Fincash » Employee Provident Fund » Universal Account Number

Table of Contents

Universal Account Number (UAN)

Over the past few years, the Employees’ Provident Fund Organization (EPFO) has been working towards making the services seamlessly available online. One of the essential elements that EPFO has is to provide the active Universal account number (UAN). The primary concept behind UAN is to provide one account number for a subscriber, regardless of the number of jobs have been changed. So, once you have received your UAN from the EPFO, it is going to be the same in all of your future organizations.

Full Form of UAN is Universal Account Number.

What is EPF Universal Account Number?

Issued by the ministry of employment and labour under the government of India, the Universal Account Number (UAN) is a 12-digit number that is provided to every member of the Employees’ Provident Fund Organization (EPFO). UAN number is also helpful in managing all of the PF accounts. It can further assist you to get the information regarding provident fund (PF), irrespective of the company or organization you work in.

Advantages of UAN

The universal number remains the same for every employee. However, a new member ID is provided every time there is a switch or change of a job. Linked to one UAN, these member IDs can be received upon submitting the UAN to the new employer.

Some of the features of UAN are mentioned below:

- The PF universal account number is helping in keeping track of the jobs that the employee has changed

- The EPFO is now allowed to access the KYC and Bank details of an employee after the introduction of UAN

- Withdrawals from the EPF scheme have decreased considerably

- The UAN has also decreased the hassles that companies had to go through with employee’s verification

Talk to our investment specialist

Important Features of Universal Account Number

- The EPF balance UAN number is a unique number for every employee and is independent of the employer

- With UAN, the involvement of the employer has been decreased as the PF of the previous company can now be transferred to the new PF account once you have completed your KYC verification

- The employer is allowed to authenticate the employees with the UAN in case KYC verification has been done

- Since the process is online, employers are not allowed to hold back or deduct PF

- Employees can check the PF deposit every month by registering on the official EPF member portal

- Upon every contribution made by the employer, employees can receive an SMS update regarding the same

- If you have changed the company or the organization, all you would have to do is provide KYC and the UAN details to the new employer so as to transfer the old PF to the new account

Online Process of UAN Allotment

Follow the steps mentioned below to generate a UAN number:

- Log in to the EPF Employer Portal by using the your ID and password.

- Move on to the Member tab and click on Register Individual.

- Provide employee’s details such as Aadhaar, PAN, bank details, and other personal details.

- Click on the Approval button after checking all the details.

- A new UAN will be generated by EPFO.

Once the new UAN is generated, new employers can easily link the Provident Fund account of employees to that UAN.

Required Documents

To have a secure and successful PF UAN number activation and registration, the following documents need to be provided:

- Updated Aadhar Card of the employer

- Bank account information along with the IFSC code

- PAN Card

- Identity proof, such as passport, driving license, voter card, etc.

- Address proof

- ESIC Card

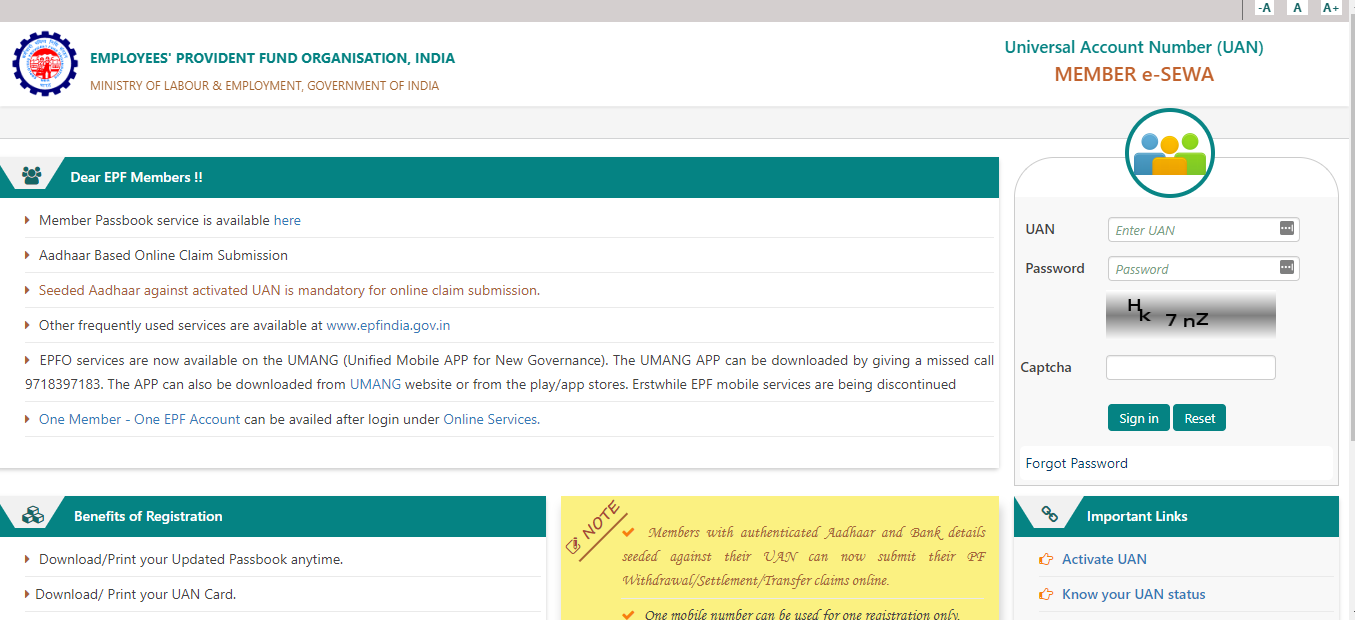

How to Register UAN?

