Table of Contents

Realized Loss

What is Realized Loss?

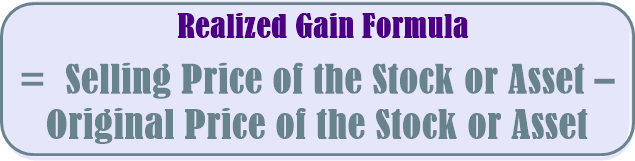

A realized loss is the loss that is recognized when assets are sold for a price lower than the original purchase price. It is a loss that occurs when the sale price of an asset is lower than its carrying amount. A realized loss is a decrease in the value of an asset that has been sold. The investor can only make claim to a profit or loss after he has sold the security at Fair Market Value in an arm’s length transaction.

Although the asset may have been held on the Balance Sheet at a Fair Value level below cost, the loss only becomes realized once the asset is off the books. An asset is removed from the books when it is sold, scrapped, or donated by the company.

Getting an Understanding of Realized Loss

When the investor goes forward with buying some Capital asset, the overall increase or even a decrease in the security’s value is not known to get translated into some profit or loss. The investor is able to make the claim only to some profit or loss upon selling the security at the given fair Market value at the given arm’s length transaction.

Working of Realized Losses for Businesses

Realize loss is known to occur when the asset’s sales price tends to be lower in comparison to the respective carrying amount. While the given asset might have been held on the respective balance sheet at some fair value level less than the cost, the loss is known to be realized only once the asset gets off the respective books. The asset gets removed from the books upon getting sold, donated, or scraped by the organization.

One benefit of realized loss is the potential tax advantage. In several cases, a specific portion of the realized loss could be applied against the realized profit or Capital Gain for reducing the overall Taxes. This might turn out to be quite favorable for an organization that might be looking forward to limiting the respective tax burdens. Moreover, companies can actually consider going out of the way for realizing losses in specific periods where the tax bill might be higher than anticipated.

As its effect, an organization might consider realizing losses on a number of assets when it might otherwise be paying taxes on capital gains or realized profits.

Talk to our investment specialist

Example of Realized Losses

For instance, let us assume an investor goes forward with Investing 50 shares of XYZ at INR 249.50 on a per share Basis on 20th March. From the given purchase dated to 9th April, the value of the given stock declined by around 13.7 percent to reach around INR 215.41. In the given case, the investor still has some realized loss if he actually sells the same at depressed prices. On the other hand, the decline in the value serves to be unrealized loss that is known to exist only in paper.

Realized losses, in comparison to unrealized losses, can impact the total amount of owed taxes. A realized Capital Loss could be used for offsetting capital gains for the purpose of tax.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.