Table of Contents

Realized Gain

What is a Realized Gain?

A Realized Gain results from selling an asset at a price higher than the original purchase price. Recognized gain is when you are able to sell an investment for more than what you paid for it. It occurs when an asset is sold at a level that exceeds its Book Value cost. When calculating your realized gain, you must deduct any costs associated with the sale. The final Earnings after all cost deductions equal your realized gain.

Although you might have known that your investment had increased in value ("gained") before it was sold, that gain was largely hypothetical until an actual sale occurred. Once the sale happens, the increase is recognized: thus, the term "recognized gain." Realized gains and unrealized gains vary considerably.

An unrealized gain refers to a gain reported on a company’s financial statements and will appreciate the value of the specified asset on a company’s books. Unrealized gains are typically not taxed.

The assets are included on the company’s Balance Sheet; however, they may be reported with or without the unrealized gains.

Talk to our investment specialist

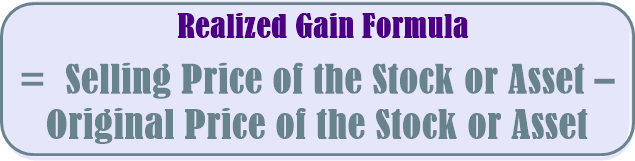

Realized Gain Calculation

For illustration purpose, let's assume you own 100 shares of Company ABC that you purchased for INR 1,000. If the value of the investment increases to INR 3,000 but you sell the shares, your realized gain equals INR 2,000.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

I like this page