Cash Budget

What is a Cash Budget?

A cash budget definition explains that it is a type of budget or plan of the expected cash receipts as well as disbursements during a specific period. The respective cash inflows, as well as outflows, are known to include expenses paid, revenues collected, payments, and receipts of loans.

In simpler terms, it can be said that the cash budget is known to be an estimated projection of the cash position of the company in the future.

What Does Cash Budget Mean?

The management of a company is typically known to develop the cash budget after the respective budget for purchases, sales, and Capital Expenditures have been made already. The respective budgets are required to be made before developing the cash budget towards accurately estimating how cash is going to be affected during the given period. For instance, the management of a company is known to ensure the sales estimates before predicting the amount of cash that will be collected during the given period.

Management of any organization is known to make use of the concept of cash budget for managing the cash flows of the company. It is imperative for the management to ensure that the company has sufficient cash for paying its subsequent bills when the same become due. For instance, it is required for the payroll to be paid every 2 weeks while the utilities are expected to be paid every month. The utilization of cash budget helps the management to assume short falls in the respective cash balance of the company while correcting the problems before the payments become due.

Talk to our investment specialist

How Does Cash Budget Work?

Companies all around are known to make use of sales as well as production forecasts for creating the respective cash budget. This is in addition to the assumptions made with respect to the necessary spending as well as accounts receivable. A cash budget becomes necessary when it comes to assessing whether or not an organization will have sufficient funds to continue its respective operations. In case the organization does not have ample liquidity for operating, it is required to raise more Capital through taking more debt or issuing stock.

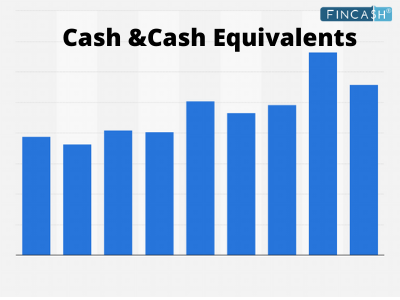

A cash roll forward is known to calculate the respective inflows & outflows of cash for the given month. This is utilized as the ending balance to serve as the starting balance for the upcoming month. The given process is known to allow the organization to predict the respective cash requirements across the entire year.

The cash budget is known to consist of three typical parts:

- Prediction related to cash inflows

- Prediction related to cash outflows

- Prediction related to the cash balance

Cash budget serves to be an extremely important tool that is made available to the financial manager of a company for planning the respective fund requirements and for assessing the cash position in the given firm.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.