Table of Contents

Liquidity

What is Liquidity?

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the Market without affecting the asset's price. In simpler words, liquidity is to get your money whenever you need it. Cash is considered the most Liquid asset, while Real Estate, collectibles and fine arts are all relatively Illiquid.

Liquidity is the ease of converting tangible assets into cash and it has different connotations for different situations and contexts. It is the extent to which an asset can be bought or sold quickly without affecting the asset's price. Liquidity also plays an important role as it allows you to seize opportunities.

What is Liquidity in Finance?

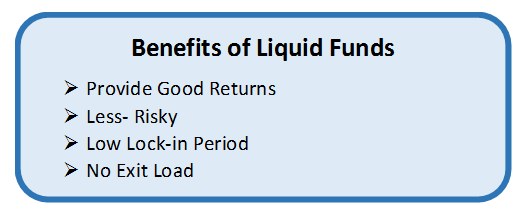

Whether to spend or invest, the simplicity of the asset's conversion into cash is referred to as financial liquidity. It also impacts how readily and at what price you can sell an item if necessary. Liquidity is present in all asset classes to variable degrees. The asset is more liquid if it takes less time to convert it to cash, such as Bank fixed deposits, listed shares, and open-ended Mutual Funds.The lower the cost of converting an asset to cash, the more liquid it is. A penalty or relevant exit load increases the price of some assets.

The more the liquidity of an asset is, the lower the price fluctuation in a quick sale. Unlike index stocks, liquid equity can be sold without materially decreasing its price. It is recommended in personal financial planning to save roughly six months' worth of expenses in liquid assets for emergencies.

Liquidity Formula

From an Accountant's perspective, liquidity is the ability of the current assets to meet the Current Liabilities. The existing current assets should be large enough to meet the liabilities. So, to measure whether there are sufficient current assets, a ratio called liquidity ratio is used.

This ratio is calculated as:

Liquidity Ratio = Current Assets / Current Liabilities

Talk to our investment specialist

What is Liquidity in Stocks?

Stock liquidity is defined as the ease with which a stock can be acquired or sold on the stock market without significantly impacting its price. It is measured by how easily and effectively a stock can be bought or sold without negatively affecting its price. Liquid stocks will have sufficient demand and supply of shares, implying that there will be enough buyers and sellers in the market to facilitate seamless transactions. The most liquid stocks are those with the highest market capitalisation.

They are often traded on the stock market, and buying or selling them quickly at a specified price is simpler. Investing in a stock with a high level of liquidity is generally safer than investing in one with a low level of liquidity. Traders consider liquidity while evaluating an investment. Illiquid stocks are frequently sold at a discount.

What is Liquidity in Banking?

In banking, liquidity refers to a bank's capacity to satisfy its financial commitments when due. Direct cash holdings with the central bank can provide liquidity. It usually stems from acquiring securities that can be sold swiftly and with minimum loss. It essentially refers to highly creditworthy instruments, such as government bills with short maturities. The reserve will affect a bank's liquidity, particularly in a crisis, much more than this cash and highly liquid securities. It will also be determined by the maturity of its less liquid assets. As some of them can mature before the financial crunch ends, they can serve as a backup source of funds.

Liquidity in Accounting

Accounting liquidity refers to how easily an asset can be converted to cash without altering its market value. In other words, it's a measure of a debtor's ability to pay their debts when they're due. This way, the easier it gets to sell an investment at a reasonable price, the more "liquid" it is considered. Cash is the most liquid asset, and real estate and Land are the least liquid, taking weeks, months, or even years to sell.

It is critical to understand the order of liquidity or the presentation of your assets on the Balance Sheet based on how long it would take to convert them to cash. This offers you a better idea of how financially sound your business would be in a crisis. A corporation with little Capital but a sizable real estate Portfolio, for example, could be in difficulty. The following is a general reference to the order of liquidity and the time required to convert each asset:

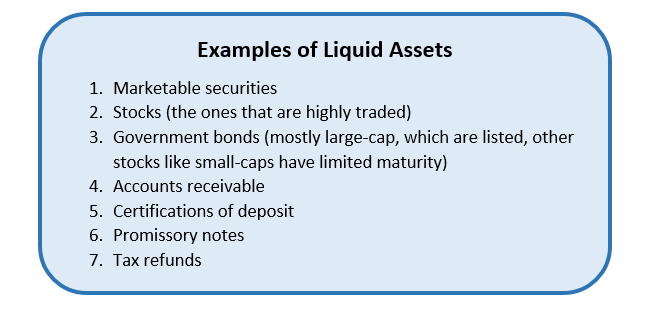

- Cash - No conversion time is required.

- Marketable Securities - Converting marketable securities to cash takes several days in most circumstances.

- Accounts Receivable - The liquidity of your accounts receivable is determined by your company's stable credit conditions.

- Inventory – In some circumstances, converting your product to cash will be impossible without Offering a significant discount to potential customers.

- Fixed Assets — Depending on whether the assets have a market value, fixed assets can take many months to sell.

- Goodwill - It cannot be turned into cash unless the company is sold.

What is Liquidity Crypto?

Liquidity crypto refers to a coin's ability to be quickly converted into cash or other cryptocurrencies. All marketable assets, including cryptocurrencies, require liquidity. Low liquidity indicates that market instability is present, resulting in price surges in cryptocurrencies. On the other side, high liquidity means a stable market with low price changes.

It is thus easier to buy or sell cryptocurrencies in a liquid market since buying or selling orders are quicker due to the increased number of market participants. Given the fast-paced nature of the this markets, a trade can be entered or exited at any time. Liquidity is a crucial notion to grasp when dealing with cryptocurrencies.

Liquidity of Money

The quantity of money readily available for investment and spending is referred to as liquidity. Cash, notes, treasury bills, Bonds, and any other asset that can be sold quickly make up this category. Understanding liquidity can help firms and people forecast economic trends and keep their finances in order. When an institution, corporation, or individual has enough assets to pay their financial obligations, they have high liquidity.

When cash is locked up in non-liquid assets or interest rates are high, it is more expensive to take out loans, resulting in low or restricted liquidity. The financial capital is higher when there is more liquidity. The difference between liabilities and assets is financial capital, wealth, or Net worth. It is a metric that gauges a financial institution's ability to tolerate losses.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.