Table of Contents

Dead Cat Bounce (DCB)

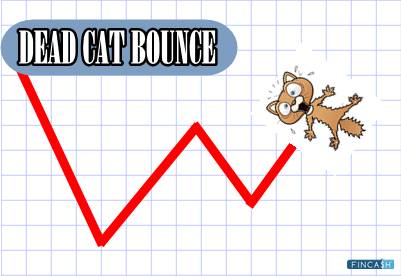

In the world of Investing, a dead cat bounce is a short-term recovery in the price of a declining stock. The term ‘dead cat bounce’ is derived from the idea that even a dead cat will bounce if it falls from a great height.

DCB is not used to describe the typical ups and downs of the Market, rather it refers to a longer-term drop, regain, and continued drop.

A dead cat bounce falls under a market trend where the prices of assets (stocks, Bonds or market as a whole) increase temporarily after a declining trend and then fall again badly to continue the downtrend.

Often it is very difficult for traders and analysts to predict DCB because it is tricky to determine whether an upturn in the market is a dead cat bounce or a market reversal. Nevertheless, it can be a good investment opportunity depending on the investor.

Technical Indicator

One can confirm an instance of a dead cat bounce only after it has taken place in the market. This is the very reason often traders mistake DCB for an actual recovery leading to financial losses. Other indicators like technical clubbed with experience and sharp insights play a big role in determining whether a sudden upward movement of a declining stock is a recovery or an instance of a dead cat bounce.

Example of Dead Cat Bounce

To understand DCB well, let’s take an example, suppose an Ocean Inc company trades for Rs.50 on Feb 1st, then drops in value to Rs. 30 per share over the next five months. Between 21st July to 30th July, the price rises to Rs. 45 per share, but then again badly declines on 31st July. Ocean Inc’s share price is steady at Rs. 20 per share.

This pattern shows the trend of DCB, where the recovery was temporary before it started declining again. Eventually, they steady at a lower price.

Talk to our investment specialist

How to Identify Dead Cat Bounce?

Spotting a dead cat bounce is tricky. As said, the DCBis usually identified after its occurrence. There are no simple or proper guidelines, however, a typical sequence of events as mentioned below can help in indicating the same:

- Identify a stock in a strong bearish trend.

- Notice if there is a steady decline in a security’s price.

- Also, if there is a short-term monetary gain in the price.

- There is again a drastic dip in the price from the most recent high.

Investing Advice to Avoid DCB

It is ideally advised to study the market well, and evaluate a stock based on technical and fundamental analysis instead of attempting to time the market. Newbies should focus on building a strong diverse Portfolio with a long-term horizon, which can protect against drops in the market and huge losses.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.