Table of Contents

Unfolding the Term Covered Call

When you buy shares, you believe that eventually, the price of the stock will increase. However, what if, after some time, you find that the rosy picture you had painted in your mind is not what the reality?

What could be even more concerning is that the stock may not even show any signs of a drive. What are you left with at this point in time? Can you make this investment productive in a way that you earn at least something while you are still holding onto the stock?

Definitely yes. And what helps you with the same is known as a covered Call. This post is dedicated to a strategy that can help you earn a premium.

What is a Covered Call Strategy?

A covered call is a straightforward Options Trading strategy that is frequently utilized by traders to secure massive shareholdings. It is one such strategy wherein, as a trader, you own shares of a specific company and sell Over The Money (OTM) covered call options of that company in the same quantity.

The Call Option doesn’t get exercised unless the prices of the stock increases. Until then, you get to earn a premium. Overall, a covered call is regarded as an unlimited risk and limited reward strategy.

Understanding the Basics

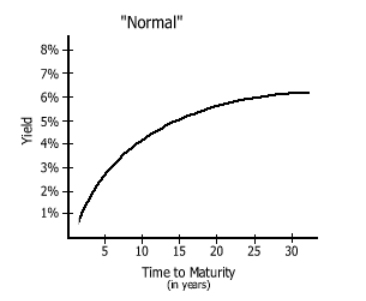

Covered calls are generally a neutral strategy. It means that you can only expect a moderate decrease or increase in the prices of the Underlying stock for the written call option.

Often, the strategy is executed when you have a short-term neutral view on a particular asset, and owing to this reason you can hold the asset long and consequently have a short position through an option to generate Income from a premium.

To put it in simple words, if you wish to hold the stock for a more extended period of time, but don’t expect a satisfactory increase in the price anytime sooner, you have an option to generate income for your account while waiting for the lull.

Basically, a covered call strategy for income caters as a short-term hedge over a long stock position and enables you to earn an income. However, you may incur penalties on your stock gains if the price goes above the strike price of the option.

Also, if you choose to exercise this option, you become responsible for providing 100 shares at the price of the strike for every written contract.

Know that if you are an extremely bearish and extremely bullish investor, this strategy isn’t going to be useful for you. As, in the former scenario, it would be good for you to sell your stocks, considering that the received premium for writing a call option will not be satisfactory to counterbalance the loss on your stock if it plummets. And, in the latter scenario, you would be better off if you don’t write the option and simply hold your stock. Here, the option will control the profit, which can ultimately decrease your entire profit gained from the trade in case the prices of your stock go high.

Talk to our investment specialist

How Can You Create a Covered Call?

- Buy a stock and get it in 100 shares lot

- For every 100 stock shares that you have, sell a call contract; considering that one call contract is 100 stock shares

- If you have 500 stock shares, you can think about selling covered calls as per the requirement or quantity that you own

- Now, wait for the call to expire to exercise, however, know that you have an option to purchase the option back before it gets expired

Defining Maximum Profit and Loss in Covered Call

The highest profit of a covered call is equal to the strike price of such a call option that is short in nature. In this situation, lesser the purchase price of the stock, more will be the received premium.

And, the maximum loss is equal to the purchase price of the stock, which is generally lesser than the premium received.

Bottom Line

Covered call writing is undoubtedly an essential strategy for those investors who belong to conservative retail. In case there is a change in rules, the approach to this strategy will also fluctuate. These rules can generally change on the Basis of how you approach your investments. Lastly, it is crucial to understand every parameter that is applied so that you can take more advantage and increase your returns to the highest level.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.