Table of Contents

Gap

What is Gap?

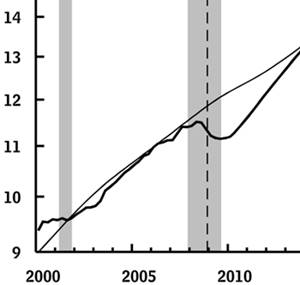

Gap meaning refers to the discontinuity in the stock Market chart, in which, the price of the commodity either goes up or comes down with no activity occurring in between. In other words, a gap is an event where the stock prices move rapidly (either up or down) with little to no activity happening in between.

Usually, gaps occur post some major news and event. For example, a large number of investors purchase the stock of a trusted company on a specific day. However, no change is witnessed in the sales of the stock for the next few days. The gaps are used by investors and traders. It allows them to tap into opportunities to grow their profits. Let’s take a look at the four main types of gaps.

Four Types of Gaps

Common Gaps

Unlike the standard gaps, there is nothing preceding the common gaps. It doesn’t take long for these gaps to be filled. Commonly called as trading gaps, common gaps have a normal trading volume.

Breakaway Gaps

Breakaway gaps occur through resistance and support. They refer to a sudden and strong price movement. This event occurs when the price of the stock goes beyond the trading Range. Now that these trends lead to the formation of a new trend, they bring a new audience. This means these gaps do not fill as easily as common gaps.

Runaway Gaps

These gaps are mainly witnessed during the trend. Runaway gaps are quite common when there are a strong bull or bear moves. The price of the stock in runaway gaps tends to change drastically towards the specific trend. Commonly known as measuring gaps, runaway gaps are quite common when there’s an increase in the interest of the security.

Talk to our investment specialist

Exhaustion Gap

Post the rapid growth in the price of the stock, the prices fall suddenly. That is when the exhaustion gap occurs. In this type of gap, the focus of the investors is shifted from stock buying to selling. As a result, the demand for particular security drops. This gap also implies that an upward trend is most likely to terminate.

So, these were the four most common types of gaps in stock trading. Now, each one of them can affect the investor’s Portfolio in a different manner. As mentioned above, breakaway gaps indicate a significant growth in the trading volume. Runaway and Common gaps, on the other hand, are completely different. It is important to note that a majority of gaps that occur in trading happen because of a specific event or news.

As the name suggests, common gaps tend to occur frequently. Besides, common and exhaustion gaps are filled quickly. Runaway and Breakaway gaps indicate either the reversal or continuation of the specific trend. That’s the reason they do not fill easily.

Gaps Limitations

Even though it is quite easy for a trader to spot the stock market gaps on the chart, these gaps come with certain limitations. Glaring Flaw is one such limitation that could result in the incorrect interpretation of the gap.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.