Table of Contents

Concept of Elasticity of Demand

Elasticity refers to measuring the sensitivity of a variable concerning change in another variable. Commonly, elasticity is the change in sensitivity of price relative to other factors. In Economics, elasticity is the degree to which consumers, individuals, or producers change the amount or demand supplied for the changes in Income or price.

Demand Elasticity refers to the economic measure of demand sensitivity relative to shifts in another variable. The demanding quality of any goods or services depends on various factors, including income, price, and preference. Whenever a change occurs in these variables, a change in the demand quantity of the service or good occurs.

Demand Elasticity Formula and Example

Here is the formula to calculate the demand elasticity:

Price elasticity of demand (Ep) = (Proportionate change in demanded quantity)/(Proportionate price change) = (ΔQ/Q× 100%)/(ΔP/(P )× 100%) = (ΔQ/Q)/(ΔP/(P ))

This formula represents that to calculate the elasticity of demand, you must divide the percent change in quantity by the percent change in price that brought it.

Let’s take an elasticity of demand example. If there is a fall in the commodity price from 1 Rs to 90 Paisa, leading to increased demand in quantity from 200 to 240. The demand elasticity for it would be calculated as:

(Ep) = (ΔQ/Q)/(ΔP/(P ))= 40/(200 )+(-1)/10 = 40/(200 )+10/((-1))= -2

Ep here refers to the coefficient of price elasticity of demand and is the ratio of two percent changes; thus it is always a pure number.

Talk to our investment specialist

Types of Elasticity of Demand

The main types of demand elasticity are:

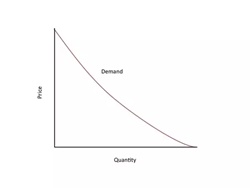

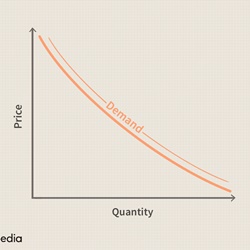

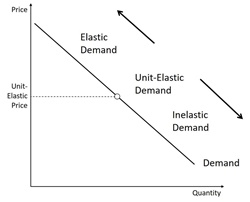

Price Elasticity of Demand

Economists unveiled that the prices of certain goods are inelastic. This means that a reduced price does not increase the demand much, neither is vice versa true. For example, the price elasticity of gasoline demand is lower as the drivers, airlines, trucking Industry, and other buyers will continue buying according to their needs.

However, certain goods are more elastic. Therefore, the price of these goods changes their demand and supplies. This is an essential concept for marketing professionals. And the primary goal for these professionals is to ensure an inelastic demand for the marketed products.

Income Elasticity of Demand

Income elasticity of demand means the sensitivity of demanded quantity for certain goods to a change in the consumers’ Real Income who buys that good while keeping every other thing constant.

To calculate the income elasticity of demand, you must calculate the percent change in demanded quantity and divide it by the percent change in the income. Using this Factor, you can identify if any good represents a luxury or a necessity.

Cross Elasticity of Demand

The cross elasticity of demand refers to an economic concept measuring the responsive behaviour in the demanded quantity of a good when there is a change in the price for other goods.

It is also known as the cross-price elasticity of demand. You can calculate this by evaluating the percent change in the demanded quantity of one good and then dividing it by the percent change in other good’s price.

Factors Influencing Demand Elasticity

Here are the main factors that affect any good’s price elasticity of demand:

1. Substitutes’ Availability

Generally, the demand elasticity is directly proportional to the number of suitable substitutes available. As specific products within an industry might be elastic due to the availability of substitutes, there might be the case that the entire industry itself is inelastic. Mostly, unique and exclusive items like diamonds are inelastic due to the availability of fewer substitutes.

2. Necessity

If there is a need for something for comfort or survival, people do not have any issue paying higher prices for it. For example, there are multiple reasons why people must get to work or drive. Thus, even if the gas prices double or triple, people will continue spending to get the tanks filled up.

3. Time

Time also influences demand elasticity. For example, if the price of cigarettes went up by 100 Rs per pack, a smoker with a lesser number of available substitutes will continue buying the cigarettes. Therefore, tobacco is inelastic as the price changes will not influence the quantity demanded. However, if the smoker understands that they cannot afford an extra 100 Rs per day and starts kicking the habit, the cigarette price for that particular consumer turns out to be elastic in the long run.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.