Table of Contents

Gamma Hedging

What is Gamma Hedging?

Gamma Hedging refers to the strategy that helps eliminate the risk created with the sudden and aggressive movements of the Underlying security. The sudden changes in the Underlying Asset are quite common a few days before the expiration date. Usually, the underlying stocks go through aggressive movements on the last date. These changes could be in favor of the option buyer or against them.

Gamma Hedging process happens to be one of the crucial and sophisticated risk management plans that are designed to help option buyers in emergency situations. Basically, the technique aims to Handle the rapid price movements that are possible on the expiration day. In fact, it can address some of the extreme and large moves effortlessly. Often seen as an alternative to delta hedging, gamma hedging acts as the defensive line for option buyers.

Gamma Hedging – How does it Work?

Gamma Hedging helps investors neutralize the risk of their option investments by adding some small option positions to their current investment Portfolio. For instance, investors can add new contracts to their portfolio should they suspect a sudden and extreme movement in the underlying stock in the next 24 to 48 hours. Make sure that Gamma Hedging happens to be a sophisticated process, which means its calculation can be a little tricky.

Gamma refers to a standard variable that is often used for pricing options. This sophisticated formula comprises two main variables, which are designed to allow traders to determine the price movements of the underlying stocks. Basically, these two variables are responsible for accelerating profits and decelerating losses.

Talk to our investment specialist

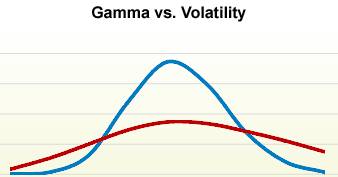

The variable Delta helps buyers know the change in the price of an option owing to the minor movements in the underlying assets. Basically, it is calculated on the Basis of a $1 change in price. Gamma, on the other hand, is used to find out the rate at which the delta of your option changes based on the movements in the price of an underlying asset. Many investors and option traders believe that Gamma happens to be the result of the option’s delta changes with respect to the underlying stocks. As soon as you add these two variables to the main Delta, you will find out the possible price movements of the underlying asset.

Any investor who tries to achieve the delta-hedged state will make trades that have extremely lower chances of major fluctuations and aggressive changes. However, it is important to note that even a delta hedging technique cannot offer the best or 100% protection to the option buyers. The reason is quite simple. Only a small amount of time is left before the final expiration day. This means even some minor changes in the price in the asset or underlying stocks could result in the extreme fluctuations in the option. That being said, delta-hedging might not suffice in such situations.

That’s when the gamma hedging is used in conjunction with delta hedging to protect the investor from the significant changes to the security.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.