Table of Contents

Gamma Neutral

What is Gamma Neutral?

Basically, the technique of Gamma Neutral helps you develop an investment Portfolio in which the change of rate in the delta is nil. Gamma happens to be a crucial options’ variable that helps option buyers to calculate the price fluctuations in the options with respect to the changes in the Underlying stock. In other words, Gamma, Delta, Theta, Reo, and other such Greek variables are being widely used to determine possible risks in Options Trading.

Like Gamma, many Greek variables can be used to neutralize these unexpected and aggressive movements in options. For instance, option buyers can use delta neutral or Vega and Theta neutral techniques to control the risks associated with the option’s price fluctuations due to the changes in the underlying stocks.

Everything You Need to Know About Gamma Neutrals

Gamma neutral definition can help control the sudden variations in the options price due to the Market conditions. It is important to note that a gamma neutral investment portfolio is still not 100% immune to the fluctuation risks.

For instance, if you Fail to make accurate assumptions regarding the option’s price and movements in the option’s delta, then the strategy to build a delta neutral investment portfolio will get risky. Besides, the position needs to be neutralized on a consistent Basis i.e., with the changes in the option’s price.

Talk to our investment specialist

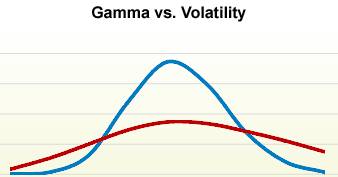

The calculation of the gamma of the option will help you find out the risk associated with the options. Of course, every option trader would like to minimize their risk. One way to reduce (if not eliminate) the Volatility rate from the option investment is by neutralizing gamma. These strategies are specifically used to build a new option investment portfolio or manage the existing one.

The major purpose of the gamma neutral strategy is to help investors get as close to “zero fluctuations” as possible. The major benefit of this strategy is that the unexpected movements in the Underlying Asset value will not impact the delta value. As long as the gamma value is near zero, the price fluctuations in the options will not affect delta value.

Purpose of Gamma Neutral Strategy

The strategies can help investors accelerate their profits from option investment. Basically, the main purpose of developing the gamma neutral strategy is to help investors build an option position, which has the gamma value either zero or as close to zero as possible. The unexpected movements in the underlying stocks are quite common. The good news is you can follow a few steps to keep your delta value stable – no matter how the asset moves.

Note that these strategies are quite sophisticated. They might not be a perfect solution for beginners, since they require a considerable amount of experience and knowledge in this Industry. You will not want to suffer losses due to wrong assumptions. Besides, it is important for investors to take some time to learn everything about Options Greeks and its working

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.