Gapping

What is Gapping?

Basically, gapping meaning refers to a strong shift in the value of the stock and the trader’s decision that happen overnight. The concept is divided into partial gapping and full gapping.

The former happens when the changes in the stock value do not go out of Range. In other words, partial gapping means there is a change in the value of the stock, but within the range of the last day’s close. In full gapping, the value of the stock and other investment instruments goes beyond the trend. The dynamic Gapping concept is used to find out the changes in the assets and liabilities over time. Let’s understand gapping in detail.

An Overview of Gapping

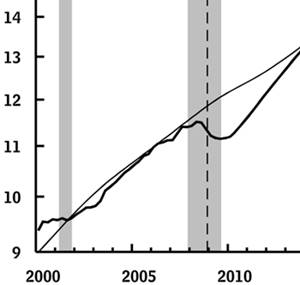

Gapping is one of the common events that are likely to occur in almost all types of instruments, stocks, and securities. Any investment commodity, in which, the trading closes and then reopens with a major change in the commodity value refers to gapping. In this process, there is no activity happening in between these changes. Gapping is observed mostly in stocks. Since the stocks are sold in large numbers every day. Currencies are also traded in large volumes every week. However, gapping happens when the currency trading Market closes for the weekend.

Short position traders often face significant losses due to gapping. Let’s say, the trader has decided to put a stop loss at $22 for the shares of a specific company. Now, the deal closes at $18, which makes it a profitable deal for the trader. However, the company gets acquired by another company on the weekend. As a result, the price of the stock increases to $24. Now, this means the trader will have to bear the loss of $2 per share.

Talk to our investment specialist

There are quite a few ways to avoid these risks. For instance, traders must wait for the company to make profits before buying their shares. Additionally, you should avoid buying stocks if you are expecting some big announcement. Any news that could impact the stock value of a company can turn out to be a nightmare to the traders. You need to be extra careful with stock trading when there is high Volatility.

Gapping Trading Techniques

Gapping is extensively used to draw analytical insights. How fast the gap occurs in a trend is a common way to know how its price will be affected in the future. Here are some tips for using a gap in trading.

- Use Gap and Go technique to avoid significant losses

- Use fading the gap strategy

- Consider gapping as the trading signal (follow the runaway and breakaway gaps to make the best of the trend.

It is important to note that gapping is possible in all types of instruments. However, the effect of gapping on traders can prove to be negative if it happens due to a major corporate announcement.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.