation should have. It varies depending on the nature of the Industry.

If the ratio is less than 1

A ratio less than 1 means the denominator (the assets) is greater than the numerator (the profits generated). This implies the assets cannot produce adequate profits. It is not a good position for a company, and they need to work on it.

If the ratio is more than 1

A ratio is more than 1 means the numerator (the revenue generated) is more than the denominator (the total average assets). This denotes a good profit-making position for the company.

Exceptions for Asset Turnover Ratio

An asset turnover ratio of less than 1 can be a good indicator of the company’s performance. This depends on the nature of business and industry standards. For example, industries like water and gas utilities and real estate have a very large asset base, but the revenue generated is not that big. Hence, the standard asset turnover ratio in these industries could be less than 1.

Similarly, an asset turnover ratio of more than 1 will not always mean the company is in a good position. Let’s take an example of the retail industry. Here, the assets are relatively less, and the revenue generated is greater. The asset turnover ratio will easily be more than 1. But it does not end here. More than 1 can mean the assets turnover ratio is 1.5 or 2 or 3 or even a greater amount. Now, here again, the nature of business and the industry standards have come into action. Say, for example, the ideal asset turnover ratio for a particular good’s retail industry is three, and a company’s asset turnover ratio is 1. Then, despite the ratio being a figure, more than 1 will not be considered a good ratio.

Conclusion

The asset turnover ratio is a really good measure of a company’s growth as it is related to the revenue generated, and the sole motive of a business organisation is the maximisation of profits. The end goal of a business can be achieved only when the assets are efficiently utilised, which this ratio helps in determining.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.