Term To Maturity

What is Term To Maturity?

Term to maturity refers to the remaining life of a debt instrument. With Bonds, term to maturity is the time between when the bond is issued and when it matures, known as its maturity date, at which time the issuer must redeem the bond by paying the principal or Face Value. Between the issue date and maturity date, the bond issuer will make coupon payments to the bondholder.

Details of Term To Maturity

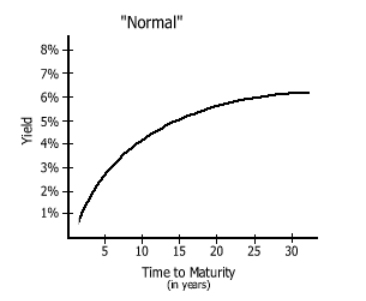

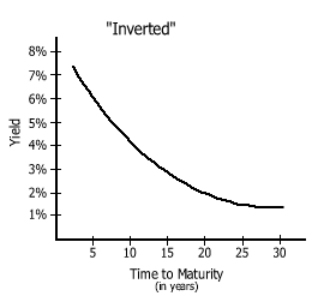

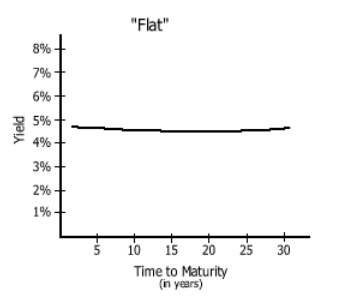

Bonds can be grouped into three broad categories depending on their terms to maturity: short term bonds of 1 to 5 years, intermediate term bonds of 5 to 12 years, and long term bonds of 12 to 30 years. The longer the term to maturity, the higher the interest rate tends to be, and the less volatile a bond’s Market price tends to be. Also, the further a bond is from its maturity date, the larger the difference between its purchase price and its Redemption value, which is also referred to as its principal, Par or face value.

If an investor expects interest rates to increase, she will most likely purchase a bond with a shorter term to maturity. She will do this to avoid being locked into a bond that ends up paying a below-market interest rate, or having to sell that bond at a loss in order to get Capital to reinvest in a new, higher-interest bond. The bond’s coupon and term to maturity are used in determining the bond’s market price and its yield to maturity.

For many bonds, the term to maturity is fixed. However, a bond’s term to maturity can be changed if the bond has a Call provision, a put provision or a conversion provision.

Talk to our investment specialist

An Example of Term to Maturity

Uber Technologies, during a non-deal roadshow in June of 2016, broke the news that it would seek a leveraged loan to help fund expansion. Then, on Friday, June 26th, Uber confirmed the news by stating that it would issue a $1 billion leveraged loan, to be underwritten and sold by US Bank in July 2016. The term to maturity of the loan is seven years. This means that Uber is required to repay the debt within a seven-year period.

The provisions of the loan stipulate that there will be a 1% LIBOR floor and a 98 – 99 offer price. At the current term to maturity of seven years and with a size of $1 billion, it's expected that the loan could yield investors between 5.28 - 5.47% to maturity.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.