Table of Contents

IRR

What is Internal Rate of Return (IRR)?

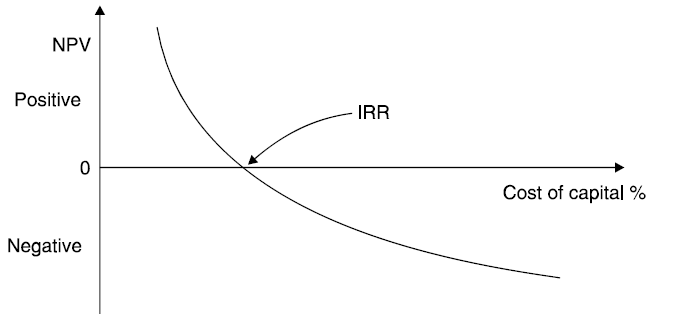

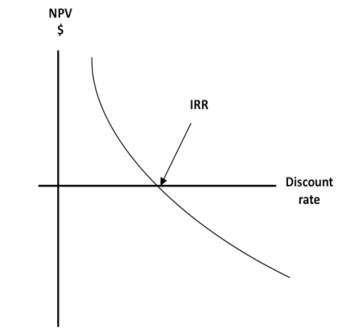

Internal rate of return (irr) is the interest rate at which the net present value of all the cash flows from a project or investment equal zero. The cash flows can be both positive and negative. IRR is used to evaluate the attractiveness of a project or investment. Ultimately, IRR gives an investor the means to compare alternative investments based on their yield.

IRR is a metric used in Capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. IRR calculations rely on the same formula as NPV does.

Talk to our investment specialist

IRR Formula

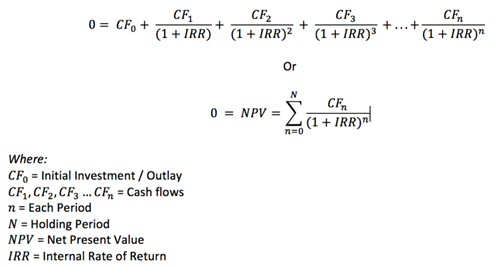

The following is the formula for calculating NPV:

Calculating the internal rate of return can be done in three ways:

- Using a financial calculator

- Using the IRR or XIRR function in Excel or other spreadsheet programs

- Using an iterative process where the analyst tries different discount rates until the NPV equals to zero

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.