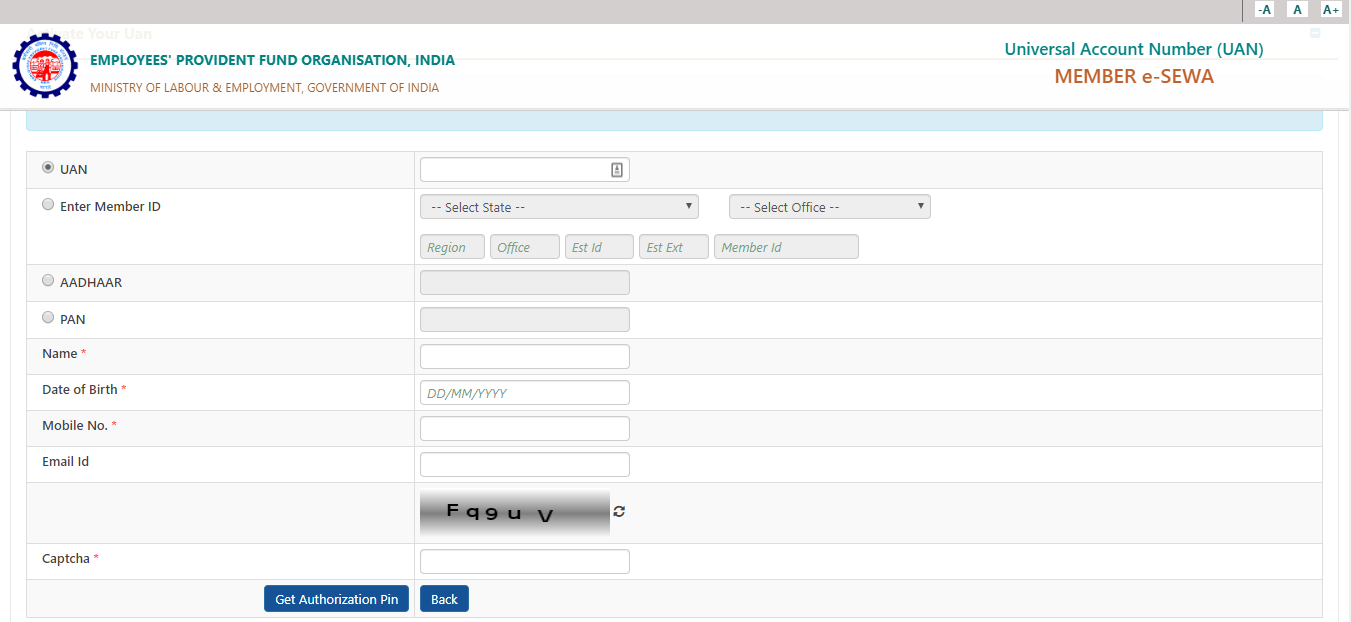

UAN registering can be done in a few simple steps:

- Go to the EPF Member Portal

- Click on activate UAN

- Add the required information, such as UAN, mobile number, email ID, date of birth, name, PAN, Aadhaar, etc.

- Click on Get Authorization PIN to receive the PIN to the registered mobile number

