EBITDA/EV Multiple

What is EBITDA/EV Multiple?

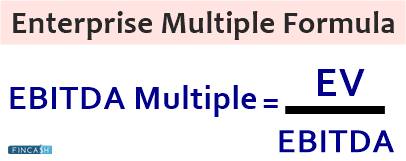

The EBITDA/EV Multiple is a ratio of financial valuation that helps in measuring the overall ROI (Return on Investment) of the company. The ratio specifying EBITDA/EV Multiple can be preferred over other mechanisms of calculating returns. This is because it is normalized for major differences between several companies.

This ratio helps in normalizing major differences in taxation, Capital structure, and Fixed Asset Accounting. The EV (Enterprise Value) also helps in normalizing differences in the Capital Structure of the company.

Understanding of EBITDA/EV Multiple

EBITDA/EV Multiple serves to be a comparable analysis mechanism that is aimed at valuing similar firms with the help of the same financial metrics. Computing the ratio for EBITDA/EV Multiple might appear challenging in comparison to other return mechanisms. It is mostly preferred as it helps in providing a normalized ratio for the comparison of the varying operations.

An analyst that makes use of EBITDA/EV Multiple is known to assume that a specific ratio tends to be applied. The same can be applied to several companies that operate within the similar line of Industry or businesses. In simpler words, the theory explains that when businesses tend to be comparable, the given “multiple” approach can be used for determining the value of one business on the Basis of another’s value. Therefore, EBITDA/EV Multiple is commonly utilized for comparing companies within the given industry.

This serves to be the modification of the overall ratio of non-operating & operating profits when compared to the respective Market value of the equity of the company along with its debt. As EBITDA/EV Multiple is mostly considered as a proxy for the cash Income, the given metric is utilized as a means of the cash ROI (Return on Investment) of the company.

EBITDA & EV

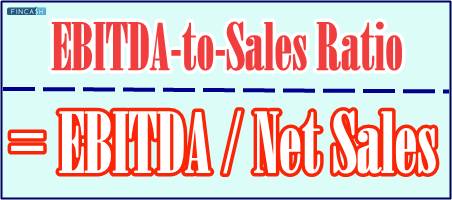

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. During April 2016, the SEC (Securities & Exchange Commission) stated the utilization of non-GAAP measures including EBITDA would serve to be the focal point for the firm for ensuring that businesses are not presenting results in a misguided manner. If EBITDA is revealed, the SEC offers the advice that the business should aim at reconciling the given metric to the net income. This would assist the investors by Offering information on the calculation of the figure.

Talk to our investment specialist

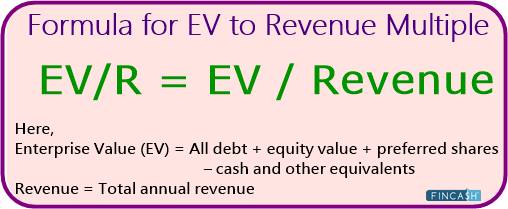

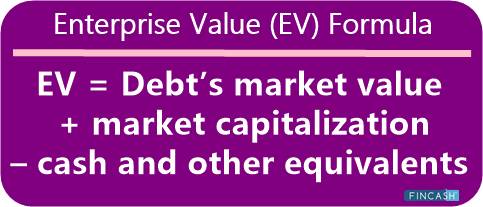

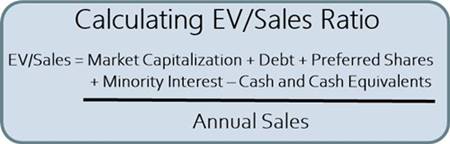

EV (Enterprise Value) serves to be the measure of the Economic Value of the business. It is mostly used for determining the overall value of the firm if the same is acquired. The same is considered to serve as an effective valuation mechanism in comparison to market capitalization. This is because the latter Factor is utilized only in context with the equity of the company without paying attention to the debt.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.