Table of Contents

Serial Correlation Meaning

From financial markets and climate research to psychological studies, serial correlations impact diverse fields and shape our understanding of complex systems. In this article, you’ll embark on a journey to explore the intriguing world of serial correlation, unravelling its significance and implications in our data-driven society.

Serial correlation, also known as autocorrelation, refers to the statistical relationship between consecutive observations in a dataset. It measures the degree to which past values of a variable are related to subsequent values, indicating the presence of systematic dependencies over time. Understanding serial correlation is crucial in various fields such as finance, climate research, and time series analysis, as it provides insights into patterns, trends, and predictive behaviour within time series data.

Serial Correlation Formula

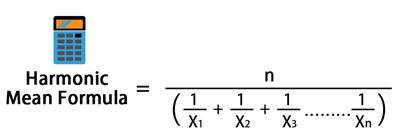

Let's assume we have a time series dataset with observations indexed from 1 to n. The serial correlation coefficient, denoted as ρ(k), measures the correlation between the observations at time t and time t+k, where k represents the lag or time gap between the two observations.

The formula for serial correlation is:

ρ = (Σ((xi - x̄)(xi-1 - x̄))) / (Σ((xi - x̄)^2))

where:

- xi is the value of the variable at time i.

- x̄ is the mean of the variable values.

- xi-1 is the lagged value of the variable at a time (i-1).

- Σ denotes the summation symbol, indicating that you need to sum the values over a specific Range.

By calculating the serial correlation coefficient for different lags (k), one can assess the presence and strength of correlations between observations at different time intervals in the time series data.

Talk to our investment specialist

Serial Correlation Example

For example, consider a financial analyst examining the daily returns of a stock over a 30-day period. By calculating the serial correlation, they can establish if there is an important connection between the returns of successive trading days. A positive serial correlation suggests that a positive return on one day is likely to be followed by another positive return, indicating a trend or momentum in the stock's performance.

Serial Correlation Vs. Autocorrelation

Serial correlation and autocorrelation are frequently used synonymously; although they have slightly distinct meanings when used in connection to data analysis. Serial correlation refers to the correlation or relationship between consecutive observations in a dataset. It measures the degree to which past values of a variable are related to subsequent values, indicating the presence of systematic dependencies over time. Serial correlation is often calculated using statistical measures like the Pearson correlation coefficient.

Autocorrelation, on the other hand, is a specific type of serial correlation that examines the correlation between a variable and its own lagged values. It quantifies the relationship between a variable's current value and its previous values at different time lags. Autocorrelation is commonly measured using autocorrelation functions or autocorrelation coefficients.

Serial Correlation in Regression

Serial correlation in regression refers to the presence of correlation among the residuals or errors of a regression model. When serial correlation exists, it violates the assumption of independence between residuals, leading to biased coefficient estimates and inefficient inference. It commonly occurs in time series or panel data, where observations are correlated over time or across different entities.

Accounting for serial correlation is crucial in regression analysis to ensure accurate estimation of model parameters and valid statistical inferences. Various diagnostic tests and techniques, such as the Durbin-Watson test or robust standard errors, can help detect and address serial correlation in regression models.

Is Serial Correlation Bad?

Serial correlation is not inherently "bad" or undesirable in all situations. It depends on the context and the goals of the analysis. In some cases, serial correlation can indicate Underlying patterns or dependencies in the data, providing valuable insights into the dynamics of a system. However, in regression analysis, serial correlation among the residuals can pose challenges. It violates the assumption of independent errors and can lead to biased parameter estimates and invalid statistical inferences.

Addressing serial correlation is important to ensure the reliability and accuracy of regression models, particularly when making causal inferences or conducting hypothesis testing.

The Bottom Line

Serial correlation, the intricate interplay between consecutive data points, offers a window into the hidden patterns and dependencies that shape our understanding of complex systems. Recognising and analysing serial correlations is crucial for accurate data analysis and informed decision-making. In order to gain new insights, improve prediction models, and further grasping of the dynamic world you live in, embrace the potential of serial correlation as you navigate the statistical terrain.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.