- To verify the account, enter the PIN

- Create a username and generate a password

Steps to Activate the Universal PF Number

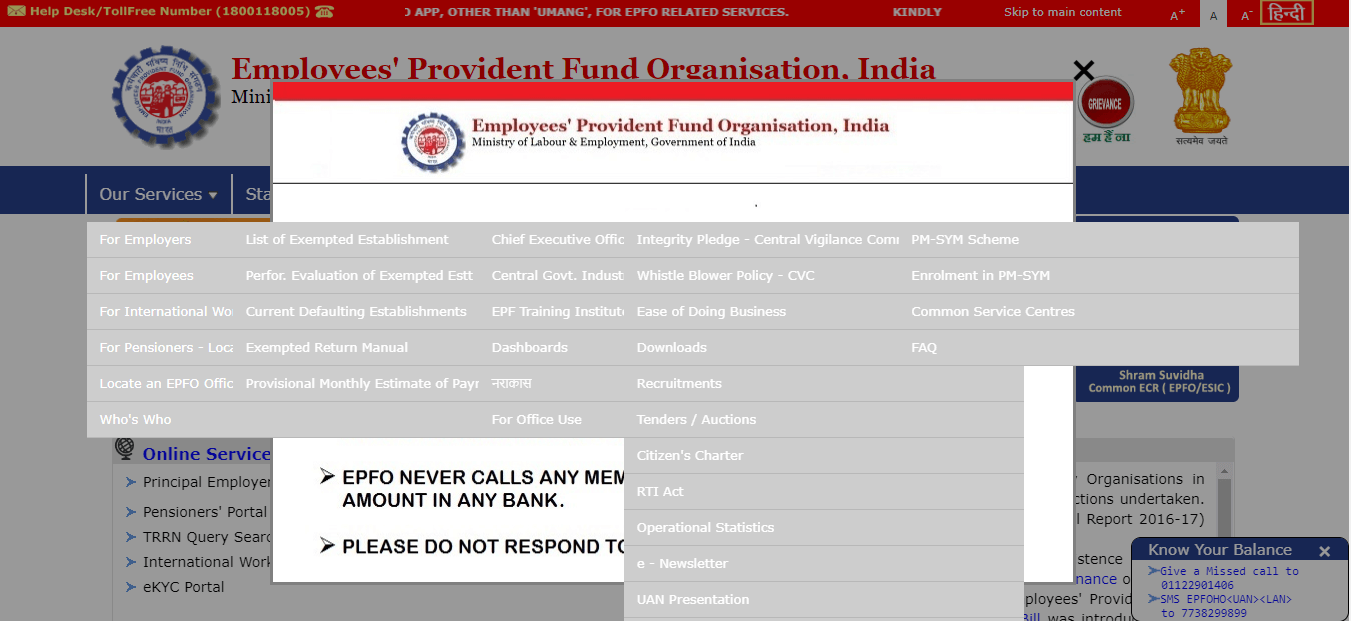

- Go to EPFO Website

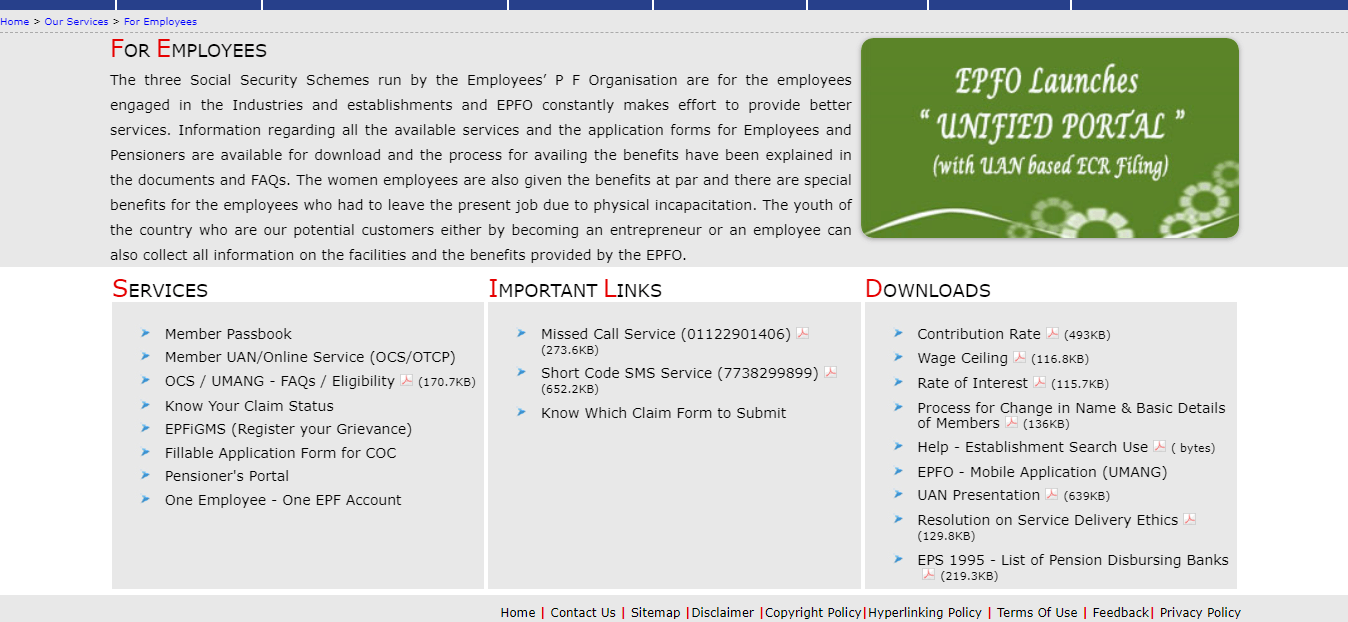

- Visit Our services and choose For Employees

- Click on Member UAN/Online Services

- A new page will open up where you will have to enter all of the information, such as UAN, PF member Id, and mobile number

- Complete the Captcha

- Click on Get authorization PIN

- Choose I Agree and enter the OTP received on the registered mobile number

- To access the portal, you will then receive a password

Conclusion

Prior to the introduction of UAN, the EPF process was excruciating and extremely time-consuming. Apart from that, the privacy was compromised at several stages as well. The UAN has brought resolution to an array of problems and is also proven to be advantageous to both the employees as well as the employers. So, know your UAN number from your employee. If you haven’t registered your UAN number, it is time to do so now.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.