Table of Contents

Internal Rate of Return - IRR

What is Internal Rate of Return - IRR?

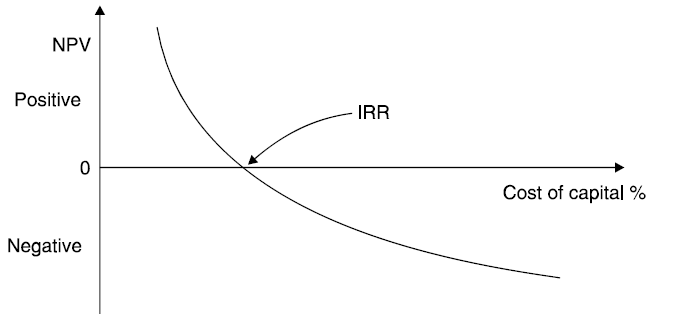

Internal rate of return (IRR) is a metric used in Capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. IRR calculations rely on the same formula as NPV does.

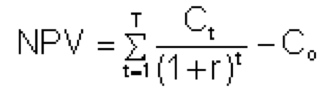

The following is the formula for calculating NPV:

The formula for calculating Net Present Value (NPV).

Where:

Ct = net cash inflow during the period t

Co= total initial investment costs

r = discount rate, and

t = number of time periods

To calculate IRR using the formula, one would set NPV equal to zero and solve for the discount rate (r), which is the IRR. Because of the nature of the formula, however, IRR cannot be calculated analytically and must instead be calculated either through trial-and-error or using software programmed to calculate IRR.

Generally speaking, the higher a project's internal rate of return, the more desirable it is to undertake. IRR is uniform for investments of varying types and, as such, IRR can be used to rank multiple prospective projects on a relatively even Basis. Assuming the costs of investment are equal among the various projects, the project with the highest IRR would probably be considered the best and be undertaken first.

IRR is sometimes referred to as "economic rate of return" or "discounted cash flow rate of return." The use of "internal" refers to the omission of external factors, such as the cost of capital or Inflation, from the calculation.

Details of Internal Rate of Return - IRR

You can think of internal rate of return as the rate of growth a project is expected to generate. While the actual rate of return that a given project ends up generating will often differ from its estimated IRR, a project with a substantially higher IRR value than other available options would still provide a much better chance of strong growth. One popular use of IRR is comparing the profitability of establishing new operations with that of expanding existing ones. For example, an energy company may use IRR in deciding whether to open a new power plant or to renovate and expand a previously existing one. While both projects are likely to add value to the company, it is likely that one will be the more logical decision as prescribed by IRR.

Talk to our investment specialist

Internal Rate of Return in Practice

In theory, any project with an IRR greater than its cost of capital is a profitable one, and thus it is in a company’s interest to undertake such projects. In planning investment projects, firms will often establish a required rate of return (RRR) to determine the minimum acceptable return percentage that the investment in question must earn in order to be worthwhile. Any project with an IRR that exceeds the RRR will likely be deemed a profitable one, although companies will not necessarily pursue a project on this basis alone. Rather, they will likely pursue projects with the highest difference between IRR and RRR, as these likely will be the most profitable.

IRR can also be compared against prevailing rates of return in the securities Market. If a firm can't find any projects with IRR greater than the returns that can be generated in the financial markets, it may simply choose to invest its retained Earnings into the market.

Although IRR is an appealing metric to many, it should always be used in conjunction with NPV for a clearer picture of the value represented by a potential project a firm may undertake.

Internal Rate of Return Issues

While IRR is a very popular metric in estimating a project’s profitability, it can be misleading if used alone. Depending on the initial investment costs, a project may have a low IRR but a high NPV, meaning that while the pace at which the company sees returns on that project may be slow, the project may also be adding a great deal of overall value to the company.

A similar issue arises when using IRR to compare projects of different lengths. For example, a project of a short duration may have a high IRR, making it appear to be an excellent investment, but may also have a low NPV. Conversely, a longer project may have a low IRR, earning returns slowly and steadily, but may add a large amount of value to the company over time.

Another issue with IRR is one not strictly inherent to the metric itself, but rather to a common misuse of IRR. People may assume that, when positive cash flows are generated during the course of a project (not at the end), the money will be reinvested at the project’s rate of return. This can rarely be the case. Rather, when positive cash flows are reinvested, it will be at a rate that more resembles the cost of capital. Miscalculating using IRR in this way may lead to the belief that a project is more profitable than it actually is. This, along with the fact that long projects with fluctuating cash flows may have multiple distinct IRR values, has prompted the use of another metric called modified internal rate of return (MIRR). MIRR adjusts the IRR to correct these issues, incorporating cost of capital as the rate at which cash flows are reinvested, and existing as a single value. Because of MIRR’s correction of the former issue of IRR, a project’s MIRR will often be significantly lower than the same project’s IRR.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.