Table of Contents

What is Arithmetic Mean?

The Arithmetic mean refers to the commonly used and universally accepted measure of the average. Commonly used in mathematics, arithmetic mean has a broad Range of applications. In arithmetic mean, the sum of the given set of numbers is calculated and the sum is then divided by the count of the total numbers.

Arithmetic Mean Formula

x¯=1n∑ni=1xi

x¯ indicates the overall mean of xi values.

This delivers the result as;

nx¯=∑i=1nxi

This implies Arithmetic Mean x¯ has ‘n’ copies of the number delivering the same sum as that of the original data.

In case the data gets grouped with fi occurrences for xi with i = 1, 2, 3, ….., n; then then mean is indicated as:

x¯=∑ni=1fixi∑ni=1fi,

For example, the arithmetic mean of the below-listed numbers will be calculated as follows:

1, 5, 8, 10, 11

AM = 1 + 5 + 8 + 10 + 11 / 5

35

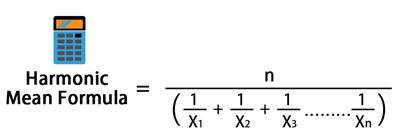

The two most common types of mean that are widely used for mathematical calculations are geometric mean and Harmonic Mean. These terms are mostly used in the investment and financial Industry. The trimmed mean is also quite common these days. It is specifically used for the calculation of consumer price index as well as personal consumption expenses.

The arithmetic mean is used in finance too. Suppose you want to know the Income estimate of the 10 researchers in your industry. All you got to do is get the sum of the income of all the 10 researchers and divide it by 10. This will give you the arithmetic mean. The calculation of the arithmetic mean is quite simple and straightforward. Even those with the basic knowledge of math and finance can measure the arithmetic mean in simple steps. The mean provides you with effective results even when you have a large group of numbers to calculate.

Talk to our investment specialist

Drawbacks of Arithmetic Mean

The arithmetic mean is not the best option, especially when one outlier has the ability to change the mean by a large extent. Suppose you want to know the allowance each student from a specific school gets. 9 of these students enjoy an allowance of INR 600 to INR 800 every week. Let’s say the last kid receives an allowance of INR 1000. Here, the arithmetic mean will not generate a fair estimate of the average.

In such a case, you must be able to get an accurate estimate by calculating the median. Similarly, the arithmetic mean is not the best option for those who want to figure out the performance of an investor. The arithmetic mean will not generate the best and accurate estimate if the compounding interest is included in the situation. While the arithmetic mean might be used in finance and investment industries, it does not make an ideal option for calculating the current and future cash flows. Researchers and analysts are supposed to take the cash flow into consideration when finding out the profit and loss of the firm for the Fiscal Year.

If the cash flow of the organization is calculated using the arithmetic mean method, it will produce inaccurate figures. For investment portfolios and other such investment-related requirements, the geometric mean is used for the appropriate calculation. Mostly, returns generated from the investment in the financial industry are correlated. The more numbers included in the equation, the trickier the formula will get. And, it will become super challenging to calculate the mean.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.