Table of Contents

Information Ratio (IR)

What is Information Ratio (IR)?

The Information Ratio (IR) is a measure of Portfolio returns above the returns of a benchmark. It is usually an index, to the Volatility of those returns. The Information ratio shows the consistency of the fund manager in generating superior risk adjusted performance. Higher information ratios indicate a desired level of consistency, whereas low information ratios indicate the opposite.

A higher IR shows that fund manager has outshined other fund managers and has delivered consistent returns over a specified period. Many investors use the Information Ratio when selecting exchange-traded funds (ETFs) or Mutual Funds based on investor risk profiles.

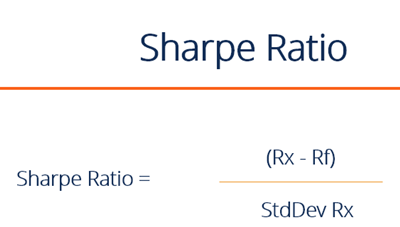

Although compared funds may be different in nature, the IR standardizes the returns by dividing the difference by the Standard Deviation:

Information Ratio Formula

Where;

Rp = Return of the portfolio,

Ri = Return of the index or benchmark

Sp-i = Tracking error (standard deviation of the difference between returns of the portfolio and the returns of the index)

Talk to our investment specialist

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.