Table of Contents

Bond

What is a Bond?

A bond is a fixed Income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or Fixed Interest Rate. Bonds are used by companies, municipalities, states and sovereign governments to raise money and finance a variety of projects and activities. Owners of bonds are debtholders, or creditors, of the issuer.

Example

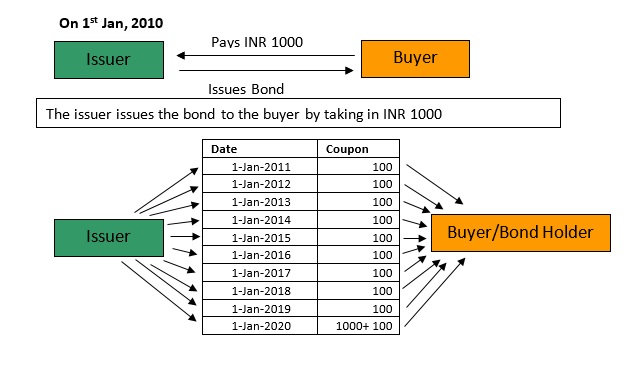

So let’s take an example of a 10-year bond issued on 1st Jan 2010 INR 1000 at 10%.

So to put in simpler terms, a bond is like a loan: the issuer is the borrower (debtor), the holder is the lender (creditor), and the coupon is the interest.

How Bonds Work

When companies or other entities need to raise money to finance new projects, maintain ongoing operations, or refinance existing debts, they may issue bonds directly to investors instead of obtaining loans from a Bank. The indebted entity (issuer) issues a bond that contractually states the interest rate that will be paid and the time at which the loaned funds (bond principal) must be returned (maturity date). The interest rate, called the coupon rate or payment, is the return that bondholders earn for loaning their funds to the issuer.

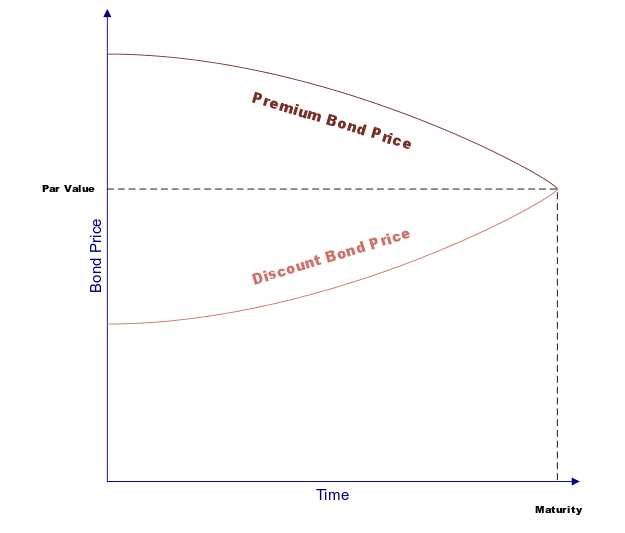

The issuance price of a bond is typically set at par, usually Rs. 100 or Rs. 1,000 Face Value per individual bond. The actual Market price of a bond depends on a number of factors including the credit quality of the issuer, the length of time until expiration, and the coupon rate compared to the general interest rate environment at the time.

Characteristics of Bonds

Most bonds share some common basic characteristics including:

- Face value is the money amount the bond will be worth at its maturity, and is also the reference amount the bond issuer uses when calculating interest payments. For example, say an investor purchases a bond at a premium Rs. 1,090 and another purchases the same bond at a discount Rs. 980. When the bond matures, both investors will receive the Rs. 1,000 face value of the bond.

- Coupon rate is the rate of interest the bond issuer will pay on the face value of the bond, expressed as a percentage. For example, a 5% coupon rate means that bondholders will receive 5% x Rs. 1000 face value = Rs. 50 every year.

- Coupon dates are the dates on which the bond issuer will make interest payments. Typical intervals are annual or semi-annual coupon payments.

- Maturity date is the date on which the bond will mature and the bond issuer will pay the bond holder the face value of the bond.

- Issue price is the price at which the bond issuer originally sells the bonds.

Two features of a bond – credit quality and duration – are the principal determinants of a bond's interest rate. If the issuer has a poor credit rating, the risk of Default is greater and these bonds will tend to trade a discount. In addition, bonds with a high Default Risk, such as junk bonds, have higher interest rates than stable bonds, such as government bonds.

Credit ratings are calculated and issued by credit rating agencies. Bond maturities can Range from a day or less to more than 30 years. The longer the bond maturity, or duration, the greater the chances of adverse effects. Longer-dated bonds also tend to have lower liquidity. Because of these attributes, bonds with a longer time to maturity typically command a higher interest rate.

When considering the riskiness of bond portfolios, investors typically consider the duration (price sensitivity to changes in interest rates) and convexity (curvature of duration).

Bond Issuers

There are three main categories of bonds.

- Corporate bonds are issued by companies.

- Municipal bonds are issued by states and municipalities. Municipal bonds can offer tax-free coupon income for residents of those municipalities.

- Treasury/Government bonds (1-10 years maturity) and bills (less than one year to maturity) are collectively referred to as simply Treasuries or Government Bond.

Varieties of Bonds

- Zero-coupon bonds do not pay out regular coupon payments, and instead are issued at a discount and their market price eventually converges to face value upon maturity. The discount a zero-coupon bond sells for will be equivalent to the yield of a similar coupon bond.

- Convertible bonds are debt instruments with an embedded Call Option that allows bondholders to convert their debt into stock (equity) at some point if the share price rises to a sufficiently high level to make such a conversion attractive.

- Some corporate bonds are callable, meaning that the issuer can Call back the bonds from debtholders if interest rates drop sufficiently. These bonds typically trade at a premium to non-callable debt due to the risk of being called away and also due to their relative scarcity in the bond market. Other bonds are putable, meaning that creditors can put the bond back to the issuer if interest rates rise sufficiently. The majority of corporate bonds in today's market are so-called bullet bonds, with no embedded options and a face value that is paid immediately on the maturity date.

Talk to our investment specialist

Bond Calculator

The bond is essentially a composition of a series of coupon payments (interest) and a final maturity amount. Hence the price of the bond is a sum of:

So how do we calculate bond price? It is not so complex as it looks.

Let’s take the formula for compound interest:

Amount = Principal (1 + r/100)t

r = interest rate in %

t = time in years

or Principal = Amount / (1 + r/100)t

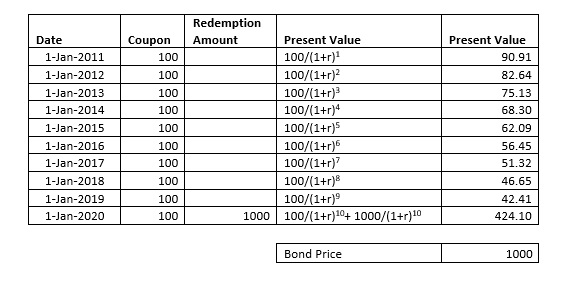

Now applying this to discount the coupon paid in each year and the Redemption amount we have the following table:

Setting the discount rate at 10% (this would be the prevailing rate currently since the issuer is raising funds at this time). The price of the bond as per calculation is Rs. 1000 (same as what we paid for it).

Thus, buying a bond is like giving out a loan and you can expect a Fixed Income return till the time of maturity. Every bond is characterised by its face value, maturity period, interest rate, and issuer. Buying a bond diversifies your investment Portfolio.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

So nice information about bonds,in marathi,I like it