Table of Contents

Income

What is Income?

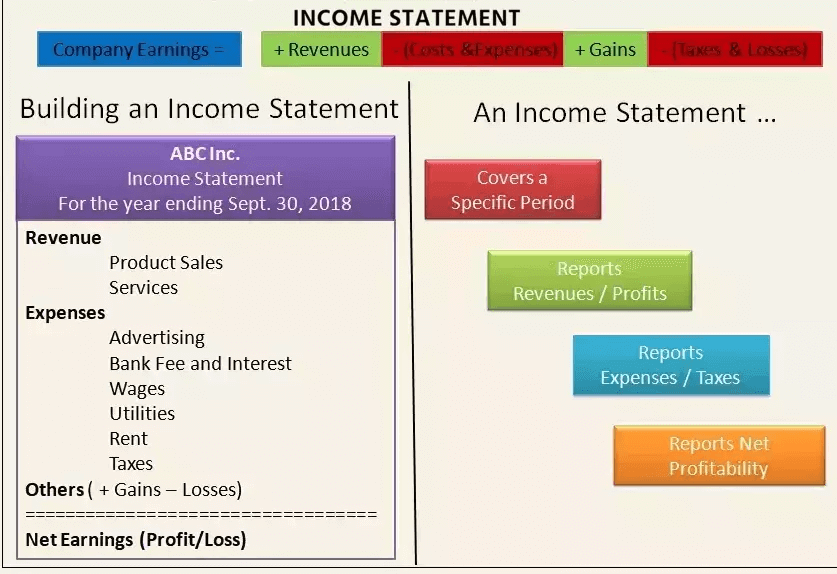

Income is money or something of equal value that an individual or business receives from providing a service, product or investment. Income is necessary for the day-to-day expenses in an individual’s life. Sources of income may vary based on profession and age. For example, investments, social securities, pension are income for the elderly.

For salaried professionals, monthly salary is the source of income. For businesses, Earnings is the income after paying off expenses and Taxes. Individuals gain income through earning on a daily Basis and by making investments. Dividends are also income. In most of the countries, the government taxes income before it is given to the individual. The revenue that comes from these income taxes is used by the government for the benefit of the country and state budgets.

The Internal Revenue Service (IRS) calls income from sources other than a job, such as investments as ‘unearned income’.

Types of Income

The types of income are mentioned below:

1. Taxable Income

The income that an individual receives from wages, salaries, interest, dividend, business income, pensions, Capital earning during a tax year is considered Taxable Income in many countries including the United State of America.

Mentioned below are some other income that will be taxed:

- Rental Income

- Farming

- Fishing Income

- Unemployment Compensation

- annuity Payments

- retirement Income

- Stock Options

- Gambling Income

- Bartering Income

- Jury Duty Pay

Talk to our investment specialist

2. Income Exempted of Tax

Income that is exempted from tax includes income from treasury securities, municipal Bonds.

3. Income Taxed at Lower Rates

Income that is taxed at lower rates includes qualified dividends, Capital Gains that are long-term, social security income, etc. However, note that social security income is taxable at times depending on the amount of other income you may receive during a year.

4. Disposable Income

Disposable income refers to the amount of money you have left after paying off your taxes. This income is then spent on purchasing necessities.

Different Sources of Income

There are several different sources of income that individuals, businesses, and governments can rely on. Here are some common sources of income:

Earned Income: This refers to income earned through employment or self-employment, including salaries, wages, commissions, tips, and profits from business activities.

Investment Income: Income generated from investments, such as interest, dividends, capital gains from the sale of stocks, bonds, Mutual Funds, Real Estate, or other Financial Assets.

Rental Income: Earnings from owning and renting out properties, including residential or commercial real estate, Land, or other assets.

Royalties: Income received from granting the use or rights to intellectual property, such as patents, copyrights, trademarks, or licensing fees for artistic works, books, music, or inventions.

Business Income: Profits generated from operating a business or entrepreneurship, including sales revenue minus business expenses.

Pension and Retirement Income: Regular payments received during retirement from pension plans, annuities, individual retirement accounts (IRAs), or other retirement savings vehicles.

Government Transfers: Income received from government sources, such as social security benefits, unemployment benefits, welfare payments, or other forms of public assistance.

Dividend Income: Earnings distributed by corporations to their shareholders as a portion of the profits.

Capital Gains: Profits realized from the sale of assets, such as stocks, bonds, real estate, or other investments, when the selling price exceeds the purchase price.

Gift or Inheritance: Income received as a gift or Inheritance, including monetary funds, property, or other valuable assets transferred from one individual to another.

It's worth noting that the availability and types of income sources can vary depending on individual circumstances, the nature of businesses, or specific economic factors in a given country or jurisdiction.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.